Invoice payment terms in the UK tell clients when they are expected to pay an invoice and the methods they should use to submit the payments. There are many different terms of payment that businesses use on their invoices.

In this guide, we will help you understand most of these terms.

Having the correct payment terms in place will go a long way towards formalising credit conditions and payments for the customers. They also help improve the company’s payment stats for any aged debt.

Most businesses set their own payment terms, including upfront payments and discounts for early payments.

Now, unless you have agreed on different invoice payment terms, the law in the UK states that customers must pay all invoices within 30 days of receiving the invoice or goods.

Why invoice terms matter

There’s plenty at stake when it comes to choosing the right payment terms. This is because they set the tone for your future relationship with the customer, and they also affect your business financially.

You must weigh the standard invoice payment terms in your particular industry and also consider the client’s payment history, plus the potential revenue the job will bring.

The financial impact is way bigger than you think. Imagine if a customer pays an invoice 30 days late, you will end up borrowing money to factor the company to cover your obligations in the 30 days.

The costs involved with doing this are about 4% or even more, and if the customer pays around $10,000 late, you will be losing $400.

Therefore, invoice payment terms wordings are extremely important, and they impact your business significantly. According to QuickBooks, you should be super concerned about payment terms due to the following information:[1]

- 80% of most small business owners are stressed about the cash flow in their business.

- More than half of all small business owners who struggle with cash flow state that late payments are the leading cause.

- 62% of all business owners do not know the exact amount of money they receive each month.

- 58% of small businesses said that they made poor business-related decisions as they were worried about their cash flow.

Therefore, accurate cash flow projections will always help you when planning your taxes, keep your business running well and helps you manage your growth.

A clear and professional invoice ensures that clients pay on time and promptly. When you communicate the payment terms, ensure that your customers are also on the same page, even before the work begins.

What are invoice payment terms?

Invoice payment terms refer to contractually agreed-upon terms between a business and its customer. They commonly refer to payment terms for when payment is due, relative to the date when the goods or services are delivered or when the Invoice was sent.

How do you calculate net terms? (use the calculator provided)

NET terms refer to the total amount of money that needs to be paid within a specific period. They can either be NET 30, 60, or 90.

Here’s the formula:

Calculate by finding the difference between the date of payment for the customers taking the early payment discount and the specific date that payment is due; divide this by 360 days.

Example:

When the payment terms are 2/10 net 30, this means that you would have to divide the 20 days with 360 days, which will give you 18 days.

Or another way:

How to calculate 2/10 net 30

— Invoice full amount: $500

— Invoice date: June 1

— Invoice due date: 30 days

— Payment terms: 2/10 net 30

— Discount period: 10 days

Begin counting days from the day after the invoice date.

A quick formula is 100% – discount % x invoice amount.

100% – 2% = 98% x $500 = $490.

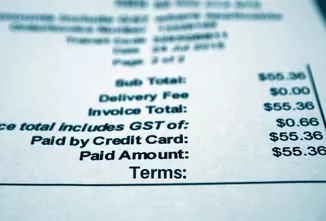

Example of payment terms on an invoice (design only)

Here is a sample invoice payment term template:

What are common payment terms & their meaning?

As mentioned above, these are the contractually agreed-upon terms for payment between businesses, and they must be included in any contract drawn between you and your customers. They should also be visible on all invoices you send.

The terms you outline should include:

- When you expect to get paid – the expected payment date should be outlined in the Invoice, and this should be very clear.

- The due date for the Invoice – This is the date when the payment is due. It should clearly be shown on the Invoice so the customer can know the deadline for payment.

- Currency – You must specify the currency you wish to be paid in, especially trading outside the country.

- Account details and mode of payment – you must also specify what kind of payment method you prefer and how the customers will pay you, including various payment methods.

- Other conditions – if you wish to include other payment instructions, you should include this. Being as detailed as possible when it comes to payments is the key to ensuring no misunderstandings.

Terms of payments explained:

The payment terms usually impact the number of days it will take you to receive payment. Without including them, you will not be able to communicate when you are expecting to be paid.

Here are the most commonly used invoice terms on invoices and what they mean:

| Term | Description |

|---|---|

| PIA | Payment in Advance

This means that you expect your client to pay you in advance, even before the work begins. You must ensure that the client agrees to these terms, before adding them on the invoice |

| Net 7 | This means that payment should be made exactly seven days after the invoice date. |

| Net10 | This means payment should be made ten days after the date on the invoice. |

| Net 30 | This means payment should be made 30 days after the date on the invoice. |

| Net 60 | This means payment should be made 60 days after the date on the invoice. |

| Net 90 | This means payment should be made 90 days after the date on the invoice. |

| EOM | This stands for End of Month. It means that the payment should be made at the end of the month, in which the invoice was made. |

| 21 MFI | MFI stands for Month Following Invoice, and it means that payment should be made on the 21st of the following month, after the invoice date. |

| 2% 10 Net 30 | This is a variation of the Net 30 day’s terms. It means that the payment is due in 30 days of the invoice date, but that the client will receive a discount of 2% off of the invoice amount, if the invoice is paid in the next ten days. |

| COD | Stands for Cash on Delivery, and it means that payment must be made on delivery of goods/services. |

| Cash Account | This means that the contract will be conducted on cash basis only, and there are no credit terms. |

| Letter of Credit | This is a documented credit line that has been confirmed by the bank, and it is often used for exports. |

| Bill of Exchange | This is a promise that is made to pay at a later date, and it is normally supported by the bank. |

| CND | Cash Next Delivery. It means that payment will be made on the next delivery date. |

| CIA | Cash in Advance. This goes without saying. Cash should be made in advance. |

| CWO | This stands for Cash with Order. It means that the payment should be made with the order. |

| 1MD | This means that they is a monthly credit payment for supply within the month. |

| 2MD | This is similar to the above, but you get an extra month to make payment. |

| Contra | This means that the payment from the customer should be made to offset against the amount of supplies purchased from the customer. |

| Stage Payment | This stands for payment of the agreed value at stage. |

| Forward Dating | This stands for invoicing for a payment to be made right after the order has been received by the client. |

| Rebate | This refers to a refund sent back to the customer after they have already paid for the goods delivered. |

| 50% Upfront | In this case, the client is required to pay 50% of the total invoice amount before the work even begins. This is a partial payment and provides you with working capital that is probably needed to complete the project. |

| Terms of Sale | These are the agreed payment terms that both the seller and the buyer have agreed on, and it is for the purchase of goods and services, which includes delivery charges, purchase price and any shipping charges. Additionally, this will specify the due date for payment. |

| Estimates & quotes | These are essentially part of the prospective and they include a whole list of products and services that are to be delivered, the estimated cost and many other pertinent details in the contract.

Generally, you create estimates and quotes for any new or existing customer so as to get approval for the job before the project starts. |

| Recurring Invoice | These are scheduled for payments made on credit or debit cards that are on file for a specific customer. All recurring payments are normally used for repeat services on a monthly period, and they are ideal for bookkeeping. |

| Interest Invoice | This happens when a customer fails to pay their invoice on time and so you charge them interest on the total amount that is due. Calculation for this is usually based on the number of days that that invoice is past due. |

| Invoice Factoring | This is assigning or selling the customer invoices to a factoring company. The company pays you an average that is between 80 and 90%, and then once they collect the payment from the customer, they provide you with the balance after deducting their fees. |

Discount payment terms explained:

Sometimes you may wish to give your client a discount for early payments, and a common way of expressing this is 2/10 net 30 days, and this means that you will give a 2% discount to the client if they pay the Invoice within the next ten days, even though the Invoice should be paid in 30 days.

Here are some common discount payment terms:

| Term | Description |

|---|---|

| Accumulation discounts | This refers to discounts for very large purchases. |

| Coupons | This refers to specific terms, for example a certain quantity of purchase has to be made or a customer has to be of a certain age. |

| Disability discount | This one is offered to customers who have a specific disability. |

| Student/educational discount | As the name suggests, this one is for students, although educators may also receive this discount. |

| Employee discount | This one is offered to employees only. |

| Military discount | This one is offered to members of the military plus their family as well. |

| Partial payment discount | After selling, you will need cash flow, and therefore you offer a partial discount to the buyer. |

| Discount for preferred payment method | This discount is given to some retailers in order to offer them a lower price in case they pay using cash. It saves them the customer any fees they may have been forced to pay using credit cards. |

| Prompt payment discount | In this case, you will give a discount to the customer using the catalogue or list price. It can sometimes apply to promotions. |

| Rebates | these are refunds given back to a customer after they have paid for the goods/service. |

| Sliding scale | This is a discount calculated on the customer’s ability to pay. It is commonly found with non-profit organizations. |

| Seasonal discount | This one is usually given when there is a slack period and the sales are down. |

| Child or toddler or kid discount | This particular discount covers discounted prices for children of a certain age. It is usually a requirement for the adult to pay the full price. |

| Trade discounts | This particular discount is for functions such as warehousing, shelf stocking or shipping. |

| Trade-in credit | This is given when something has been returned. |

How do you write invoice terms & conditions?

Writing invoice terms and conditions includes critical and small aspects that are necessary to complete the conditions on the invoices such as:

- Using polite, simple and straightforward language.

- Mentioning all of the details of the business and the client.

- Completing all the details of the service or product which includes discounts and taxes.

- Including the invoice number and reference number as well.

- Making a mention of the payment mode.

Additionally, the invoice terms and conditions have best practices that must be used and followed in order to make things work fast and simpler.

These include:

The terms of sale

There should be a clear distinction of the terms of sales that will wipe out any chances of disagreement or misunderstanding of both parties. Therefore, it is of utmost importance to mention the sale terms, including cost, single unit cost, quantity, date and time of delivery, payment method, etc.

During the cross-border transactions or deals, mention the responsibility of duties, international taxes, and any other regulations that will make the payment process trouble-free.

Advance payment

This is a usual payment term where the service provider asks the client for full or partial payment before delivering the goods or services. It is prevalent in the service industry, plus it is followed to avoid any non-payments.

Mostly, businesses practice this to avoid any out-of-pocket expenses that may be needed to finish the project.

Usually, they are written as PIA and must be incorporated and followed by the business. The client must, however, look out for such things on the contract terms.

Instant payment

As a service provider, you must demand payment immediately after delivering the goods or services if this is your policy. It is often referred to as COD – Cash on Delivery, and this term and condition must be mentioned to the client even before the project begins.

Net 7, or Net 10 or Net 30

These are explained above, and they refer to advance payments when the client has been offered some credit, and they clearly show when the payment should be expected.

Warranty terms

The invoice must have terms of warranty for the service or goods. This specifies the number of days the warranty is applicable and when it’s not. You must clearly state the warranty period and mention what you are willing to do for the client during this period.

The warranty terms and conditions need to be included in the Invoice. The most commonly used terms in this case are;

- Any products that are damaged during the transit are not covered by the warranty or,

- All products carry a warranty of 90 days unless stated otherwise or,

- The products carry a manufacturer’s warranty only, and there are no returns or exchanges allowed.

Replacement or return policy

For any business, there must be a return policy. This is especially if they deal with retail, and the number of returns they have per product will determine how popular the product or service is.

You will also be able to safeguard yourself from faux orders and claims. The return/replacement terms will reduce any probable losses as a result of the refunds.

Here are some examples of the kind of policies you should have:

- All products for replacement or refund must be returned in the same saleable condition they were during delivery.

- That 10% restocking charge shall apply to all non-defective replacements.

- In case your product or item I damaged, contact the company immediately.

Penalties for late payments

You must educate your customer about late invoice payments and the consequences thereof. There is no harm in letting them know your late payment conditions, and these may include:

- Reminding them of the due date.

- That they will have to compensate you for costs incurred due to any delays.

- That the payment dates cannot be compromised.

- If the Invoice is not received by the specified date, the customer may incur late payment charges at a specified rate.

How to choose suitable payment terms for your clients?

Most businesses will offer their clients certain credit levels for goods and services before making the payment, but customers are known to delay payment almost always.

This places a considerable strain on businesses as the income needed to run the business is then delayed.

To safeguard this cash flow issue, you should check up on your customers by using the information you receive from credit agencies and analyzing company accounts.

You should always explain the conditions and terms of payment to the customers at the beginning of every relationship. You could send them a written confirmation always.

Another condition you need to consider is electronic payments, as this makes it easy to keep track of all payments instead of cash.

Here’s how you can best choose the payment terms for your clients:

Start by looking through the client’s history

The client’s history will tell you about their payment habits, and you can easily find this out through previous relationships the customer has had and their credit information.

You are allowed to pull the business credit report as well, and this will show you whether they pay on time or they are delinquent with their suppliers.

In the beginning, you may also want to require them to pay upfront or at least 50% of the cost to show their commitment.

Even when a client has good credit, working with someone new will always have a level of uncertainty to it and testing the waters is advisable. First, you could do the project in phases and ensure that you get paid in each phase before proceeding to the next.

Size of invoice

For the smaller invoices, you may not wish to spend too much time chasing the payment, e.g. when it’s just a few hundred dollars. In this case, you should require the payment to be upfront or immediately after the delivery is made.

A longer deadline is necessary for the larger invoices so the client can come up with the funds. In case you have a new client, asking for upfront payment or deposit is advisable, so you can reduce any risk of non-payment.

Most business people swear by Net 30, and they say that this always works for them.

Late fees and interest costs

You should consider adding late interest charges to the invoice terms and conditions in order to enforce the payment expectations. It is usually customary for businesses to charge between 1.5 and 2% of the invoice amount.

This is the fee charged for any late or overdue invoices.

Invoice payment terms – examples for SMEs & freelancers

Payment terms are normally consistent across the board depending on the industry you are in. It also depends on the size and length of the job you are doing.

If your business falls into an industry where the terms are Net 30, you do not have any flexibility on that.

For small businesses, there are generally three groups:

- First, the business may offer their customers the same payment terms as similar businesses in the industry.

- Second, the business may decide to offer a narrow range of terms, and

- Third, the payments may vary for different businesses in the same industry.

The main categories that businesses fall into when it comes to setting the payment terms include the following:

- Net 30 – almost all manufacturers offer their goods on NET 30 terms.

- Net 30 to Net 60 – this is mostly found in the construction and fashion industries.

- Varying terms – each business chooses its terms. For example, freelancers may require upfront payments while others are willing to wait for 60 days.

Now, to make sure that your invoice is paid on time, you will need to do enough research to determine the best terms and conditions for your customers.

Setting the right terms early in the contract will ensure that you are paid much faster, and this helps you have a positive cash flow at all times.

What are terms of payment?

This refers to the most common terms that are used by freelancers when they are dealing with their clients:

Late payment terms

This is how you would handle any payments not made on time or in full by the invoice date. One of the most common ways of handling this type of predicament is by adding penalties for non-payment and unpaid invoices after the due date has passed. This includes interest charges.

Once clients know that they are likely to pay a higher bill simply because they did not stick to the rules, they are more likely to pay on time. It makes billing easier, predictable, and reliable, enabling you to achieve higher financial freedom for your business.

Payment due dates

Every invoice you send must have a due date, so your client knows when they are supposed to make payment. Some of the most common due dates have been explained above, and they include such terms as; Net 7, Net 15, Net 30, Due on receipt, Or advance payment.

Payment methods

Different businesses will choose to use different payment modes.

Of course, they choose the most convenient way of receiving payment that is also hassle-free for both them and their clients. Ensure to outline this in the invoice and let your client know which method you accept.

The most common options include:

- PayPal

- Credit or debit card

- Checks

- Bank transfers

Making this clarification will prevent you from winding up with a check when you would have rather received cash or credit card payment.

Discounts offered

It is quite common for companies to offer discounts to their customers and sometimes discounts help you get paid earlier and it also encourages a full payment. Certain discounts encourage networking among your clients and could land you a bigger contract.

For example, you could offer a certain percentage for either early payments, payments within 10 or 20 days, for large purchases, for a second or third order, etc.

Currency

As a business, you probably have clients who are in other countries, and as such, their currencies are, of course, different. In this case, you must ensure to give them the right currency, which you expect to be paid.

Deposits

This is an important payment term that must be outlined when setting up the contract. For example, if you wish your client to pay the invoice amount upfront, you will need to tell them way in advance, even before signing the contract.

You must also tell them:

- How much deposit do they need to make?

- When they need to make the deposit

- Whether it will be deducted from the overall invoice amount or not, and

- Whether it will be refundable at the end.

Where to include payment terms on invoice?

Payment terms on invoice can be included in the following places:

In the quotes

Quotes are a fantastic place to introduce your guidelines and payment terms. The quotes will tell your client what they should expect even before you start working together, and they help set a clear vision of the working relationship you will have together.

In the quotes, you do not have to spell out all the details of payment, such as the exact amounts or due dates, and they can cover some basics such as;

- The billing cycle.

- The currencies and payment methods you are willing to accept.

- Whether or not a deposit is needed.

- How non-payments and late payments are handled.

Include them in the contracts

The contract should be where you specify all of the payment terms in great detail. If you have used an online template, you can create a contract and then look at which payment terms to include and then adjust them as needed.

It is extremely important for the terms in your contract to be reviewed and signed by the client. If there are any serious payment issues or disputes, these terms will help you if anything winds up in court.

Add them to the invoice

So, similar to quotes, the invoice does not have to include the nitty-gritty details of the payment terms, but it should have the following information:

- The exact amount due.

- The specific and clear due date.

- The invoice number and invoice date.

- The acceptable modes of payment.

It is, however, simple enough to just add these lines to the invoices to detail this information without necessarily making it too complicated.

How strict should you be regarding payment terms?

VERY. There is no point in coming up with payment terms if you will not stick by them. As a business owner, you rely on prompt payments to keep your business running, and as such, payment terms are paramount to this.

Whenever a client goes against these terms, such as paying for goods and services late or even using a different method that is not your preferred method, you do not have to get accusatory or aggressive.

Instead, you should let your payment terms become your point of reference to gently remind them of what you both agreed on for the project. These payment terms are supposed to protect you and help you in running a good business.

So, the answer is “Very Strict.” You have to be very strict regarding payment terms.

How to negotiate better invoice terms with clients and suppliers?

Here are a few ways of ensuring that you come up with better payment terms with your clients:

Talk to you clients

Of course, not all of your clients will agree to new payment terms. You must be extra careful when dealing with the existing clients, although new clients are easy as you do not have a pre-existing contract.

Go through your current client list to identify those that are willing to take on new payment terms. You should look for the kind of clients who have been with your company for a long time and those who believe that you are the best at what you do, which means you are not likely to lose them.

Another way you can go about this is by offering them incentives such as discounts for early payments and free delivery, among others.

Come up with shorter payment agreements

You are free to set your payment agreements, and you do not have to stick to the agreed 30, 60, and 90 days. You could come up with payment terms every two weeks, where you allow the client to pay a little at a time.

For large corporations, the likelihood is that they will want to get longer payment terms such as 90 and 120 days.

If that is unacceptable to you, you will have to decide whether you will continue with the client or not, although the large companies tend to have the biggest orders that will change the status of your business.

Learn to be honest

It is wise to always be honest with your clients, especially the new ones. Let them know that you are not willing to wait for more than 30 days for an invoice to be paid, but you must never threaten them in any way.

Negotiate with them until they understand the need for early or on-time payments.

Be willing to compromise

Remember that you are still a business person, and you need your clients at the end of the day to buy your products and give you money.

As such, do not be too rigid and strict when it comes to such negotiations.

Be open to talks and listen to your clients to have an agreement to proceed with the business.

For example, if you are dealing with a start-up, be willing to compromise as they are just getting their foot off the ground, and this means that they do not have as much cash flow as you would expect or that they depend on sales to make money.

Do adequate research of the clients

Before going into business with a new client, properly research them, and especially their business. Find out how they currently pay their suppliers and their credit scores.

Be sure to understand what kind of business they are in and how such businesses perform. This helps when you need to know whether they will sell the goods on time and pay you back.

You must ask yourself how many credit facilities they have already taken, so you can understand their credit position.

How to encourage clients to abide by payment terms?

Most clients will do all sorts of things to make sure that their clients pay on time. Yet, despite all of this, they still have lots of unpaid invoices waiting for them to follow up.

This is quite irritating, and it is good to know what you can do.

Here are a few ways you can use to encourage your clients to abide to the payment terms:

Allow them to pay in instalments

You could allow the clients to pay in installments of milestones. In this case, you receive payment after each stage of the project, at which point you move on to the next stage. Without paying for the first stage, then the project does not proceed.

Customers are therefore more likely to pay and be on time throughout the lifespan of the project.

In the invoicing world, NET is another word for full payment, and most customers will insist on either net 30 or Net 60; this is way too long for any business to accept, and condensing the timeframe and requiring them to pay after a project is completed, or goods are delivered will help you get paid faster.

You may consider asking for a deposit before the project kicks off. This will cause the client to complete the payment early, in order to have their projects done on time.

Come up with a late payment fee

Some customers are simply geared towards paying late, and regardless of how attractive your on-time incentives are, they will never send the money when it’s supposed to.

In this case, you have to be strict, and the best way to go about this is through threatening them with charges and late payment fees for late payments.

This practice is allowed by the law, and you can charge them additional costs of about 1.5-2% of the total invoice amount that remains unpaid. You should, however, not just say it; you must implement it whenever they are late with payments.

Keep updated on your invoices

This means that you should monitor and track all invoices to identify the customers who haven’t paid. This can either be done manually, or you could automate the process and put up alarms when due dates come around.

There are plenty of web-based systems such as accounting software that can be used for this purpose. Regularly reminding clients of payments, they should make could be the push they need to make the payment.

Keep in touch with your clients

For the business relationship to work, talking with your customers constantly is necessary. This helps build respect and trust, plus you can know where they are when it comes to paying the Invoice.

When you have this strong connection, you are likely to have clients who will pay promptly and without any arguments to retain the relationship.

Give them Incentives

Offer your clients incentives for early and prompt payments, such as offering them discounts. This is great for them as it will save them some money.

Additionally, it helps you because you will have cash at hand and keep your books accurate.

Accept different payment methods

This gives your clients options and ensures that you accommodate everyone and their needs. This is a great way of encouraging them to pay on time and quicker as they do not have to start adopting new ways of payments, which may discourage them.

Make it easy for your clients to order and pay

Adopt a system of ordering and paying for goods and services that is easy on your customers. There are many dedicated ordering platforms that you can use from a single dashboard, and these will keep track of all the clients and their orders plus payments.

People love easy things, and this is a fantastic way of making life easy for the customers.

How to improve invoice payment terms to aid business cash flow?

Here are a few tips you can use to improve the invoice payment terms and to aid your business cash flow:

Shorten NET days

As we have already explained, Net days refer to the total amount of money that should be paid within a specified number of days after the invoice has been sent. The standard days are either 30, 60, or 90.

Shortening these days to let’s say, two weeks or 14 days, means that you will receive your money much faster. The faster the payments, the better your cash flow.

However, be careful because not all customers will be open to this, and you may end up losing some of them due to the shortened time frame. Communicate in advance and discuss with the client beforehand.

Define the number of days

When setting the deadline, use the number of days you want to be paid and not the distinct due date.

Okay, let me explain this; for example, if you wish to be paid on a date like 4th of April, that is approx., 15 days away, simply tell the customer that you wish the payment to be made within 15 business days. This is clearer.

When this is done, the customer is likely to mark this on their calendar to forget. Customers do not like to pay early but rather on the due date.

Use of a clear language

Communicate clearly when it comes to payment terms and ensure that your customers understand these terms well. Let them know when the payment is expected, the late payment fees, and the consequences of non-payment.

All of this should be done before the contract is signed. But, ensure to be polite at the same time as you talk to your customers.

Ensure that the payment terms are in writing

It is extremely important to write down the payment terms as this shows the proof of the agreement with the customer.

Let all the payment details be written out and discussed with the customer. Also include all the information needed, such as the customer’s address, their scope of work, and the invoice number. This information will come in handy in case there are disputes.

Give them incentives

There are numerous incentives you can offer your clients, but one that is sure to work anytime is giving them discounts for early payments, which motivates them to play faster and early.

When you give them a discount on the total bill, you can receive money early, which is great for your cash flow.

Data based on millions of UK invoices sent over Xero.

FreshBooks data analytics of 1,393,062 invoices sent.

Typical invoice terms by industry

When you decide the payment terms for your business, there is something you must know; when you extend your payment terms for too long, you will end up jeopardising the future of your business.

Why?

Because the business normally decides the invoice terms. E.g., restaurant owners are usually paid within one or two days, while companies that deal with constructions can wait for up to 90 days to receive the funds.

Here are some of the typical invoice payment terms by industry:

Typical invoice terms by country

Here’s what you should expect in terms of invoice payment terms for different countries:

Frequently asked questions:

Conclusion

Invoice payment terms are used to spell out the relationship between a supplier and their customer.

It is essential and paramount for your company’s success that you include these terms in the contract so they can give a direction on different issues such as when the invoice should be paid, how the invoice should be paid, and the total amount to be paid.

This helps eliminate misunderstandings and disputes that may arise between the trading parties.

The terms also come in handy in case there is a court case concerning a specific transaction.

In the end, it is a set of terms and conditions that seek to protect both the supplier and their customers.

![Invoice payment terms - UK edition 2022 [+ Net calculator] 1 Brodmin](https://brodmin.com/wp-content/uploads/2020/10/brodmin-logo-231x71px.jpg)

![Apology letter for late payment to supplier [with examples] 5 apology letter for late payment to supplier](https://brodmin.com/wp-content/uploads/2021/09/apology-letter-for-late-payment-to-supplier.webp)

![Simplified guide to the late payment directive [EU/UK edition] 7 late payment directive EU UK edition](https://brodmin.com/wp-content/uploads/2021/09/late-payment-directive-EU-UK-edition.png)

![Invoice payment terms - UK edition 2022 [+ Net calculator] 9 brodmin.com](https://brodmin.com/wp-content/uploads/2020/11/brodmin-logo-200x60-1.png)

![Invoice payment terms - UK edition 2022 [+ Net calculator] 10 webauditr.com](https://brodmin.com/wp-content/uploads/2020/11/webauditr-logo-200px-60px.png)

![Invoice payment terms - UK edition 2022 [+ Net calculator] 11 halr.co.uk](https://brodmin.com/wp-content/uploads/2020/11/halr-logo-200px60px.png)

![Invoice payment terms - UK edition 2022 [+ Net calculator] 12 clinkco.com](https://brodmin.com/wp-content/uploads/2020/11/clinko-logo-200px-60px.png)

![Invoice payment terms - UK edition 2022 [+ Net calculator] 13 qrank.co.uk](https://brodmin.com/wp-content/uploads/2020/11/qrank-logo-200px-60px.png)