It is every business’s responsibility to come up with their own fair payment terms that ensure timely payments when invoices are due.

Of course, arrangements can change during tough economic times like what was experienced in 2020/21 due to the Covid-19 pandemic.

We have all felt the pandemic’s impact on the economy; but, no segment of the economy was hit as hard as small businesses with unpaid invoices and shortage of cash flow.

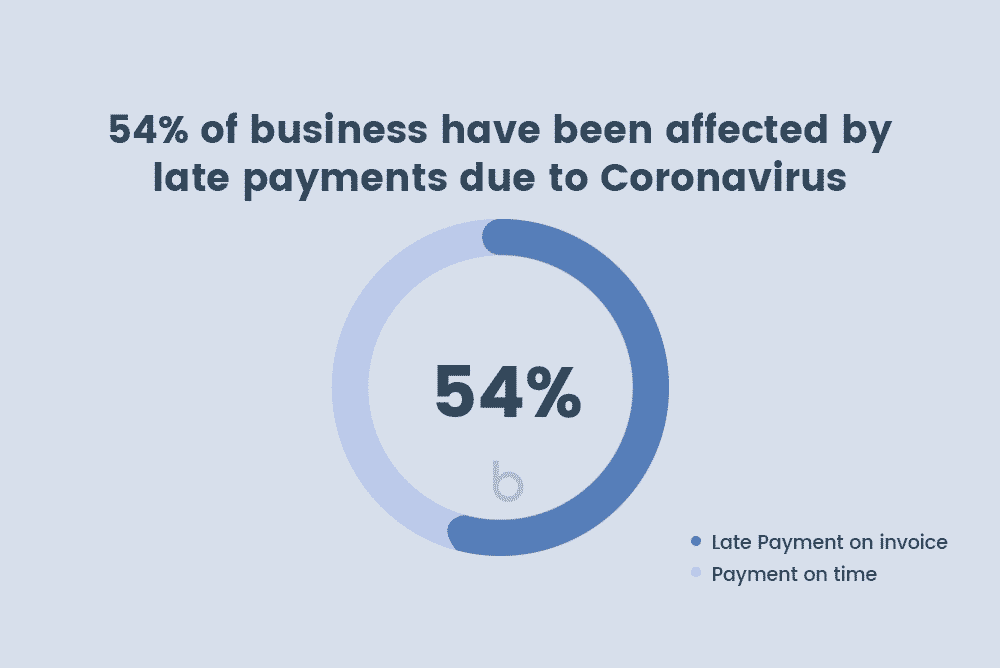

According to the Office for National Statistics (ONS), as of September 2020, 54% of businesses said they were waiting on late payment of invoices as a result of the coronavirus pandemic. [1]

According to SME Loans Google Analytics data, over half of the companies in the UK applying for business finance were looking for loan amounts lower than £10,000. These two statistics clearly show us the impact that late payment of invoices is having on small businesses. [2]

The importance of fair payment terms to a small business

Everyone wants payment terms that are fair or more favourable to them. The benefits of fair terms extend beyond a single transaction to future transactions with other customers and suppliers. That’s why governments advocate for fair terms that allow for equitable financial arrangements and payment certainty. [3]

Having fair payment terms will help build a strong relationship between you and your customer. This can be very beneficial because it means return business for you and thus guarantees regular revenue. On the other hand, the customer is guaranteed consistency in timing and quality.

Fair payment terms also motivate the supplier because they wouldn’t want to lose a good customer. The supplier is also motivated to either increase the quality of their deliverables or be very protective of consistency in quality.

Fair payment terms create a good reputation for both the supplier and the customer which can lead to more referrals. A supplier with a good reputation can easily get more customers because they have a proven track record of consistency and quality while working with existing or previous customers

When you see a business honouring its financial obligations on time, it signals that it is financially healthy and stable in its operations. This is very important when a business is looking to work with bigger companies that are keen on working with businesses that honour their invoice terms and maintain a good relationship with their suppliers.

It also signals that the business has well-established processes that make it operate efficiently.

How payment terms have been impacted by Covid-19

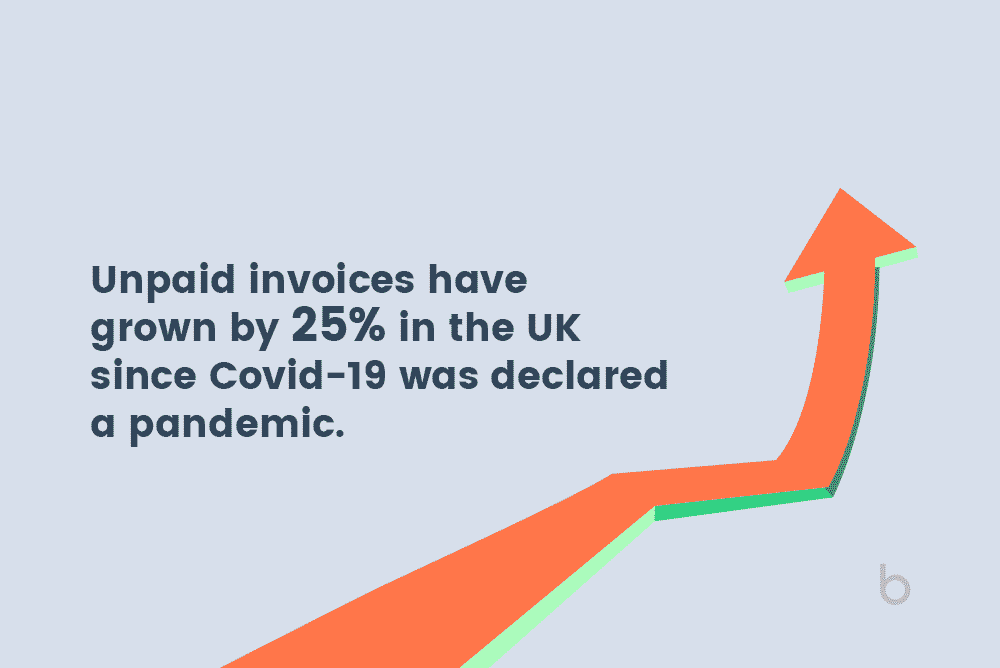

According to Sidetrade, the amount of money that is more than 10 days overdue has grown by 25% in the UK since Covid-19 was declared a pandemic. [4]

With such alarming statistics, companies had to re-evaluate their relationships with suppliers and customers who were also hard hit by the pandemic. The payment terms that most suppliers were already uncomfortable with were in most cases adjusted by their customers’.

With one out of every five small businesses in danger of failing by May, businesses had no option but to agree to the unfavourable terms just so as not to go out of business or lose important clients.

While some of their customers were in distress and changed the terms to maintain a productive relationship during the pandemic, others changed the terms because they saw an opportunity to exploit smaller businesses for their benefit.

Below are some of the negative changes in payment terms that we are currently experiencing:

I. Lengthened payment period

These businesses had their customers demand that they increase the period between when the invoice is delivered and when it falls due. Cash flow shortage due to reduced business meant that the product or service they procured took longer to be paid for by their customers.

Without ample time to also get paid, most businesses feared that paying their supplier would leave them cash-strapped and unable to pay for business expenses.

This has meant that smaller businesses have had to reduce the number of businesses they can do because their capital is held for longer periods without any increase in return. The limited liquidity has also meant that most businesses were at the mercy of the customers that they invoiced and the failure of a major customer to pay could easily have led to them closing down their business.

II. Advance pay option cancellation

Advance pay is very important to businesses that do not have a lot of capital that can enable them to comfortably deliver their services or products and then deliver one invoice covering the complete contract. Without advance pay options, opportunities for smaller businesses were limited during a period when business was already low. [5]

If you have a significant advance payment option your risk is reduced and the possibility of the client not paying doesn’t have to hold your business hostage.

Without an advance payment option, your business is highly exposed in case the customer goes out of business or there is a disagreement that stops the contract delivery halfway.

During the same month of September, the U.S. Census Bureau’s Small Business Pulse Survey showed that nearly eight in ten small businesses in the United States requested aid from the government. [6]

This goes to show how much the small businesses needed liquidity to keep their business operational. Without advance pay or financing options, most of these businesses might have had to close down despite having credible customers.

III. Suspension of payment on delivery

The payment on delivery is very favourable to many businesses not only because it allows them to maintain adequate liquidity but also carries minimal risk from late invoice processing.

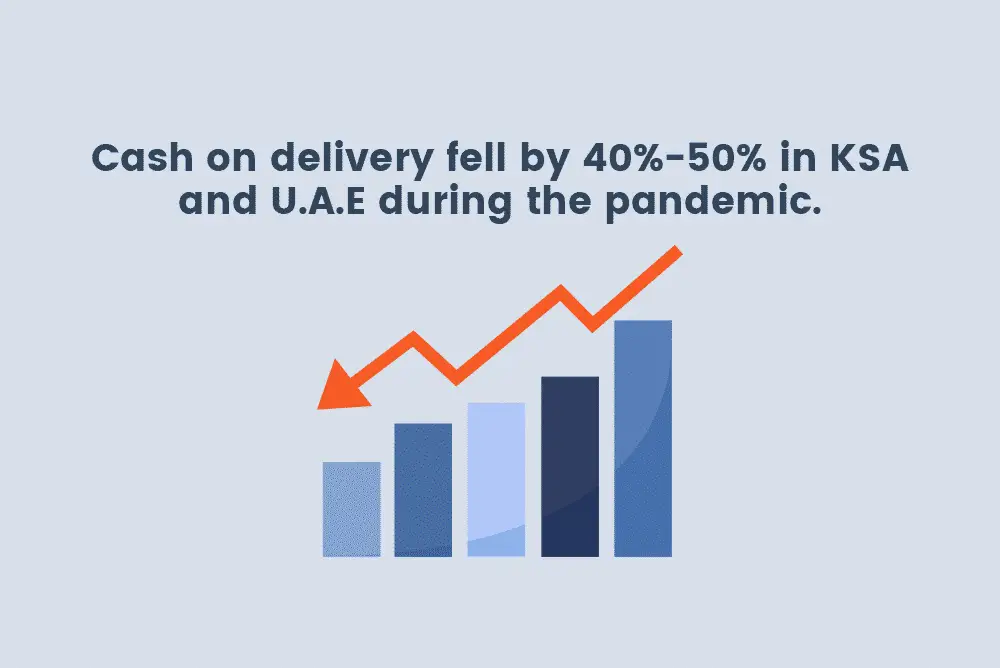

According to Aramex, cash on delivery fell by 40%-50% in Saudi Arabia and U.A.E during the pandemic as businesses wanted to protect the available liquidity. This has pushed businesses that cannot afford to wait for payment aside and their customers have been taken by bigger businesses who can afford to wait for payment months after invoicing. [7]

Businesses gave their suppliers the option to either significantly reduce the amount of product they supplied to get paid on delivery or deliver the same quantity and increase the period between delivery and when the invoice falls due.

Changes in delivery frequency can increase the cost of delivery and in some cases will make the order not feasible for the business due to the increased per unit supply cost. Cancellation of the payment on delivery terms has made it more difficult for many businesses to continue operating profitably.

IV. Recurring invoice bundling

This has been a major problem for businesses that provide subscription services to other businesses. Due to the pandemic that led to many businesses allowing their staff to work from home, many recurring expenses remained unpaid because the employees who process and approve the payment couldn’t do it remotely.

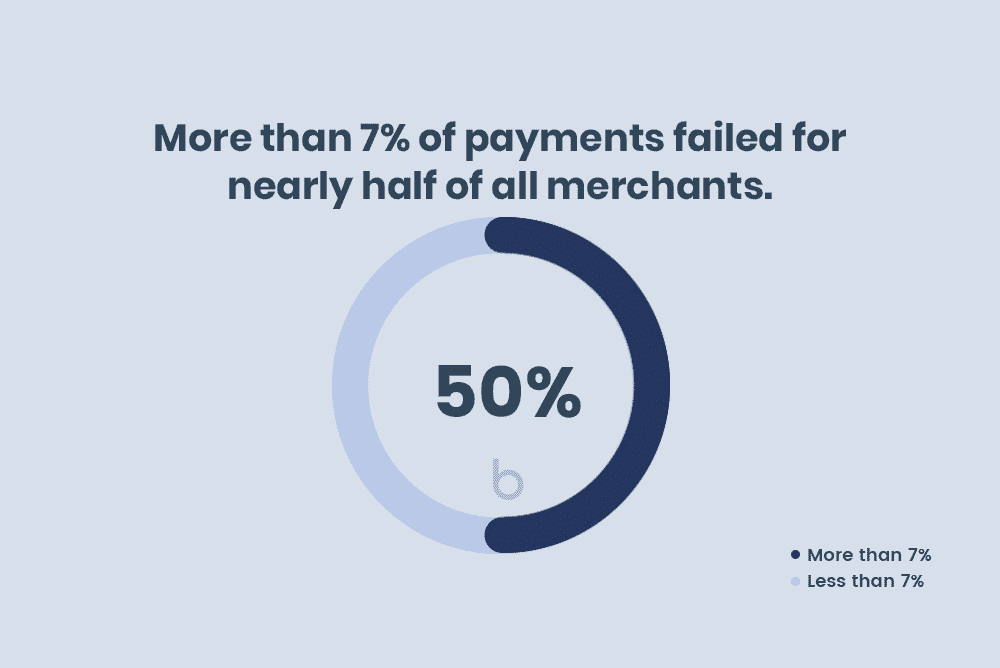

According to a Forrester report commissioned by GoCardless, in September 2020 more than 7% of payments failed for nearly half of all merchants. [8]

Also, many businesses requested that their recurring expenses be bundled up; for instance, monthly payments to be turned into quarterly payments. This is not good since we know that changes in the payment period cause cash flow problems that make it more difficult for the business to undertake its operation successfully.

V. Increased incentives for early payments

Businesses will at times offer discounts for the customers based on how fast they make their payments.

These discounts reduce the profit they are expected to make at a time when there is already reduced revenue due to a decrease in consumer’s spending capacity. In most cases, such decisions are made to secure continuity of business so that they can still be open after the pandemic is over. [9]

It’s worth noting that some big businesses take advantage of other businesses offering this incentive and insist on getting the discount despite not paying early enough simply because they know the business offering this discount is in financial distress.

VI. Increased invoice factoring rate

Invoice factoring is a strategy employed by businesses to gain cash flow from invoices that have not been paid yet by selling the unpaid invoices to a third party at a discount.

During the pandemic, the risk of an invoice not getting paid or the period from when it falls due to when it is paid being too long has increased significantly. Companies that offer invoice factoring services have adapted to this increase in risk asking for higher discounts on the invoices they pay for. [10]

In some cases, factoring companies have also incurred heavy losses as some companies that seemed financially healthy are now struggling to fulfil the payment obligations owed to them.

Expected payment terms changes post covid-19 pandemic

According to the Federation of Small Businesses (FSB), 62% of all small businesses experienced either payments being frozen completely and/or had an increase in late payments as a result of COVID-19. [11]

With these statistics you should be very keen on the customers you would be willing to transact with and the specific terms that would be acceptable to you.

Some of the changes in payment terms that we expect to see post-Covid-19 include:

#) Formulation of payment terms will be dependent on the financial health of the customer and their previous record with other suppliers.

More than ever before, businesses will check in directories such as brodmin to see if their customers have been reported for not honouring their financial commitment after receiving invoices.

If the customer has been reported several times by other suppliers, the business will most likely request advance pay, or payment on delivery to minimize the risk involved.

#) We shall see more businesses demanding a contract with a customer to be signed before they can proceed with the transaction.

A contract adds an extra way through which a business can legally pursue a customer who refuses to honour their obligation after receiving an invoice.

With a clear contract, it would be easier to state the course of action that is to be undertaken if the invoice is not paid after it falls due.

The idea of businesses only relying on an invoice as a source document will be abandoned by most businesses and freelancers.

With a signed contract and all transaction documents available, businesses will be wary of the other party pursuing legal solutions to unpaid invoices.

#) More sellers will now keep an eye on their customers’ financial health and ensure that they adjust the payment terms based on it.

This will motivate more businesses to maintain a good reputation to get better payment terms from their suppliers.

This is because the financial health of the company from an outsider’s perspective can be directly related to their ability to fulfil their financial obligations including invoices that have fallen due.

#) More sellers will break down the supply order and the invoices being delivered to the customer.

The invoices will also have different due dates to ensure that the risk is reduced.

The breakdown of the supply orders will ensure that they are getting regular payments instead of one consolidated payment.

#) More sellers will now engage financial consultants to help them create a credit plan that ensures the long-term financial health of the business.

With clear credit limits, a business can manage its credit risk and maximize the profit from credit transactions.

Payment terms put forward by the suppliers will take into consideration the credit limits of their own business.

Formulating the payment terms to decrease the chances of late invoice payment

Payment terms that are good to a supplier will ensure that they retain the customer, get paid as close to the due date as possible, and position the supplier to get more orders.

To achieve this, a supplier must consider the following factors:

- They reflect the customers’ nature of business: For instance, pharmaceutical manufacturers might withhold pay until they test the quality of the material supplied. The terms with such a customer need to take into consideration the materials testing period.

- Competitors’ terms: It is important to research what the payment terms the competitors are offering to ensure customer retention and better positioning when payments are being processed.

- Economic situation: Payment terms that reflect the economic situation minimize the risk of the customer being unable to honour their payment obligations.

- Customer relationship: The payment terms must be formulated to reflect the need to grow the relationship with the customer. A good relationship with the customer can also allow the supplier to request early payment when they have cash flow shortage problems.

Some of the terms that the supplier can adjust to decrease the chances of late invoice payment include:

- Requiring advance payment before delivering goods to their customer ensures that they minimize the risk of loss as well as show the customer’s commitment to the transaction. However, the advance payment requested should not be too high that it scares away the customers.

- Breaking down big orders into smaller deliverables and smaller payments will not only secure continuous cash flow but also encourage the customer to make the payments.

It will be important for businesses to note that the impact of Covid-19 will not just go away after a return to normal life.

An analysis by Ernest and Young found that 72% of the family businesses will be losing money within four years unless there is increased funding from NHS England. [12]

This is why businesses need to adhere to the above strategies to ensure they minimize their exposure even at the expense of some of the profits.

Handling delayed invoice post covid-19 pandemic

If in the UK and the business owing money does not show serious signs of paying invoices that are due, report them to brodmin.

This is an independent directory focused on collecting reports on businesses that leave service providers unpaid.

There are many suppliers whose invoices fell due many months ago and are now worried about whether they’ll ever get paid.

With Covid-19 cases going down and more vaccines being approved, many businesses are looking forward to a return to normalcy which would mean an increase in their revenue.

As a supplier who has a late payment that seems less likely to be paid by the day, this is the perfect time to talk to the customer and come up with a new payment plan.

At the end of the day, a late payment is better than no payment at all or an expensive lawsuit that can take months to be settled.

It is important that as the late payment is being pursued, the supplier retains a long-term view of the relationship with the customer.

This can be done by agreeing to partial payments that are to be made as the business continues to recover from the Covid-19 financial shock.

In some cases, it would even be okay for the supplier to agree to continue supplying more goods if they are confident of the customers’ ability to fulfil their obligations from the day the invoices fall due.

It is also important to be firm but reasonable and polite while asking for payment from the customer.

This is because the suppliers’ reputation is also at stake despite being the party that is owed.

However, by being firm and polite, you increase the chances of getting paid as well as the chances of getting referral business.

When calling to ask for late payments, do not just focus on demanding to get paid, instead, ask questions to understand how the business is doing.

After all, you want the next step that you decide to take to take into consideration the current situation of the business owing you money.

Conclusion

In conclusion, we expect to see changes in not only the structuring of payment terms but also in how unpaid or late invoices are handled after the Covid-19 pandemic.

It’ll now be a great opportunity for businesses to also evaluate the credit limits and their financial health to ensure they are better positioned to handle economic shocks in the future. Unfortunately, so many businesses have closed down due to cash flow problems while they were still owed money.

It is now time to not only restructure the business but also the payment terms to ensure the business is not over-exposed in the pursuit of higher profits.

Businesses should also take advantage of the available technology to report companies that don’t pay their invoices as well as look up the status of those companies they are supplying or want to start supplying.

![Apology letter for late payment to supplier [with examples] 5 apology letter for late payment to supplier](https://brodmin.com/wp-content/uploads/2021/09/apology-letter-for-late-payment-to-supplier.webp)

![Invoice payment terms - UK edition 2022 [+ Net calculator] 6 Invoice Payment Terms UK Edition 2021](https://brodmin.com/wp-content/uploads/2021/09/Invoice-Payment-Terms-UK-Edition-2021.webp)