Financial management is a constant challenge for enterprises of all sizes, from startups to corporations.

Common problems, such as unforeseen expenses, inconsistent cash flow, and poor data quality, can hurt a company’s bottom line and financial health.

There’s also a risk of human error, especially for organisations that still rely on legacy systems.

A company’s financial management system has many moving parts, adding a new layer of complexity. This complexity can lead to data inaccuracies, poor tax compliance, missing or incorrect invoices, and other issues. Unfortunately, no software programme can totally eliminate these problems.

On the positive side, you can take steps to improve your financial management and mitigate risks. By doing so, you will be better able to fulfil your commitments to clients and vendors, allocate resources, and achieve long-term growth.

That said, here’s what you should know about good financial management and how to optimise your processes.

What is a financial management system?

Any organization, big or small, uses specific processes and software programs to manage payroll, invoicing, and other financial operations.

Think about payment gateways, accounting systems, online banking apps, financial tracking apps, tax management software, etc. These products and operations represent a company’s financial management system (FMS).

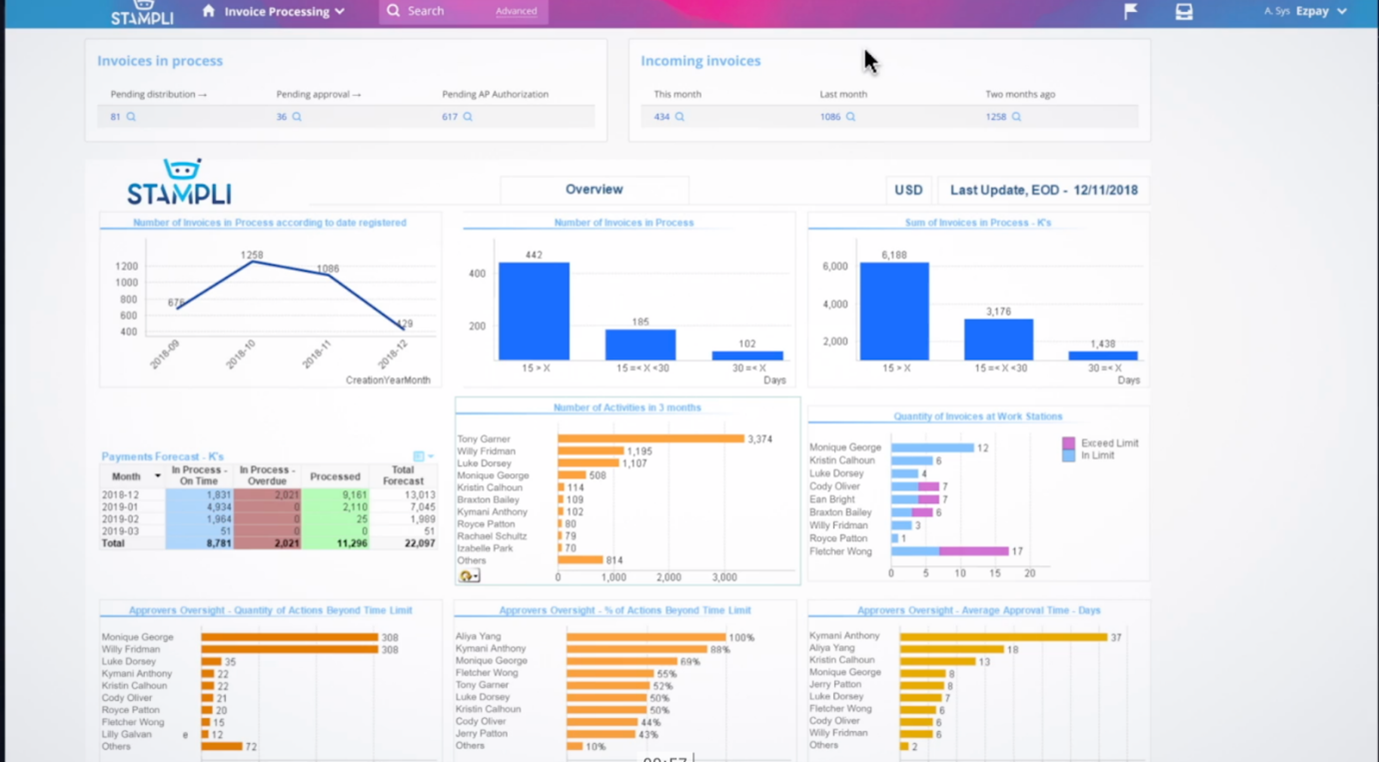

A robust financial management system can streamline invoicing, bill collection, tax compliance, forecasting, and other processes. At the same time, it reduces accounting errors and makes it easier to plan for the future.

Other potential benefits include:

Upmetrics, for instance, features cutting-edge tools for financial planning, forecasting, reporting, and other operations.

Using an all-in-one solution, you’ll better understand your finances and make data-driven decisions supporting business growth.

Plus, your employees will have more time to focus on critical tasks instead of spending hours on redundant activities.

Good financial management also allows organisations to allocate resources more effectively and reduce losses. At the same time, it makes it easier to keep up with the changes in tax and accounting regulations, helping your company avoid hefty fines.

Moreover, it can provide valuable insights into business performance and uncover opportunities for improvement.

Most problems in this department are due to inefficient processes, fragmented finance systems, and other challenges organisations face.

For example, some companies still rely on spreadsheets or legacy software programs to manage revenue and expenses. As a result, they have to deal with missing or incomplete data, payment delays, invoice errors, and other issues.

Given these aspects, optimising and automating your processes as much as possible makes sense.

Analyse your financial position

The first thing you need to do is analyse your financial health.

You want to know where your money goes, what debts you owe, how long it takes to receive client payments and more. Also, it’s important to assess your company’s financial system, identify redundancies, and determine room for improvement.

This information can lead to better decision-making and guide your business in the right direction.

Plus, it could make it easier to raise capital. Investors will want to see your financial statements, so it’s in your best interest to have everything in place.

Harvard Business School recommends starting with an analysis of the balance sheet.

Pay close attention to your company’s liquidity, fixed vs. current assets, amount of debt, owners’ equity, and other critical data.

Next, check your income and cash flow statements to see the company’s profits and losses, investments, equity financing, and more.

This data can reveal where your business is, where it’s heading, and how it performed during a specific period.

Lastly, you must analyse key financial ratios, such as your return on assets, inventory turnover, gross profit margin, and coverage ratio.

For example, the return on assets (ROA) ratio measures a company’s ability to generate revenue from existing assets.

Ideally, you should aim for a ROA of at least 5%.

Compare these financial performance indicators across periods and see how other companies in your industry are doing. Look for trends and patterns to identify areas of improvement and uncover inefficiencies.

Manage account payables and receivables

A thorough analysis of your company’s financial health will reveal what you owe and what others owe you.

Current debts and other liabilities owed to vendors, suppliers, and creditors are called accounts payable (AP). Accounts receivable (AR) are what you are owed.

These figures will appear on your balance sheet.

Managing accounts payable and receivable will ensure you fulfil your financial obligations to others and get paid on time. Therefore, it can help prevent late payments and make it easier to keep your finances up to date.

This practice can also improve your cash flow, which is essential for business survival—considering more than 80% of small companies go out of business due to cash flow problems.

That said, here’s what you can do to manage accounts payable and receivable more effectively:

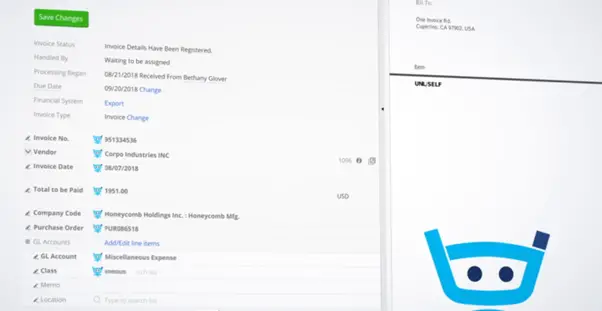

Most importantly, business owners should centralise the organisation’s AP and AR processing and reporting. This streamlining allows them to reduce friction between systems and departments, standardize processes, and decrease costs.

Go one step further and automate your operations to prevent manual errors, duplicate or missed payments, fraud, and other common issues.

Automate your finances

Finance automation can reduce data entry errors by a whopping 95% and improve data quality.

As a result, companies can generate more accurate reports, track invoices and payments, save time, and cut unnecessary expenses.

Moreover, this set of practices can strengthen internal controls and drive efficiency across the entire organization.

With automated B2B payment systems in place—particularly for paying invoices to vendors and contractors—enterprises can prevent costly mistakes and improve their workflows. Manual processes are time-consuming and prone to human error, which could result in revenue loss.

More than 70% of finance leaders agree automation can increase efficiency and free up employees’ time, reports a 2018 survey conducted by Dun & Bradstreet.

It’s possible to automate up to 80% of all accounting processes, significantly reducing operational costs.

Getting started is the hardest part, especially for finance departments that rely on legacy systems.

First, you need to assess your current accounting processes. Next, find ways to automate repetitive, time-consuming processes that do not need a “human touch.”

Let’s see a few examples:

Once you’ve completed these steps, evaluate the financial management systems you have in place. Is there any way to link them together or switch to a centralised platform?

With that in mind, set up automated workflows for your core financial operations. Then, test the workflows and make adjustments as needed.

This process is much more complicated than it seems, but your efforts will pay off.

Take one step at a time, track the results, and give your employees time to adjust. Don’t try to change everything at once. For example, you could start by automating basic functions and processes like billing, invoicing, or reporting.

Leverage digital technology

Building the right financial management and tracking apps makes it easier to budget your expenses, monitor asset growth, and put your profits to work through investments and a diverse portfolio. Plus, modern financial apps can automate repetitive processes and improve data quality.

For starters, consider your business needs and budget, as well as the challenges your finance team faces.

CFO University explains that many finance professionals struggle to get things done because of disconnected processes, extensive paperwork, or poorly organized data. Each day, they spend hours on redundant tasks due to inefficient tools and outdated technology.

Discuss these aspects with your team to identify appropriate solutions. For example, you could switch to cloud-based financial management apps to reduce paperwork, get insights in real-time, and improve collaboration across teams.

Finance apps can streamline budgeting, increase data security, and boost productivity.

In the long run, they may improve strategic planning and lead to better decision-making. Plus, most applications are highly scalable, meaning you can add new features or remove extras as your business needs change.

You may also use team collaboration tools, mobile payment apps, inventory management software, data analytics software, and more.

These digital technologies can improve teamwork and communication, reduce friction between departments, and, ultimately, enhance the customer experience.

Get your customers to pay on time

Most businesses have to deal with late customer payments.

Life gets busy, and your clients may forget to pay what they owe. Sometimes, they may run out of money and postpone the payment.

The question is: What can you do about it?

One option is to send payment reminders or charge upfront. Requesting advance payments for large orders or dealing with new clients is common practice.

As a general rule, make sure you have a contract in place. This document should specify the payment terms, how you handle late payments, what payment methods you offer, and so on.

Some companies also conduct background checks on new customers to ensure they can pay on time. If you go this route, reach out to Experian, TransUnion, or other major credit agencies.

Depending on the nature of your business, you may also set up a retainer agreement.

For example, if you provide marketing services, you can charge your clients upfront for the next three or six months. Make a habit of invoicing customers as quickly as possible to keep cash flow positive. And don’t hesitate to follow up if you’re not paid promptly!

Inc. recommends billing your customers at regular intervals. For example, if someone expects an invoice from you on the 5th of each month, you should stick to that schedule to keep things running smoothly.

Plan for unforeseen expenses

An effective financial management system should also take into account unforeseen expenses. You not only need to create a budget but also keep up with your debts and plan for the unexpected.

For example, you may have to hire new employees, upgrade your technology, or pay for equipment repair. You might also stumble upon an opportunity that requires extra capital.

Considering these factors, setting some money aside every month or as often as possible is important. Create an emergency fund, identify and eliminate unnecessary expenses, and save your tax return.

You could also switch to a finance app with forecasting capabilities.

Use these tools to estimate your business revenue and profits, anticipate losses, and test different scenarios. For example, how would things play out if you moved to a bigger office, lost a major client, or switched suppliers?

Streamline your financial management processes

Building friction-free financial management systems for your business takes time and planning. The key is to make small but impactful changes, measure the results, and take calculated risks.

To get started, see where you’re at right now and look for areas of improvement.

Review your financial position, cut unnecessary expenses, and stay on top of invoices.

Most importantly, automate manual or repetitive tasks to reduce human error and standardize processes.

Also, take the steps needed to ensure customers pay you on time.

For example, use financial software to bill and invoice, send payment reminders, and maintain accurate data records.

Last but not least, file your tax returns on time, pay any outstanding debt, and build an emergency fund for your business.

![How to write past due invoice emails that work [+ tips & templates] 3 How to write past due invoice emails that work](https://brodmin.com/wp-content/uploads/2022/04/How-to-write-past-due-invoice-emails-that-work.webp)

![How to invoice international clients [+ 10-point checklist] 4 Invoicing international clients](https://brodmin.com/wp-content/uploads/2021/10/Invoicing-international-clients-0.webp)