There are companies that exploit SMEs as an overdraft for free credit and delay the payment period for as long as they can get away with it. But the biggest reason why companies choose to pay their invoices late is to benefit their cash flow.

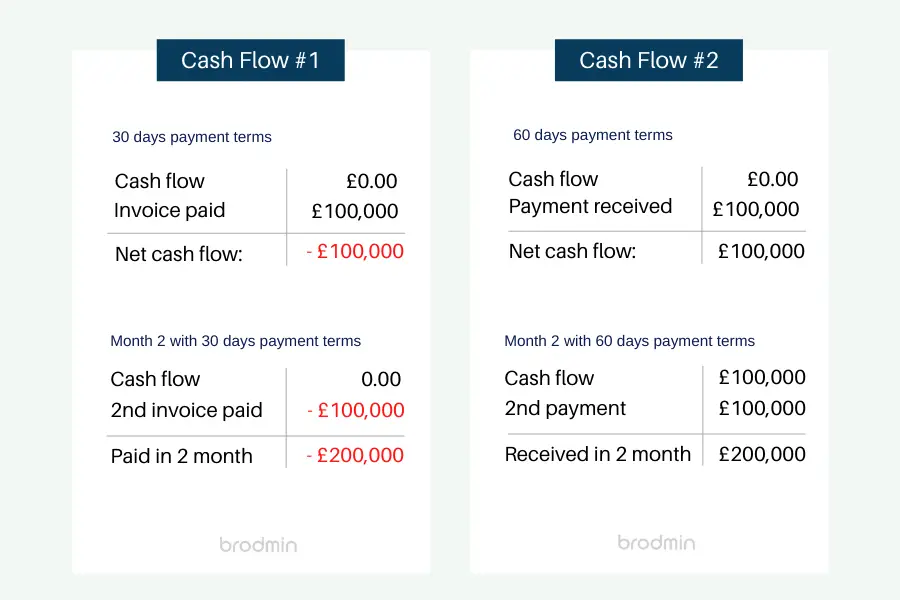

For example, you are paying your suppliers an amount of £100,000 each month on cash terms.

This means immediately you make the purchase and you do not take any credit, then it means that in one month you will have paid out £100,000, which comes from your cash flow for settling debts.

If the same thing happens in the following month, you will have parted with £200,000 in two months.

Assuming that your income covers that amount, but you do not make the sales until the second month, then you may have to finance the first month’s purchases with an overdraft.

But, if the invoice has a 30 day period, meaning that you will only have to pay after 30 days have elapsed, then, you do not need to get an overdraft of £100,000, which of course has to be paid back with interest. £100,000

If you continually keep making 30-day payments, then this additional cash flow benefit will be in your business, which is a great benefit.

If you can in fact take 60 days payments for invoices, the benefit accrues as follows:

In month one, you will not have to pay out the £100,000 and neither will you have to get an overdraft.

Then in the second month, again you do not have to pay £100,000.

At the same time, your customers have already paid you £200,000. This is cash flow to your business.

Such situations are the reasons why most companies pay invoices late.

If cash flow is not taken care of, most companies end up collapsing.

Some large companies even take 120-day invoice periods.

Here are some other reasons why invoices are paid late

Administrative issues

Most companies pay invoices late. This is probably because the department invoiced processes many invoices at the same time, and with so many different people involved in authorizations, there are plenty of signatures that must be appended on the invoice.

Lack of proper procedures and frequent errors

Vigilance is required when preparing invoices as most companies will refuse to pay an invoice that has got some errors on it.

This inevitably causes payment delays because any rejected and unpaid invoice must be sent back to you and you must balance your books first before re-issuing another one.

Some clients also claim “forgetfulness,” when it comes to invoices and they fail to pay the invoice.

Always be extremely accurate when preparing the invoice and ensure that you have followed up with the client as needed so they can pay the invoice.

Cash-rich companies might pay slower than others:

- CFO who needs cash for speculation or investment in short-term investments

- Companies may not see the benefit of accelerating supplier payments if they have a slow and cumbersome approval process for accounts payable

- Delays can be caused by errors in invoices, disputes, and unprocessed credit.

- Some companies play dirty; these companies will pay large, powerful suppliers while delaying small suppliers.

Advantages and disadvantages of delaying payments to suppliers

Advantages

- You get to pay the vendors after selling the goods.

- You get to keep up with the industry trends through conversations as you can be sure that your vendors will keep calling you as you owe them money.

- The discounts offered from paying in short order will help with your costs.

Disadvantages

- You may be charged penalties such as late payment fees if you do not pay within the allotted time.

- Your credit may be damaged if you do not pay or if you are consistently late.

- You may run into trouble with your business where you are required to borrow in order to offset your debts.

What can be done to encourage a large company to pay late invoices?

What can be done to encourage large companies to pay late invoices?

Know Your Customer

KYC may sound like a cliché, but it helps to establish a good relationship with your client.

It is much easier to sort out the payment terms and chase the overdue payments when you know what kind of client you are dealing with.

Do not let the frustrations of the late payment sour this relationship. However, small business owners run the risk of offending their clients by being too tough on them about payments.

Do not just go into a business agreement blindly. Instead, do proper research of the business you are about to engage with.

Find out their typical timescales for settling invoices and whether or not they do pay the invoices.

The most extended payment period for Invoices in the Business to Business Sector for the UK is usually 27 days. Find out whether this is agreeable with them.

Ensure you understand their business in detail and the kind of challenges they face. For example, are they profitable, how have they been interacting with other businesses? How many credit facilities have they taken?

All of these are essential questions to be answered when getting into a B2B business, as it will give you an idea of how long it usually takes them to pay an invoice, which you can include in the contract you will prepare for them.

Agree on the payment terms before the contract starts

When you agree on payment terms in advance, you are in a better position to protect yourself from late payments and non-payments.

One thing to be aware of is that the blue-chip companies tend to insist on long-term payments of almost 90 days.

When you enter into a contract with such as company, you must either request payment upfront or be willing to wait for that duration for the payment to be made.

For small businesses, this is a long time to wait for cash, and therefore, they must decide whether or not the business is worth it.

Additionally, the large companies will want to receive discounts for paying early, and this should be considered early on and incorporated into the contract.

Ensure that you invoice promptly and correctly

Not only should you ensure that you send the invoice on time or immediately after the delivery of the services or goods, but you must also ensure that the invoice is correctly written and prepared.

The faster you send the invoice, the faster the company will start preparing the payment. Most companies perform their invoicing in batches, and it may take as long as a week or longer to pay their clients.

Errors on your invoice can also become a big issue, whereby the company may refuse to pay the invoice.

Ensure that the quoted prices match up to all the other data in the system. There must be no inconsistencies that are likely to expose your company and derail your payment.

To mitigate against this, have a quality control system that ensures that more than two people go through the invoices before sending them to the customer.

Remind clients to pay the invoice immediately it’s due

When dealing with and preparing invoices, the best thing to do is to ensure that you prepare and deliver them to the client immediately after the service or goods has been delivered.

Heavy-handed attempts to collect from the client will sometimes backfire and sever the relationship with the client.

This is, in fact, pretty delicate when small companies are trying to negotiate with small ones. The small firm will be uncomfortable applying too much pressure to the big company, and at the same time, trying to salvage the relationship.

Make sure you understand vendor portals correctly

One recent trend for large corporations is implementing online vendor portals where their supplies can log in and submit their invoices and even check on the status of the invoice and any upcoming payments.

It is important that you understand the system and how it works so you do not end up not getting paid.

Understand the right way to issue invoices, accept the purchase orders, and input the correct banking details.

Most times, the portals are designed to cut out the interactions with humans, eliminating the need for helpdesks.

Take time to learn how the portal works to avoid any delays.

How long do companies legally have to pay an invoice?

30 days, unless otherwise agreed. If the invoice does not specify a payment date, or if the business has not discussed it beforehand, you must pay within 30 days.

Running late on an invoice payment is pretty standard, especially if your business is not doing well or if you are having some trouble with your credit card bills. [1]

I have gone through it in my business, and with time I had to learn how to handle such bills.

It is crucial to understand how this will impact your business because every payment will necessitate an entry into your credit report.

You may want to know when a late payment will appear in your report and if you are allowed some grace period.

Every payment missed or late will impact your credit score and credit report.

Usually, late payments will not end up in your report for at least 30 days.

This is after the date of the missed payment, and you may incur late payment fees.

If, however, you are just a few days late, or you are a couple of weeks late on the same payment, you can make full payment on the invoice before the 30 days are up.

The lenders and creditors may report you to the Credit Reference Agencies or CRAs for the late payment.

Bear in mind, though, that if you cannot make the full payment and only make a partial payment, you will be reported as being late.

Is it possible to negotiate better invoice terms to get paid faster?

Yes. Although it’s not an easy thing to do, it can be done. Here’s how:

Choose your clients wisely

It’s not possible for all your current clients to agree to new terms, which means that you have to be very careful with new clients. Set the right payment terms with them, and ensure that they are different from what you currently have.

Also, you can choose amongst your current clients who are likely to agree to new payment terms, and who aren’t. Be very sensitive with this point, so you do not cause any friction with them and end up losing your clients.

You can offer incentives such as a discount on early payment of the next contract, and with each negotiation, make sure that you have learned something new and then move on to apply it with the next client.

Set short-term payment arrangements

As a company, you are free to set your own payment terms. You do not have to stick to the agreed usual 30 days, or 60 days, or 90 days. In fact, you could set payment terms to be two weeks. In this way, you will be able to receive your money early and on time.

The large companies however require even longer payment terms such as 90 days and 120 days. In case this is not acceptable to you, then you have a decision to make. Either miss out on the business or have your money tired up for almost 4 months.

Unfortunately, large companies also tend to be the best clients, who can make large orders. So, in the end, you may be forced to accept their payment terms in order to keep your business going.

What you could do is to clearly agree on the terms of payment before any contracts are signed, so both parties are aware of what to expect from each other.

Be honest

It is important for a new client to understand that you are not willing to wait more than 30 days for your invoice to be paid. Well, you shouldn’t threaten to withdraw your business, but you could instead negotiate and come up with a plan that works for both of you.

Compromise

At the end of the day, remember that you are still in business and you need clients. Do not be too strict and rigid that you are not willing to listen to your client.

If they honestly cannot pay in the stipulated time, and you can wait for the money, then go ahead and allow them to buy from you.

They could be a start-up that is just trying to get their foot off the ground, which means that they do not have much in terms of cash flow, but they show lots of promise, so, go ahead and support them in this way, you may even end up with a long-term client.

Research your clients

Do not just go into a business agreement blindly. Do proper research of the business you are about to engage with.

Find out their typical timescales for settling invoices and whether or not they do pay the invoices.

The most extended payment period for Invoices in the Business to Business Sector for the UK is usually 27 days. Find out whether this is agreeable with them.

Ensure you understand their business in detail and the kind of challenges they face. Are they profitable, how have they been interacting with other businesses?

How many credit facilities have they taken?

All of these are essential questions to be answered when getting into a B2B business, as it will give you an idea of how long it usually takes them to pay an invoice, which you can include in the contract you will prepare for them.

Related article: Invoice payment terms (UK Edition)

Conclusion

Large companies do take time to pay invoices, but they also make large orders. As mentioned above, it is wise for you to decide whether you are willing to wait for the payment or not. At times it is beneficial to the company to wait, while other times it’s not.

![How to write past due invoice emails that work [+ tips & templates] 6 How to write past due invoice emails that work](https://brodmin.com/wp-content/uploads/2022/04/How-to-write-past-due-invoice-emails-that-work.webp)

![How to invoice international clients [+ 10-point checklist] 7 Invoicing international clients](https://brodmin.com/wp-content/uploads/2021/10/Invoicing-international-clients-0.webp)