Cash flow problems in business often stem from late payments. Cash flow problems for a business can manifest in multiple ways, such as having trouble paying your bills or not being able to balance all your spending and growth goals.

Business cash flow problems are hard to avoid if your invoices are not paid on time, but it’s essential to do what you can to avoid them before they start cribbling your business.

What are the most common problems that businesses face?

Let’s take a look at cash flow issues and how small businesses can prepare for them.

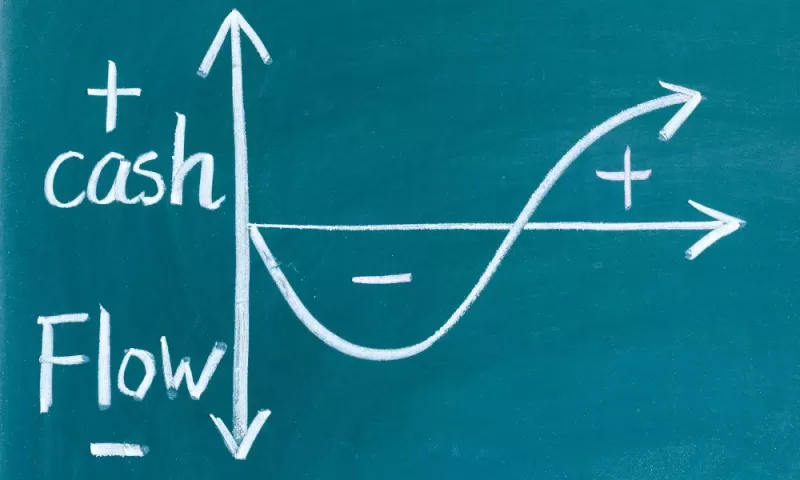

What is cash flow?

It is crucial to monitor and maintain your cash flow forecast, how money moves in and out of your business and investments.

Without cash flow management, problems occur when the amount that flows out (expenses) exceeds the amount (income).

Business cash flow often must be planned six months in advance because it takes time for invoices to be paid, revenue to come in, and checks to clear. [1]

Cash flow problems are a significant cause of stress for business owners

Cash flow problems with businesses often stem from late payments. [2]

Cash flow problems happen in several ways, such as having trouble paying your suppliers or not being able to balance all your spending and saving goals.

Cash flow issues are hard to avoid, but it’s essential that you tackle business cash flow problems and late payments early before they become too severe.

What are the chief causes of business cash flow problems?

The main cause of business cash flow problems for many SMEs is not having a business cash reserve.

Cash flow problems can appear in unexpected ways and are hard to avoid, but it’s essential to do what you can to get out of them before they become too severe.

It is also vital for business owners to think about how they will make up the cash shortfall if a client takes a long time to pay.

Eight typical reasons for cash flow problems:

Cash flow problems are something you need to fix as soon as your business starts. It can be very difficult to get back on track if you start off wrong.

Even if your business has been around for a while, you should still keep an eye on cash flow and correct any issues that might arise.

It is also vital for business owners to think about how they will make up the cash shortfall if a client takes a long time to pay.

1. Unforeseen expenses

Underperforming revenue streams can lead to sudden and steep drops in your business’s cash flows even at times when you’re managing your costs exceptionally well. This can happen through any expense, from renovations or training programs to supplier discounts; such expenditures have no place in an operational budget without proper preparation.

2. Poor cash flow forecasting

Business owners must always be vigilant in monitoring cash flow. Too many minor errors in assessing the actual state of your business’s financial health can add up to real problems down the line.

3. Declining sales

Lower-than-projected sales can profoundly impact a cash flow, especially if you either don’t have or choose not to use credit lines during leaner times.

4. Lack of a plan for building up cash reserves

You may be able to avoid catastrophic cash flow issues by maintaining some cushion built up through profits or access to private loans available to lend money against property for short-term relief.

5. An unprofitable product line or service line in the mix with profitable ones

When you’re building a profitable company, you can’t afford to sink too much time or capital into projects that may not work out.

6. Operating on too tight a margin to make ends meet

Not factoring in additional expenses in your monthly budget is one of the easiest ways to find yourself in trouble with cash flow if circumstances change unexpectedly.

7. Managing payables poorly so that they are not paid on time and creating late charges

The best way to avoid dealing with late charge issues is to pay all payments on time especially invoices from suppliers and contractors, customers even bills from vendors like advertising firms and credit cards. It is never a good idea to pay invoices late, even if you have the money.

8. Too much inventory

Having too much inventory in stock can be a significant problem for your business. If you do have excess inventory, spend some time finding ways to get rid of it. If you cannot sell the excess inventory at a reasonable price, then liquidate the items and use the money to pay off your debt or invest in something else that will help you increase the revenue stream.

What are signs of impending cash flow problems?

The first sign is seeing unexpected drops in income coming from any area of your finances. This means that fewer customers are buying products and services, or vendors are extending due dates without prior notice.

Late payment cash flow problem examples

Late payments cost businesses an enormous amount of money each year.

The costs are primarily due to the advanced fees and interest rates charged by lenders, which exceed 18%. [3]

For a company with £1 million in outstanding invoices, that’s an additional £180,000 in yearly expenses.

When businesses cannot pay their bills on time, it suffers from penalties and late-payment fees incurred by vendors and banks.

These costs mean companies must adopt policies that minimize the chances of getting behind on bills, like paying invoices as they come in.

Here are a few examples of late payment problems:

- You have a business account for your retail store. One day you run out of your cash reserve, so you take an advance on your credit card to cover the business’s expenses, only to find out that you didn’t process your credit card installment on time resulting in an additional £30 late fee.

- You have a contract with a large business due at the end of every month. You tend to be very slow in processing your payments. When this particular corporation sends you their invoice, instead of paying it within the standard terms and conditions, they decide to charge you with interest for being late plus extra late fees.

- You are having some financial difficulties, so one day, you receive an invoice from your landlord who wants his rent now instead of later, or else he will start charging you penalties until the bill is paid up in full.

- One night after closing hours, there is a knock on your door, and you find a man from the local sheriff’s department with an order to place your business in receivership because you have failed to pay several of your creditors.

- You decide that it would be better to pay off some of those late fees by going ahead and paying your creditors directly without using a credit card, so you call up one day, they take the money out of your account but then charge you even more interest than before.

- As a result of all these late payments penalties on previous months, one month, your bank statement shows that there are no available funds left in any of the accounts, which means all deposits will not go through, including payroll and vendor fees, until the following statement comes out. This results in fines being issued for non-compliance and your business eventually being closed.

- In a final attempt to conquer these issues, you make a list of all parties that are waiting for payment, call them up, and promise to pay upfront next week, only then get tricked by an internet “payday loan” company that charges you an outrageous interest rate and points for this tiny advance which lasts just until the following payday, but before you know it, even that advance goes into arrears.

The consequences of business cash flow problems

The consequences of business cash flow problems, such as overhead expenses and business expenses, are severe issues.

When cash flow is tight, overhead expenses need to be paid before business expenses. This is because overhead expenses are overhead costs that the small business owners will incur regardless of operating.

Examples of business overhead expenses for a small business owner would be rent, salaries for people not generating income, general office expenses, etc.

The overhead expenses will continue to be incurred even if the business isn’t doing well.

Business expenses are overhead costs that depend on the company being open and producing income.

Another business consequence of cash flow problems in business can be a reduction in credit scores. This will have an impact on your ability to borrow for a mortgage, car loan, or other types of credit.

Your bank may also require you to put up more collateral or security when you want to borrow.

Sometimes, people are forced to sell investments they usually hold onto, such as stocks or bonds, without enough cash on hand. On top of all this, it is difficult to get new credit if your history has been marred with too many late payments.

The most severe consequence for small business owners

The most severe business consequence of cash flow problems is that it can lead to a company’s bankruptcy and adversely affect its suppliers. It can also lead to layoffs, which affect the unemployment rate and economic growth.

Cash flow is the lifeblood of a business and can make or break it

Businesses that lack a cash reserve risk being unable to meet their financial obligations.

This includes payroll expenses, making required tax installments, interest on loans, and lease payments. Failing to pay these bills on time can result in penalties and other legal actions against them.

In business, there may also be problems with suppliers who might not ship goods or services without payment guarantees from the company.

A negative cash flow situation can also affect employee morale because there are no funds available for raises or bonuses, which has been shown to reduce productivity levels of worker’s overtime.

Avoiding the problem

To avoid business cash flow problems, business owners should begin by making a list of all their expenses.

They can then prioritize the need to pay each category, including what is most important and what can wait. It’s also important to save for major purchases ahead of time, reduce credit card charges and put off unnecessary spending.

Having an emergency fund that allows you to meet unexpected costs without borrowing money or taking from savings is a sensible financial decision.

Therefore, it’s best for business owners to set aside a portion of their profits if they had an emergency that required them to use some operating funds.

The goal is to always have two months’ worth of cash available on hand so that if there are any disruptions in sales, you will still be able to pay your expenses and keep the business running smoothly.

Given below are some ways how companies can better handle late payments:

1. Do not process payments too early

Invoices must be processed at least five days before the end of each month. This will ensure that it reaches your account before the end of the billing cycle, and you won’t be surprised by a sudden overdraft on your account.

2. Agree with each creditor regarding late payments

This will avoid any situations where penalties are charged for payments arriving past due dates. Work out a schedule with each of your clients, which will provide you enough time to process the payment before any penalties are imposed.

3. Check all creditors’ payment dates every month

You must check when debt payments are due for payment because some may charge a fee if they miss the cutoff date.

4. Be aware of interest rates and late fees

Before you sign up for any loan, be mindful that there are usually additional costs for being late with your payments. If you have trouble making it to the bank before closing hours, use a credit card that is accepted online, or if you want to pay directly with your card, then consider setting payment reminders in your phone so that they can do the work for you. You should also call each creditor to determine if they charge interest for late payments or require a minimum amount to be paid on time every month.

Bottom line

In conclusion, we have discussed the reasons and consequences of business cash flow problems. Late payment is also a type of cash flow problem that can cause debt to increase and affect your company’s credit rating. Entrepreneurs need to be aware of all kinds of cash-flow issues to avoid them in their business practices.

![Apology letter for late payment to supplier [with examples] 5 apology letter for late payment to supplier](https://brodmin.com/wp-content/uploads/2021/09/apology-letter-for-late-payment-to-supplier.webp)

![Invoice payment terms - UK edition 2022 [+ Net calculator] 6 Invoice Payment Terms UK Edition 2021](https://brodmin.com/wp-content/uploads/2021/09/Invoice-Payment-Terms-UK-Edition-2021.webp)