Living and working in Britain means that we are all living in a late payment culture that is killing small businesses every day.

Large businesses fail to pay their debts and UK entrepreneurs are suffering because of it. How deep do these problems run?

What is the late payment culture?

According to the Late Payment of Commercial Debts Act, all payment should be made within either 30 days when dealing with public entities or 60 days when dealing with private business. This can be extended as long as it is fair to all parties involved.

In Britain, we live in a culture which means that not everyone pays their debts on time. In fact, more than 3 in 5 small business owners have recently seen an increase in late payments of invoices.

63% of small businesses have experienced an increase in late payments from customers since COVID – 46% of invoices were paid late in the last 18m. It’s not just the bank balance which late payments affect either – the mental health impact is always significant too.

— Leapers (@LeapersCo) September 15, 2020

The late payment culture leads to businesses being unable to fund investments, pay employees, and the possible closure of what they are trying to grow. Accepting late payment means that small businesses struggle to survive, especially in the shadow of bigger enterprises with greater cash reserves.

Allowing a culture of late payment means that we will see the UK economy dominated by a small number of larger businesses that will squeeze out competitors such as small independent traders to medium-sized organisations. This is deeply unfair.

How is mental health affected by late payment culture?

Mental health issues are on the rise in Britain and the late payment culture adds to the difficulties for traders every day. Failing to hold people to account will lead to an increase in mental health issues and put a greater strain on our National Health Service.

Small business owners are exposed to stress, insomnia, depression, and extreme anger due to the problems that late payment causes. These are all serious issues that deeply impact a person’s life and protecting them will help them thrive and add money to the UK economy.

In some severe cases, people have contemplated or even committed suicide. Now, this is no longer about just stress due to late payments, but people’s lives.

Some #ExcludedUK freelancers also facing unjust #LoanCharge and massive retrospective tax demands which destroying mental health and families. Seven suicides.https://t.co/xpt3reH5st pic.twitter.com/y5qGO4ofVW

— Jim B Brown #LCAG (@NotRichYoungFa1) December 30, 2020

Freelance people, add few $$ on your invoices for mental health damage

— Charly G. (@ixeurban) November 5, 2019

Due to the controversial Loan Charge legislation pushed through in 2017, contractors are especially susceptible to having to pay back tax that was owed on loan payments made in place of actual wage payouts. [1]

This was a tax loophole that contractors were advised to use to ensure they were recognised as self-employed. Late payment fears and difficult dealings with larger businesses have led to extreme tax bills being left with freelancers and contractors.

40% of loan charge victims had contemplated suicide. Over £100,000 worth of debt was owed by some individuals. 7 people have committed suicide.

Some freelancers have actually made a niche for themselves by directly catering to other freelancers and helping them deal with stress and guard against mental health issues. These issues are an accepted problem for freelancers. That is unacceptable.

What is the damage caused by late payments?

Surveys carried out in 2019 show that 25% of small business owners think that outstanding payments affect their personal life. They can’t separate work and home because the stresses of late payments weigh heavily every day and threaten the existence of thousands of small businesses.

During the COVID crisis of 2020, 63% of small business owners have faced increases in late payments which is holding them back from investing, paying their employees, and maintaining their business. Almost half of all invoices were paid late.

There is a huge loss in trading that is felt because big businesses don’t pay small businesses and then the small businesses cannot pay their suppliers. This chain of missing payments leads to damage to the economy which could easily be changed if people paid their debts!

We have people like @ImmyKaur who have faced up to £15,000 worth of invoices failing to be paid. This culture causes financial damage to the British economy, but also human damage to those who want to make a better life and run their own businesses.

Hey friends, the £15,000 + of outstanding invoices being paid would really help my mental health. It’s not easy running a small business.

— Imandeep Kaur (@ImmyKaur) May 10, 2017

Freelance people, add few $$ on your invoices for mental health damage

— Charly G. (@ixeurban) November 5, 2019

What has the British government done about late payment culture?

The strongest piece of legislation a small business can use is the Late Payment of Commercial Debts (Interest) Act, last updated in 2018. This allows small businesses to claim a fixed sum and interest on payments that have been left outstanding.

The government introduced tough new rules on prompt payments in September 2019, but the effect of late payments continues to put a strain on the mental health of British small business owners. Why are they not working and how do SME owners continue to suffer? [2]

What is the financial cost of the British late payment culture?

In research published in January 2020, Pay.UK found that small businesses face up to £23 billion in overall late payments. This number rose £13 billion from the previous year. Many people have no idea how to get back what is rightfully theirs. [3]

And this late payment culture has affected every sector:

Artists working with large venues to provide art and music

the UK industry is shit they couldn’t care less about your mental health, they just leave unpaid invoices and vibes 😹

— karms𓂀☆ (@ArtByKarma) November 12, 2020

Venues! If you want to support the mental health of artists in this precarious climate, pay your invoices on time. Love, everyone.

— Eve Leigh (@EevLee) September 7, 2017

Screenwriters and script developers

You know a small thing that could be done RIGHT NOW to improve mental health in Arts is pay free-lancer’s invoices ON TIME, EVERYTIME

— John K (@JohnKachoyan) February 9, 2017

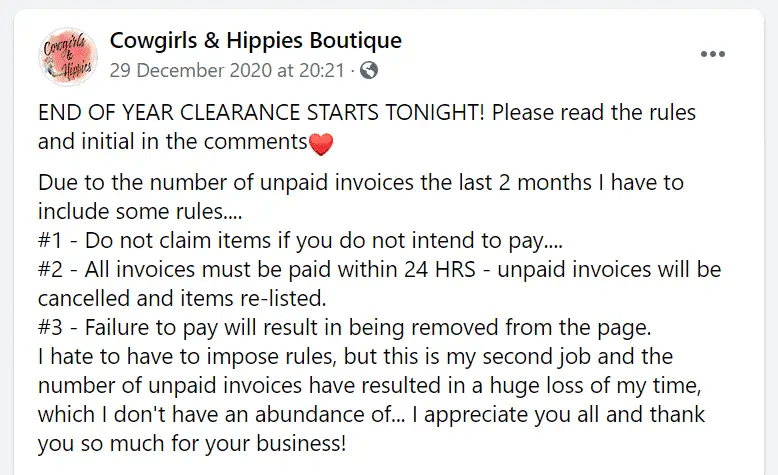

Small boutiques having to call in their outstanding invoices and bring in new policies for paying promptly

Stoppages in cash flow cause serious problems for SME owners, including stress, mental health issues, lack of ability to invest, diminishing cash reserves, and having to lay off staff. This isn’t just a financial cost, but a human cost too. But how damaging is it?

A survey carried out by Easle showed that invoices that are written off (i.e. considered uncollectible) caused on average £2,000 worth of damage every year.

Of the people who write off invoices, the average amount a year was over £2,000.

— Easle (@EasleTeam) September 14, 2018

Think about that – £2,000 of debt that an owner cannot collect due to the failing of the legislation and the ability to enforce the bully tactics of big enterprises to pay their debts. This environment hurts and demoralizes small business to a grave extent.

How does late payment affect the mental health of SME owners?

Pay.uk’s research into the human cost of late payment culture showed some damning figures for British business:

- 88% of the smallest businesses (fewer than 10 employees) worry about late payment

- 66% of owners found their work less enjoyable because of late payments

- 25% said that late payments affect their lives outside of work

- 9% have considered seeking professional help due to the stress of late payments

The effects of late payments are the leading cause of worry for those entrepreneurs with the least ability to weather the lack of income. Almost 1 in 10 of British small business owners think professional help is necessary to deal with their anxieties.

Without proper intervention from the courts or the British government, we risk allowing a toxic environment for small businesses to go on. People are searching for professional help due to our culture of late payment and the existing legislation is evidently not working.

PPD research shows that the 4 main mental health issues resulting from #latepayments are: stress, insomnia, depression and extreme anger – in that order. Late payment is about more than just #cashflow @besagroup @sb_commissioner @SECGroupEsca @fisorg #SME

— ThePromptPayDir (@ThePromptPayDir) May 22, 2018

Mental health issues affect 1 in 4 people in Britain in some way during the course of a year and 1 in 6 are affected at least once a week by them. SME owners are most affected by stress, insomnia, depression, and severe anger issues according to research by The Prompt Payment Directory. (Note: TPP is no longer trading).

At a time when mental health issues are growing, our late payment culture adds to them and means that more and more people suffer every year from a range of mental health issues. This is not just a strain on the economy, but our healthcare system as well.

How does late payment affect freelancers?

Freelancers often feel the brunt of late payment. They are sole traders and have very little financial muscle to challenge their debtors in claiming what they should rightfully be paid. Instead of being able to focus on their services, they have to chase late payments and struggle with uncertainty.

Research carried out by IPSE shows that 32% of self-employed individuals report that their stress levels are extremely high. This can lead to severe health problems such as heart disease as well as worsening existing conditions such as asthma or gastrointestinal disease. [4]

It also shows that 29% of respondents had an extremely low level of job satisfaction. Being self-employed or a freelancer today is a high-stress job that can crush even the most capable of individuals. Do we want to chase talent out? Why doesn’t the British economy help people who can offer essential skills?

This is particularly felt by freelancer traders who work with bigger businesses:

It’s honestly disgusting how companies take the piss when it’s time to pay invoices. It can affect someone’s mental health amongst other things. Freelancers need their money to literally live you pricks.

— machine gun Kele (@kelechnekoff) December 6, 2019

We live in a culture that makes freelance workers choose between taking care of their own mental health and getting paid. Big businesses don’t seem to be afraid of paying late fees and will hold out on paying for services in spite of the Late Payment of Commercial Fees Act.

Freelancers only have the income they can make from direct payment and find that chasing late payments leads to bigger companies “acting spicy”. How has this disrespectful environment been created? Why are freelancers seen as being above their station for expecting fair payment?

@FullConker adds that freelancers can’t even push back too much for fear of losing out on future work. Providing excellent service is only half of the job – late payment culture means that freelancers have to walk the tightrope of requesting payment and being dropped.

These stressful situations lead people like @shaykennedyblog to consider leaving the freelance market, abandoning their small business ambitions, and returning to regular employment.

Companies who don’t pay their invoices to freelancers are the worst. A couple of hundred pounds to them means nothing, with no idea the ramifications it has on the finances, mental health and personal relationships of those they haven’t paid. Trying to get the money

— Shay🐺 (@shaykennedyblog) June 6, 2019

How are employees affected by late payment culture?

Although research has tended to focus on late payment culture and its effect on owners, employees are just as likely to suffer the effects of poor cash flow and late payments. In fact, they are probably the first people who will feel the pinch.

Late payment of wages causes people to struggle to pay for their basic needs like food, mortgage payments, or rent. If people cannot afford to pay their mortgage or rent, the risk of more people facing the same challenges that @nharmertaylor did:

5. As soon as I was put in the mental health unit, they made me sign paperwork so they could receive housing benefit for me being there.

6. Was made to apply for universal credit, I applied for it in the January and didn’t receive my first full payment until late March.

2/2

— Nathan Harmer (@nharmertaylor) December 18, 2018

After the COVID crisis of 2020, businesses of all sizes face the perils of what is to come. But the first people who will feel the bite of late payments and lack of cash flow in the economy will be the employees who are reliant on others for their wages.

What can we do to combat this late payment culture?

@ionayoungmoney has an idea for dealing with prolific late payers who do not respect their debts or the legislation:

Getting passionate responses to my @ftmoney piece, including one from a freelancer who can’t comment under her real name about a client always paying late for fear of upsetting them. That’s why we need a new late payment tsar to name & shame on our behalf https://t.co/jhQuzHThHI

— Iona Bain (@ionayoungmoney) January 3, 2020

Finding a new “tsar” of late payment naming and shaming is important for enabling and empowering SME owners and freelancers alike to hold big business to account and make sure that people get what they are owed.

If we continue to allow a culture of late payment, people like @sabuhi_gard face late payment interest being ignored and still having to wait an unfair amount of time for any payment at all.

Great article! I agree that clients should settle invoices for work completed in December before Christmas. One of my clients hasn’t done this. I am expecting payment in February. Clients also frequently ignore the charging interest on late payments. No fear of retribution!

— Sabuhi (Mir) Gard (@sabuhi_gard) January 4, 2020

In conclusion

The late payment culture is killing the British economy and there is a serious need for government intervention to help out small and medium-sized business owners. They are the ones facing the biggest challenges and have their own payments to make to suppliers.

Using the Late Payment of Commercial Debts Act is the first step in claiming back what is rightfully yours – this allows for a fixed fee and interest to be added to late invoices to help creditors with the stress of facing late payment.

But on its own, it is not enough. Our late payment culture is forcing small businesses under and meaning that owners face and employees both face extreme stress about payment or whether their jobs will even exist the next day.

Fighting back against late payment is the first step for helping our country defend against mental health issues in business and make the British economy great again for entrepreneurs and freelancers alike.

Get support from a mental health charity

Anxiety UK

Phone: 03444 775 774 (Monday to Friday, 9.30am to 5.30pm)

Website: www.anxietyuk.org.uk

Bipolar UK

Website: www.bipolaruk.org.uk

CALM

Phone: 0800 58 58 58 (daily, 5pm to midnight)

Website: www.thecalmzone.net

Mental Health Foundation

Website: www.mentalhealth.org.uk

Phone: 0300 123 3393 (Monday to Friday, 9am to 6pm)

Website: www.mind.org.uk

PAPYRUS

Phone: HOPElineUK 0800 068 4141 (9am to midnight, every day of the year)

Website: www.papyrus-uk.org

Phone: 0300 5000 927 (Monday to Friday, 9.30am to 4pm)

Website: www.rethink.org

Samaritans

Phone: 116 123 (free 24-hour helpline)

Website: www.samaritans.org.uk

SANE

Website: www.sane.org.uk/support

Phone: Parents’ helpline 0808 802 5544 (Monday to Friday, 9.30am to 4pm)

Website: www.youngminds.org.uk

Do you think the government should do more to prevent late payments?

Do late payments keep you awake at night?

8 Comments

Comments are closed.

![Apology letter for late payment to supplier [with examples] 6 apology letter for late payment to supplier](https://brodmin.com/wp-content/uploads/2021/09/apology-letter-for-late-payment-to-supplier.webp)

![Invoice payment terms - UK edition 2022 [+ Net calculator] 7 Invoice Payment Terms UK Edition 2021](https://brodmin.com/wp-content/uploads/2021/09/Invoice-Payment-Terms-UK-Edition-2021.webp)

I feel it will take serious work and time to change this and get businesses to understand they need to respect the rules of the game. I hope that your late payer’s directory will help nudge them in the right direction.

Thanks, Daniel. So true, it will be a lot of work convincing every business to pay on time and it will take years. By reporting them online for everyone to see, we could achieve that goal much faster. Stay safe.

This recent increase in late payments is mostly because of the COVID pandemic that has hit many businesses (especially smaller ones) so hard. For some, it has been very, very difficult to survive these last 18 months.

Hi Eva,

Yes, this is surely related and at the same time, being late with a payment is unfortunately considered “normal” by some business owners. While there are owners that absolutely hate being late and would never allow it there are also others that don’t care that much about it. It’s just like in life: some people will always pay on time and others might always be late. And there’s also some that are mostly on time but may encounter problems from time to time. The business world is just a reflection of us, as a society.

The biggest problem is how to separate work and home. So many of us (myself included) have serious difficulties in leaving our work related problems past the door to our house. I experienced that a client can’t pay me because they are awaiting payment from one of their own suppliers. I’ve had this happen again and again. Most of my clients are honest, hard working people and I trust them so I will bear with them. This is a time when we need to stick together and help each other out as much as possible.

Hi Kevin,

As you’ve experienced yourself, late payments affect the whole supply chain. That is why it is important that everyone gets paid on time. Keep up the good will!

It’s so sad and disheartening to hear so many small business owners are contemplating and even committing suicide :(

It’s horrible to have the stress of having to pay your employees, your taxes and trying to stay afloat when something like this pandemic happens. It can seem impossible but I think there are always solutions to be tried. Suicide should never be an option.