What is a valid tax invoice? Tax invoices are invoices sent by registered dealers to the purchaser indicating the amount of tax due. It contains the details of goods, services, and taxes. A tax invoice allows your tax-registered suppliers to claim their tax credit for purchases.

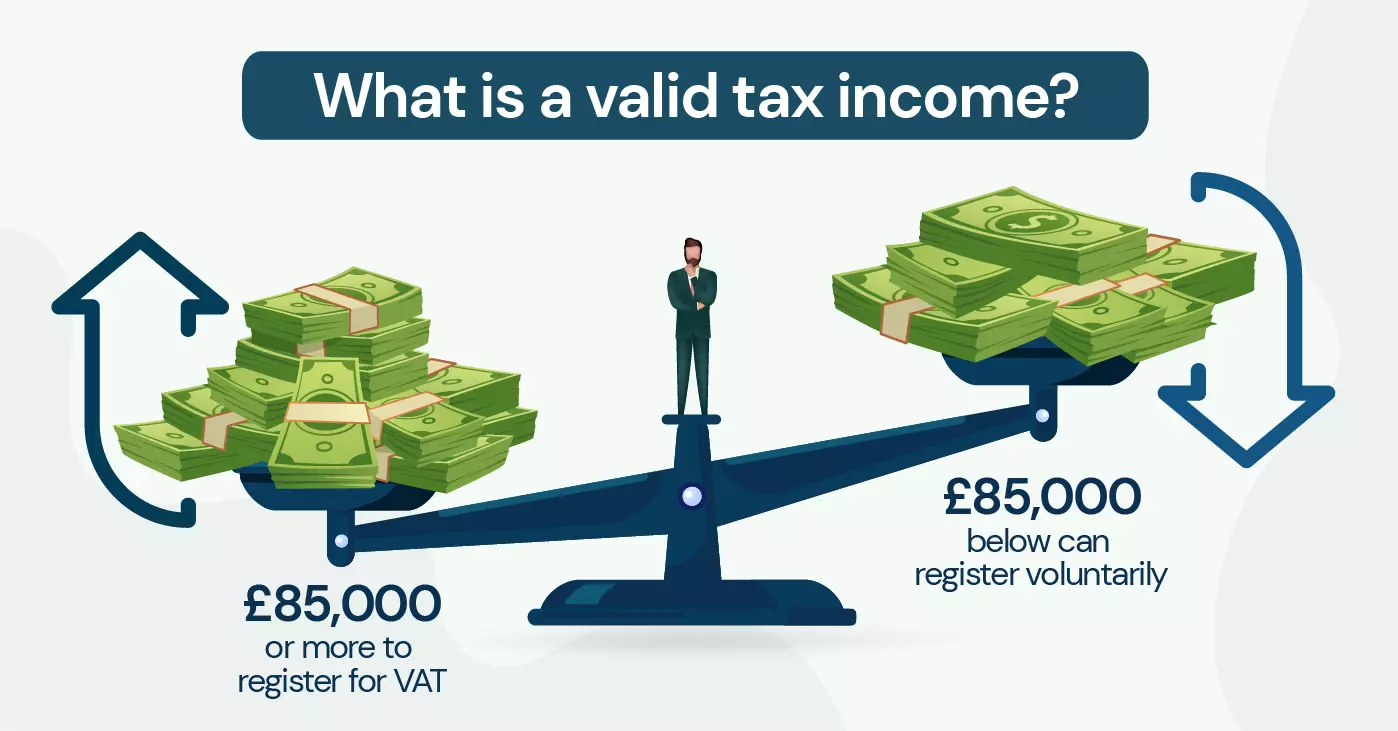

In the UK it is compulsory for businesses with a turnover of £85,000 or more to register for VAT. Businesses with a turnover below £85,000 can register voluntarily.

A valid tax invoice contains all the information required to identify the following:

- The supplier’s identity

- A brief description of what is sold

- The extent to which the sale is taxable

- The date the document is issued

- The number of goods & services tax (VAT) applicable to each sale.

What makes a tax invoice valid?

What makes a tax invoice valid is when the invoice issued is clear to read and contains a breakdown of VAT for all goods and services invoiced.

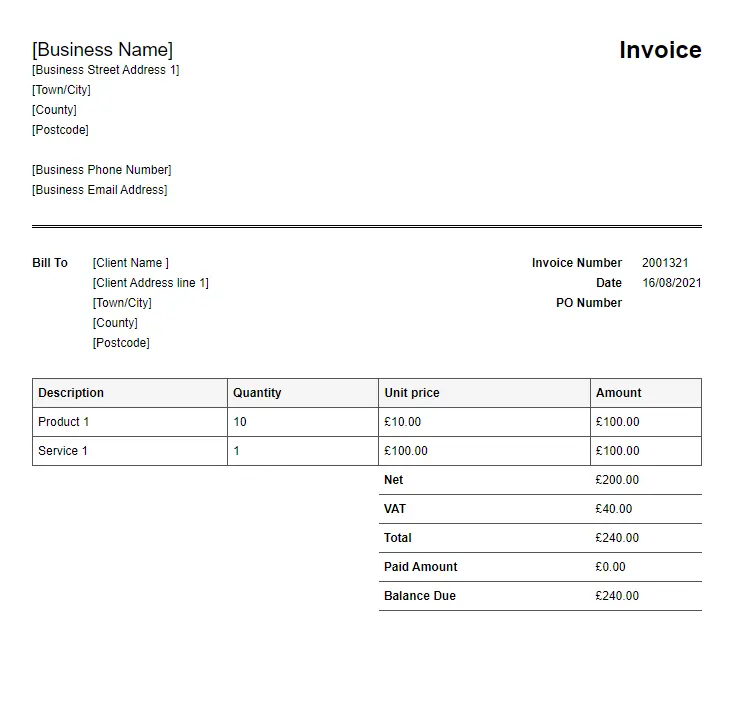

A VAT invoice is valid if it meets the following requirements:

- The department being billed

- The purchase order (PO) or contact name of the department.

- Invoice number

- Payment terms

- Invoice date/tax point

- Customer’s name, address, postcode, and VAT registration number

- Goods and service details including quantity, item description, unit of measure, total value, and unit price.

- The agreed charge, including discount, handling, and other charges.

A valid invoice should not be printed on dark paper. It should not be printed in a color that’s difficult to scan. Should not be stapled as it will create problems in scanning.

Types of VAT invoices

- Full VAT invoices.

- Modified VAT invoices.

- Simplified VAT invoices.

What should a valid tax invoice include?

A tax invoice should include:

- The supplier’s name, address

- VAT registration number

- A unique identification number

- The name and address of the client

- The date of issue

- The time of supply of the goods or service

- A description of the goods or services sold, including the quantity

- The total amount, excluding VAT

- Price per item, excluding VAT

- The rate of VAT charged per item (if the item is exempt from tax, it should be stated)

- The rate of discount per item

Simplified VAT invoices should include:

A simplified VAT invoice should be for items that total under £250. This invoice includes:

- The supplier’s name, address, and VAT registration number

- A unique identification numbers

- The time of supply of the goods and services

- A description of the goods and services supplied

- The rate of VAT charged per item

- The total amount including VAT

Modified VAT invoices should include:

- A modified VAT invoice is for retail supplies that exceed £250.

- It contains the same information as a full tax invoice. But also consists of the full amount including VAT.

If you’re a sole trader, the tax invoice must contain:

- Your name and any business name that you use

- An address where any legal document can be delivered to you.

Limited company invoices contain:

- The full company name as it appears on the certificate of incorporation

- If you choose to include the names of all directors, then it should include all the names.

How do I prepare a tax invoice?

You prepare a tax invoice by including the information required in a full invoice, simplified, or modified invoice [1]. There are plenty of places where you can get free tax invoice temples, including online.

Why is a tax invoice necessary?

A tax invoice is necessary as it supports a registered business’ claim for the deduction of input tax incurred on the product, goods, and services.

It helps determine the supplies that should be included in the taxable period. The date of the tax invoice will define the time to account for input tax.

A valid tax invoice is also necessary because:

- It helps determine the supplies that should be included in the taxable period.

- The date of the tax invoice is important for accounting purposes.

- Failure to produce a valid tax invoice is a violation of the law.

When to Issue a tax invoice?

A tax invoice is issued when the goods sold are for resale.

- Registered businesses can only issue tax invoices. You must:

- Issue and keep the invoice-be it paper or electronic

- Keep copies of all the tax invoices you issue, even if you produce one by mistake or cancel them.

- Keep all the purchase invoices for items.

You are required to send the invoice within 30 days of the date of payment (if you paid in advance) or the date of supply.

Tax invoice example (UK)

Valid invoice requirements in U.S & Canada

Unlike the U.K, U.S tax invoice requirements are more relaxed. [5]

There’s no regulatory format that you must follow. But you must include all the relevant details of the transaction. There’s no input tax deduction to be claimed in U.S invoices. [6]

In Canada, the tax applied is known as goods and services tax (GST)/HST-Harmonized sales tax and PST-Provincial sales tax. [7]

Included in an invoice are:

- Business name

- Date of invoice

- GST registration number/business number

- Client’s name

- Brief description of the goods and services

- Terms of payment

- Total amount payable

VAT Invoices for foreign currency

Invoices for foreign currency must show the VAT payable in sterling on the invoice. This applies if the client is in the U.K.

If the client is outside the U.K., you should keep a copy of the invoice in English. You should provide this invoice when required by HMRC.

There are two methods that you can use to convert total payable VAT.

They include:

- HMRC’s period rates of exchange.

- The UK’s market selling rate at the time of supply.

If you wish to use a different method of conversion, you should contact HMRC. A simplified invoice cannot be used for clients in another country. You must issue a full/modified invoice.

FAQs

Conclusion

A regular invoice shows customers how much they need to pay. A tax invoice does the same thing with the additional purpose of indicating tax due on specific sales.

You need a valid tax invoice to claim tax credits. Therefore, you must meet the guidelines before you send the invoice.

![How to write past due invoice emails that work [+ tips & templates] 4 How to write past due invoice emails that work](https://brodmin.com/wp-content/uploads/2022/04/How-to-write-past-due-invoice-emails-that-work.webp)

![How to invoice international clients [+ 10-point checklist] 5 Invoicing international clients](https://brodmin.com/wp-content/uploads/2021/10/Invoicing-international-clients-0.webp)