Late payments have gradually become one of the most pressing issues that not only businesses face, but private employees and even freelancers have to deal with too.

Amongst the numerous negative consequences you face because of this delay, the hassle of charging interest on late payments is the most pertinent one.

By charging a fixed amount of interest for each day that the client exceeds the due date, you can get monetary compensation for the delays that you have faced from your clients not honouring their commitments.

However, before charging this interest, we recommend being well-versed in the subject. That is why we have aimed to give you a complete overview of all aspects related to late payment interest so that you can implement them to your benefit.

What is late payment interest?

All business transactions follow a certain set of rules. To ensure smooth and conflict-free business dealings, it is important that payments are made within the agreed time limit.

This time limit is marked by the “due date” of a contract. Once this due date expires, and if your contract allows, you are entitled to charge a late payment fee and late payment interest charges.

Charging interest not only benefits you with the extra payment of interest on the due amount but at the same time encourages clients to make timely payments. This is because if the client refuses to pay the late payment interest or delays payments after a certain duration, there can be serious legal consequences.

In the UK, the implementation of this interest on late payments began after the Late Payment of Commercial Debts (Interest) Act 1998. This act also recognised reasonable costs. You will find out more about these later on.

When can you charge interest on a late payment?

The contract you sign with your client will clearly mention the last date after which you have the liberty to start charging late payment interest.

The most common duration for receiving public sector payments is 30 days whereas for private sector payments it’s 60 days. This duration may be subject to change according to different contracts for different clients.

Before taking steps to charge interest on late payments, it is advised may be a good idea to send reminders to the client. You can do this in one of three ways. You may want to start by dispatching a reminder email two or three days after the due date has passed.

If the payment is delayed by more than seven days, it may be a suitable time to make calls. Formal letters or messages can also be sent. If payment is still not received, you can start charging interest formally.

How much late payment interest can you charge?

The interest on unpaid invoices you charge can depend on two factors. It can either be dictated by the law of the country or the interest rate that you set in your contract.

If there is a fixed interest rate that you have mentioned in the signed contract then you will be required to abide by that. However, the duration of 60 days that is set by the law still needs to be followed.

In the absence of any mentioned interest rate in the official contract, you will have to charge the interest rate fixed by law on late payments.

HMRC regulated interest rates

The HMRC or the HM Revenue and Customs is the organization responsible for the collection of taxes. It also passes a law dictating the interest rates that can be charged on late payments. [1]

The interest rate that is charged is 8% on top of the base interest rate set by the Bank of England. The interest rate of the Bank of England has seen many recent reductions. This is because of the overall relaxation in the interest rates brought about due to the current COVID-19 pandemic. [2]

March 2020 saw two revisions in this base rate; it was initially reduced to 0.25% from 0.75% but was then further reduced to 0.1%.

As a consequence of this, the HMRC late payment interest also reduced, becoming 2.6% effective from April 2020. However, as we mentioned earlier, these interest rates are only applicable if the interest rate has not been decided in your contract.

Different types of invoices and interest

Most types of invoices can be divided into two broad categories; paid and unpaid invoices. In business transactions, paid invoices are those that the client pays on time.

Unfortunately, however, there is a significant majority of invoices that belong to the other category as well. Many times, you might refrain from reporting late invoices to remain shielded from time-consuming legal proceedings.

These unpaid invoices fail to be paid on time by the client. Their due date has long expired and thus, interest can be charged against them.

The interest rate for late payment of invoices is the same across all unpaid transactions between businesses. However, business dealings bound by a contract that mentions a pre-decided interest rate have to follow it.

The interest rate on unpaid business transactions varies depending on whether the invoice belongs to a B2B transaction or a B2C transaction. A B2B transaction refers to a “business to business” transaction. This is the category you are concerned with. The B2B invoice is issued from one business to another asking for payments to be made.

The business size can range from a well-established company to a sole trader. The interest calculations and details mentioned below are regarding all types of B2B business dealings. The interest charged on B2B late invoices is decided by the Late Payment of Commercial Debts (Interest) Act of 1998 and the EU’s Directive.

On the other hand, B2C transactions are those that take place from business to consumer. Online websites such as Amazon can be used as an example to understand B2C transactions.

There is no legal requirement of charging interest on late payments on the invoices of this type of transaction. However, if a business wishes to charge interest to the consumer, it must clearly communicate the intention to do so through the payment terms.

How to calculate the late payment interest?

This section will expand on how to calculate the late payment interest.

The late payment interest calculator does not include any advanced calculations. It requires calculating simple interest on the overdue amount and then calculating how much money you are charging every day as interest.

Let’s look at how you can calculate this interest by using an illustrative example.

Consider that a business is 60 days late in making payments to you. The contract that you signed with this client at the beginning of the working relationship included a clause about interest being applicable on a per-day basis in case of delayed payments.

However, the contract did not specify the amount of interest that you can charge. Thus, you follow the interest rate set by UK law alongside the interest rate of the Bank of England. Let us imagine these to be 8% and 0.25% respectively.

If the client owes you £5,000, the first step you should take is to find out the 8.25% (combined interest) of this value. You will do this by multiplying 5000 by 0.0825 (5000 x 0.0825), which yields £412. This amount is called the annual statutory interest.

The next step is to find out the daily interest rate from this statutory interest. This is fairly simple. All you need to do is divide £412 by 365 (412/365). This yields a daily interest of £1.13. This is the monetary amount that you will charge every day that the client delays payment.

The last step in making late payments interest calculations is to find out the total amount you will charge as interest combined. To do this you will multiply the per day interest rate by the number of days the payment is overdue.

For example, if it has been 60 days over the due date, you will multiply £1.13 by 60 (1.13 x 60). This would mean that the client will owe you £67.2 as interest alongside the actual amount due.

The complete process for making claims on late payment interest

The process of making claims on the late payments of commercial debts is not highly demanding. This being said, to ensure that the process goes smoothly and yields fruitful results, some important things need to be remembered.

You will need to issue your client an official notice called Late Payment Demand. This will serve to inform your client of all the details regarding the late payment and the late payment interest. It will include the details of the following.

- The calculated interest rate:

You can include the number of days that the client has delayed payments and the monetary amount of interest being charged per day. Any other costs or compensation that are due will also be included in this.

- Description of the late payment due:

Here, you will include the details of the payment that the client owes you. You will include the number of the invoice originally issued.

- Details of the transfer of the late payment and interest:

The most important part of a Late Payment Demand is informing the client to who to transfer the payment to. If your contract does not mention the method of transfer, you must include it here. Moreover, the date by which the payment is expected is also a part of this section.

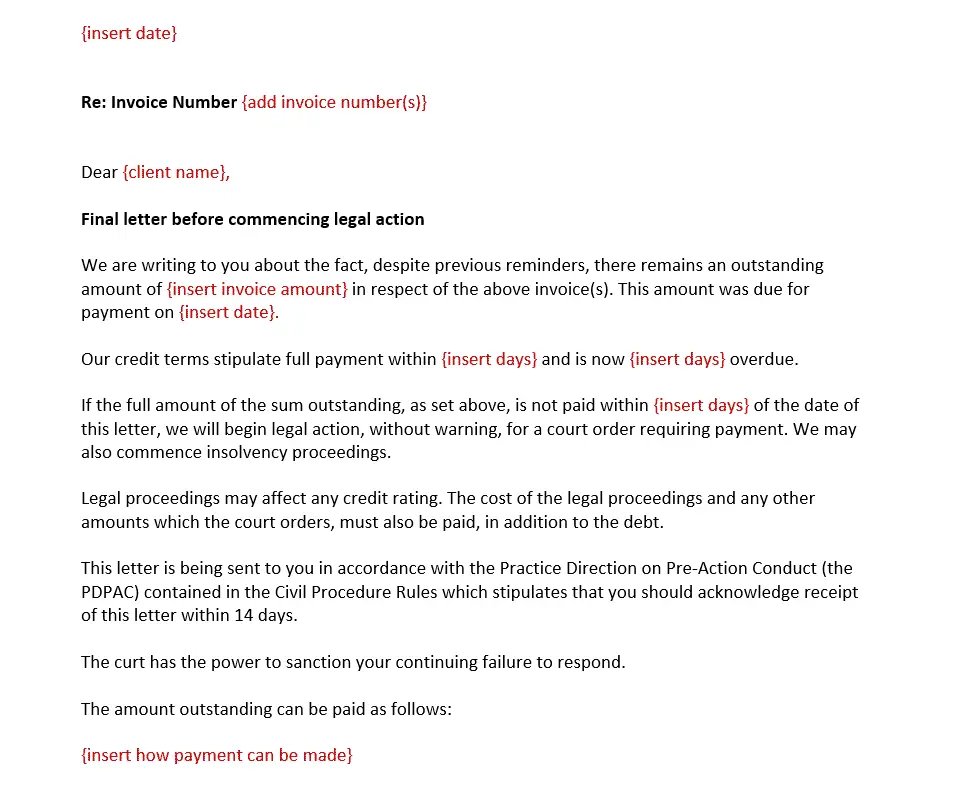

If you still do not receive a favourable response, an LBA or a Letter Before Action is the last resort for receiving late payments. It acts as a last warning for the client. [3]

The next step after the issuance of a Letter Before Action is legal proceedings against the client. The Letter Before Action includes a final time duration that can range from a week to a month. After this time frame elapses, the client can not request more days to make the late payment.

Most clients want to avoid court proceedings because it not only harms their credibility but is very time and resource consuming. For this reason, Letter Before Action becomes highly effective in pursuing a late payment alongside interest.

Role of late charge assessments

Assessing the late payment interest and the various other aspects of the later payment are extremely crucial. If you are unaware of the exact amount of payment due or the interest that you need to charge the client, things will get problematic.

In order to avoid this, you should conduct an extensive assessment to fully understand the process of making claims of the interest.

The first thing you should do is evaluate the contract that you have signed with the client in question. Through this, you will assess the terms both you and your client have agreed to that relate to the late payments and the late payment interest.

You can only charge the interest rate governed by UK law if your contract does not include any other interest rate that you have agreed on.

Moreover, this assessment will also include recognizing any time requirements that your contract mentions. This will help you plan your course of action for charging interest on the late payment accordingly.

As part of this assessment, you will also crosscheck any other details mentioned in the contract to the late payment interest you have calculated.

What are “reasonable costs”?

According to UK law, there are three additional compensations you can claim depending on the value of the overdue payment. These are;

- £40 for debts of less than £1,000

- £70 for debts between £1,000 and £10,000

- £100 for debts of £10,000 or more

However, sometimes, the process of chasing late payments cost significant amounts of money. If you find yourself to be in such a situation, you can claim the amount you’ve spent as “reasonable costs”.

Thus, reasonable costs essentially ensure that you are not paying anything out of your pocket while trying to obtain your missing payments from the client. Those individuals who hire the services of a debt collection agency to get these payments are most likely to spend more money on the process and thus can claim as “reasonable costs”.

Lastly, these costs can not be obtained if the interest rate being charged is that of the contract and not the one mentioned in UK law.

How long can this process take?

Making claims to receive late interest payments is a simple process.

It does not involve you running around to fulfil certain requirements or collect numerous documents. Neither do you have to complete difficult paperwork. However, it can indeed be time-consuming.

The total time that this process takes depends on the time that the client takes to first acknowledge and then to process the late payments and the due payment interest.

The time frame that the UK law allows the client is 30 days in the absence of a decided due date in the contract. This duration begins from the day the client receives the official invoice asking for payment. Interest can be charged from the day right after the promised due date.

In the UK, public sector clients have a window of 30 days to pay the late payment interest after the claim has been made. For private sector clients, this duration is 60 days.

If these deadlines are not respected, you would have to wait for an additional time limit that is mentioned in the Letter Before Action that you issue. This time duration can vary depending on the Letter Before Action you draft. You can wait for as short as a week or as long as 60 days.

What happens when a customer doesn’t pay the interest?

There will always be the risk of not receiving late freelance payments even after several prompts and reminders. Some clients may refuse to acknowledge the pending payment or the fees and interest that you have charged.

In such circumstances, the only resort that is left is to proceed with legal solutions. This is perhaps the most severe action that you can take and should be avoided unless absolutely necessary.

Once legal proceedings begin, there is a high chance that your relationship with the said client will come to an end. Moreover, there are crucial considerations that you need to be aware of before taking legal action against clients for pursuing late interest payments.

These include substantial legal fees alongside valuable time that will be consumed. In this situation, the best course of action may be to conduct a cost-benefit analysis.

In summary

We understand how smooth cash flow is contingent on timely business payments. To ensure this smooth flow it is crucial that late payments are avoided.

Interest that is charged on late payments helps facilitate this cash flow. This interest acts as your compensation for not being paid timely.

But to make certain that you make the correct payment and interest claim to your client, it is extremely important that you evaluate all related aspects to it.

This includes how the interest is calculated, how long it will take to process the claims, and what should be done if the client is uncooperative. Obtaining information regarding the late payment interest deductible is also very important whilst considering the interest charged.

How do you deal with unpaid invoices and do you charge a late interest fee to your clients?

Did we leave anything important out in our guide?

Let us know in the comments section below.

8 Comments

Comments are closed.

![Apology letter for late payment to supplier [with examples] 7 apology letter for late payment to supplier](https://brodmin.com/wp-content/uploads/2021/09/apology-letter-for-late-payment-to-supplier.webp)

![Invoice payment terms - UK edition 2022 [+ Net calculator] 8 Invoice Payment Terms UK Edition 2021](https://brodmin.com/wp-content/uploads/2021/09/Invoice-Payment-Terms-UK-Edition-2021.webp)

Late payment interest should be included in every contract, all over the world. It just keeps things clear and holds people accountable. Most people I know talk about adding interest but are too afraid of the repercussions.. I probably couldn’t have done this when I first started out, but I got to a point where I can select my clients and work with those that appreciate my work and pay on time plus agree with my contract requirements.

@Aurora, thanks for your comment. I too had the same fear at first adding any kind of fee to my invoices. For years I never even considered it as I was certain I would sour my relationship with the client and I couldn’t afford to lose any of them.

If legislation in the UK would be enforced better, the late payment culture would change. If other countries would do the same that could really improve the SME marketplace.

Glad to hear you work with clients that pay on time. If they don’t, you know what to do… : )

Yeah, as a new business it is very difficult to do something like this because there’s always the risk of losing clients. But, I do understand where you’re coming from and I also want to get to a point where I can work with whomever I want and decline clients that are not in flow with me. I know it will take me some time to get there but it’s a goal that motivates me.

Hi Tina,

Some of us are braver than others when it comes to charging interest or fees. If we could get rid of the late payment culture altogether then there would be no need to worry about losing our hard earned clients over late payments. Keep us updated on how you get on.

I know it’s hard at first but try to include interest as soon as you can. Don’t postpone just because you assume you will lose clients. Offer more than what a client has ordered and also demand more of them. Raise standards all around. The clients who accept this (some will even praise you) are the ones you want to work with.

Here’s how I go about it:

If the due date is almost there, I let them know 1 day prior to it, with an email. If it has been 3 days after the due date, I email or phone them (usually both, one after the other) letting them know that I have started charging interest. In 80% of the case this email/call makes people issue the payment within 3 days.

Great process Bernard. Can I ask what system you are using? Are you using automated invoicing software or are you setting reminders in your calendar?

I try to give them a bit more time. I won’t charge interest up until it has been 10 days after their due date. But, I do charge a mean interest and my clients know this. If you are late, you have to pay :)