Even as the global health crisis slows down business operations, international trade continues to flow freely.

UNCTAD reports that global retail commerce, particularly e-commerce, grew from 14% in 2019 to 19% in 2020.

Thanks to increased digitisation, you can find products, make purchases, and send payments to any country in the world within seconds.

On the business side, things aren’t as simple. You might need to consider exchange rates, taxes, and trade regulations.

So, if you’re a business taking advantage of the increasingly globalised economy, here’s what you need to know about invoicing international clients.

What is a foreign invoice?

A foreign invoice is any invoice you send to an international client. The main difference from local invoices is that they require you and your client to agree on a currency to use. Moreover, in a regular invoice, you need to charge VAT.

Since international clients will follow their own country’s tax rules, addressing VAT in a foreign invoice will depend on the invoicing countries, which we will discuss later in this article.

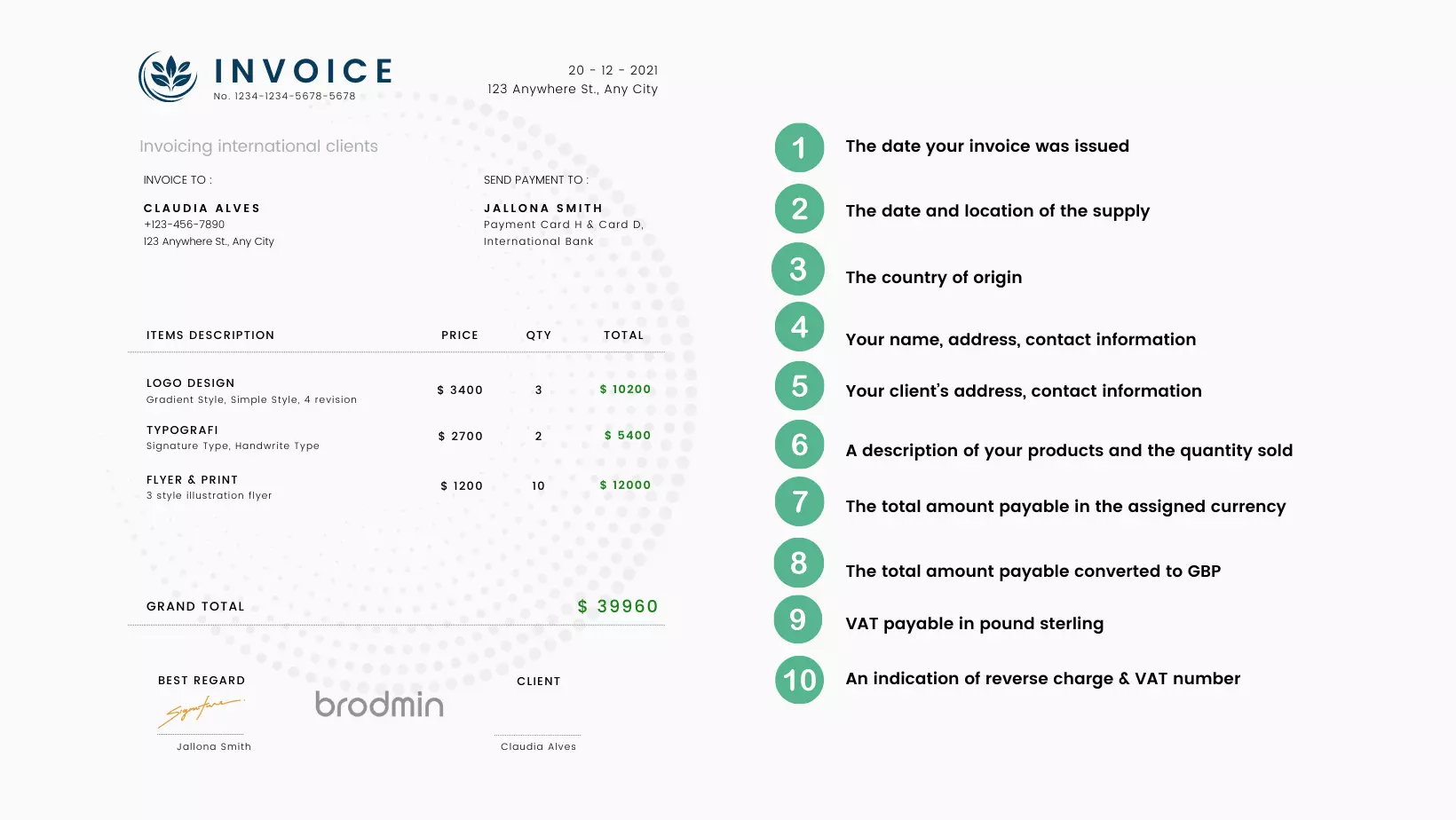

What should be on an international invoice?

In addition to the usual information in local invoices, your international invoice should also include two things. First, the currency you will invoice your client in and, second, the country where you will be supplying your product or service.

For example, if your client is in Japan and you agreed to pay in US dollars, your invoice should indicate that the currency is US dollars and that the supply country is Japan.

You may also add billable time, expenses, and mileage. When including billable costs, they need to be converted into your chosen invoice currency.

Can I invoice in a foreign currency?

As long as you and your client agree on which currency to use, you can write an invoice using any fiat currency. If UK VAT is due on the transaction your invoices must also show the following in sterling:

- The total net value of goods and services at each VAT rate

- The amount of VAT, if any, at each rate

You do not need to show sterling figures for each line on the invoice. [1]

What currency should be used on the invoice?

Traditionally, businesses trade in commonly used currencies, such as euros, dollars, and pound sterling. The relative stability of these currencies means there will be less risk of losing money during the conversion.

However, FXCM notes that due to the COVID-19 pandemic, historically stable currencies all experienced some level of volatility. Even the US dollar, which is often regarded for its strong performance as a currency, dropped in value when the delta variant emerged.

In cases where you cannot use a common currency, it’s always best to use your client’s local currency. This way, you free your client from the burden of conversion.

It’s important to note that there are certain exceptions to this rule. Countries where local currencies are heavily regulated, such as China and Malaysia, may prefer to trade in USD.

Should you choose to invoice in GBP, on the other hand, your client may charge you additional fees for the cost of converting and transferring their local currency.

What are known tax issues with international invoicing?

Usually, when you sell goods, you need to add VAT to the item’s total price. This way, customers can pay VAT to the government through you.

The purpose of VAT is to raise revenue for the government through consumer spending. Because your consumers aren’t from the UK, they would not be obligated to pay UK taxes like VAT.

Instead, they must follow their own country’s laws on consumption taxes.

Thus, you do not need to charge UK VAT on any goods you export to foreign countries. There are, however, certain exceptions. [2]

For instance, VAT will be applicable if you deliver your goods to a UK address, even if your clients themselves are located outside the UK.

The UK government also requires all invoices to reflect your VAT payable in pound sterling. So, if you don’t charge VAT on a product, your invoice needs to indicate that the VAT payable is £0.

This way, the HMRC can use your invoices as evidence of removal, proving that the goods left the country.

Our article ‘What is a valid tax invoice’ also notes that invoices in foreign currency should include the VAT payable in GBP.

In case your VAT payable is not 0, you need to convert your total payable VAT using either the HMRC’s period rates of exchange or the UK market’s selling rate during the time your item was supplied.

Since you’re not charging VAT, clients become responsible for paying their consumption taxes. Even certain countries have provided suppliers with the option to handle consumption taxes on behalf of their customers.

The EU, for example, has the Import One-Stop-Shop (IOSS), which is an electronic portal that allows suppliers to pay EU VAT for their customers.

Suppliers providing goods or services to EU member states can use the IOSS to declare and pay international VAT on behalf of their clients if the sale does not exceed €150.

Sending an invoice outside the EU

There are no special rules for sending invoices outside of the EU. Follow the rules stated above: discuss with the client which currency you will use for the transaction.

If the goods are delivered outside the UK, indicate in the invoice that the VAT payable is £0. It may help consult a professional, such as an accountant or lawyer, for different international laws.

Sending an invoice within the EU

Sending invoices to EU countries will have different rules if your business is based in Northern Ireland. It is different is because of Brexit. [3]

England, Scotland, and Wales exited the intra-EU market, while Northern Ireland remained within the EU single market.

This means that Northern Ireland remains subject to sales rules in the EU.

Northern Ireland follows the EU’s rules on VAT, so they also follow the reverse charge procedure. The reverse charge procedure means that there’s a reverse in tax liability: rather than the seller handling tax, it is the buyer’s job to pay.

Businesses in Northern Ireland would need to write reverse charge invoices. A reverse charge invoice includes a reference to the shift in tax liability.

Businesses in Northern Ireland also need to write reverse charge invoices when selling to EU member states. A reverse charge invoice is an invoice that doesn’t include tax rates and instead adds a reference to the reverse charge procedure.

For example, an invoice might indicate that the VAT Payable is zero, then add a note that says, “Invoice without VAT due to the reverse in tax liability.”

Businesses in England, Scotland, and Wales no longer must follow this procedure.

They must treat EU transactions like they would any other international client.

However, they can also use the IOSS to declare and pay EU VAT for their clients.

When using the IOSS, indicate on the invoice the international VAT paid.

Payment methods considerations for international invoices

There are several ways you can accept payments from overseas clients. Credit cards like Visa and Mastercard are always an option, though they may charge high transaction fees.

An alternative is to use an online payment platform. Payment gateways, PayPal, Google Pay, and Amazon Payments, let users transfer money between two parties from different countries without requiring them to open overseas bank accounts.

Like credit cards, they may charge fees for transactions. PayPal, for instance, charges a fee of 4.4% plus currency fees for products sold outside the US.

You can also use foreign exchange payment companies, such as OFX, AFEX, and Wise, to directly transfer money from a domestic bank account to an international bank account.

If your international clients all come from the same country, opening a domestic bank account in that country might be beneficial. A local bank account prevents you from incurring the fees associated with online payment platforms and payment exchange companies.

It also makes it easier for your clients to pay. Then again, this process might be less time-efficient since it will take extra effort to manage the account and transfer the funds back into an account in your country.

Research the preferred payment gateways in the countries you’re trading in. For example, businesses in China may prefer to use UnionPay and AliPay, while companies in Japan prefer JCB. On the other hand, companies in EU member states tend to choose credit card payments via Visa and MasterCard.

International invoice checklist

The items your international invoice should include are as follows:

International invoice payment terms

A quick reminder that countries across the world have their own invoice payment terms, laws, and codes.

Taulia, a supply chain finance business, has studied more than 180 countries around the globe through legal online text, new articles, and contacts with trade officials of the government and industries departments. [4]

The methods used to control payment practices and deal with late commercial payments may vary from specific industry to broad legislation by the government.

Laws include establishing the maximum terms for payment, sanction and fines, dispute resolution or enhancing transparency by imposing public reporting obligations.(Like in the UK).

In conclusion

International trade might seem complex, especially since many rules have changed after Brexit took effect.

Fortunately, when invoicing international clients, the only additional factors you need to note are currencies and tax laws.

You can also seek the assistance of an accountant or lawyer to keep better track of tax rules and regulations and the jurisdictions in which these may apply.

Do you have question about international invoicing?

Let us know in the comments below.

![How to invoice international clients [+ 10-point checklist] 1 Brodmin](https://brodmin.com/wp-content/uploads/2020/10/brodmin-logo-231x71px.jpg)

![How to write past due invoice emails that work [+ tips & templates] 4 How to write past due invoice emails that work](https://brodmin.com/wp-content/uploads/2022/04/How-to-write-past-due-invoice-emails-that-work.webp)

![How to invoice international clients [+ 10-point checklist] 9 brodmin.com](https://brodmin.com/wp-content/uploads/2020/11/brodmin-logo-200x60-1.png)

![How to invoice international clients [+ 10-point checklist] 10 webauditr.com](https://brodmin.com/wp-content/uploads/2020/11/webauditr-logo-200px-60px.png)

![How to invoice international clients [+ 10-point checklist] 11 halr.co.uk](https://brodmin.com/wp-content/uploads/2020/11/halr-logo-200px60px.png)

![How to invoice international clients [+ 10-point checklist] 12 clinkco.com](https://brodmin.com/wp-content/uploads/2020/11/clinko-logo-200px-60px.png)

![How to invoice international clients [+ 10-point checklist] 13 qrank.co.uk](https://brodmin.com/wp-content/uploads/2020/11/qrank-logo-200px-60px.png)