When a client doesn’t pay an invoice on time all aspects of running a business are affected.

Unpaid invoices affect cash flow, you can’t pay wages, you can’t pay your own supplier, the business can’t grow and many more parts of running a business are held back.

When invoices are not paid on time there is a domino effect, not to mention the extra time and money spent chasing those late invoices. Just chasing late invoices for UK SMEs totals £50bn a year. [1]

Research conducted by Atomik Research found that the average UK SME is chasing five outstanding invoices at any one time, amounting to an average of £8,500 being owed and 1.5 hours per day – or almost 900,000 hours in total, across all SMEs, per day.

If a customer doesn’t pay an invoice on time, you are entitled to charge late fees on your outstanding invoices.

This is supported by the Late Payment Act.

The law mandates that you can claim interest and debt recovery costs if a business doesn’t pay an invoice on time. [2]

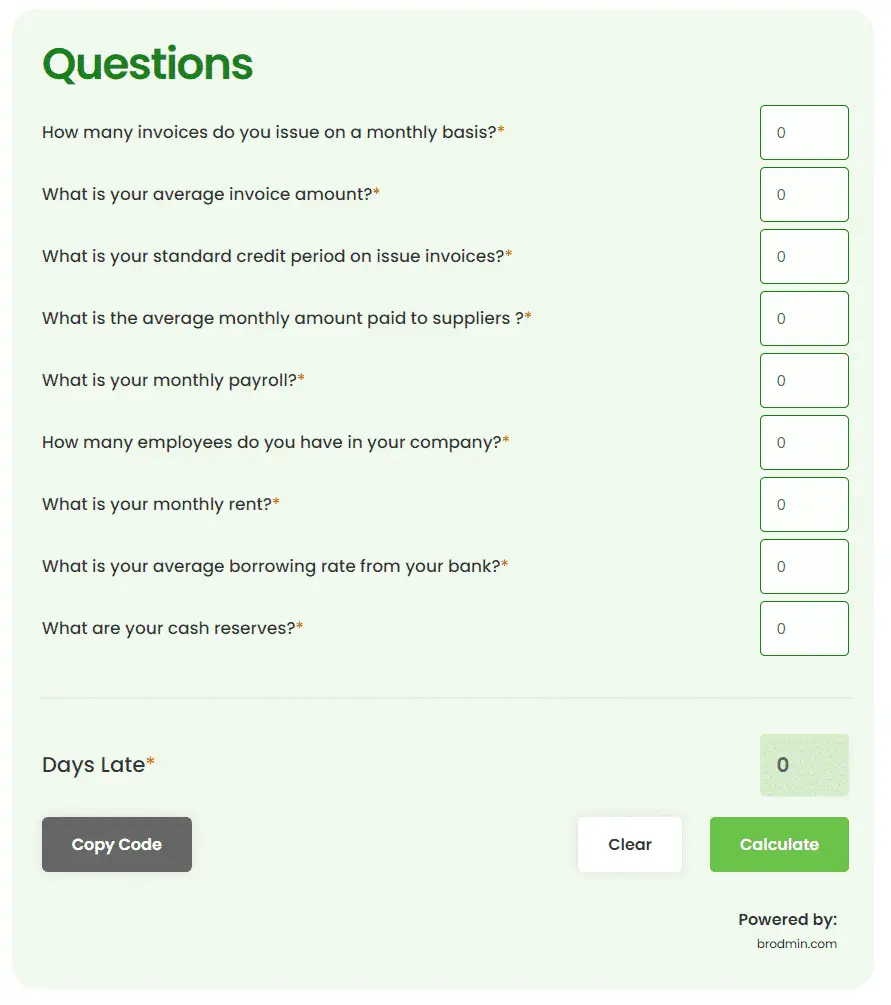

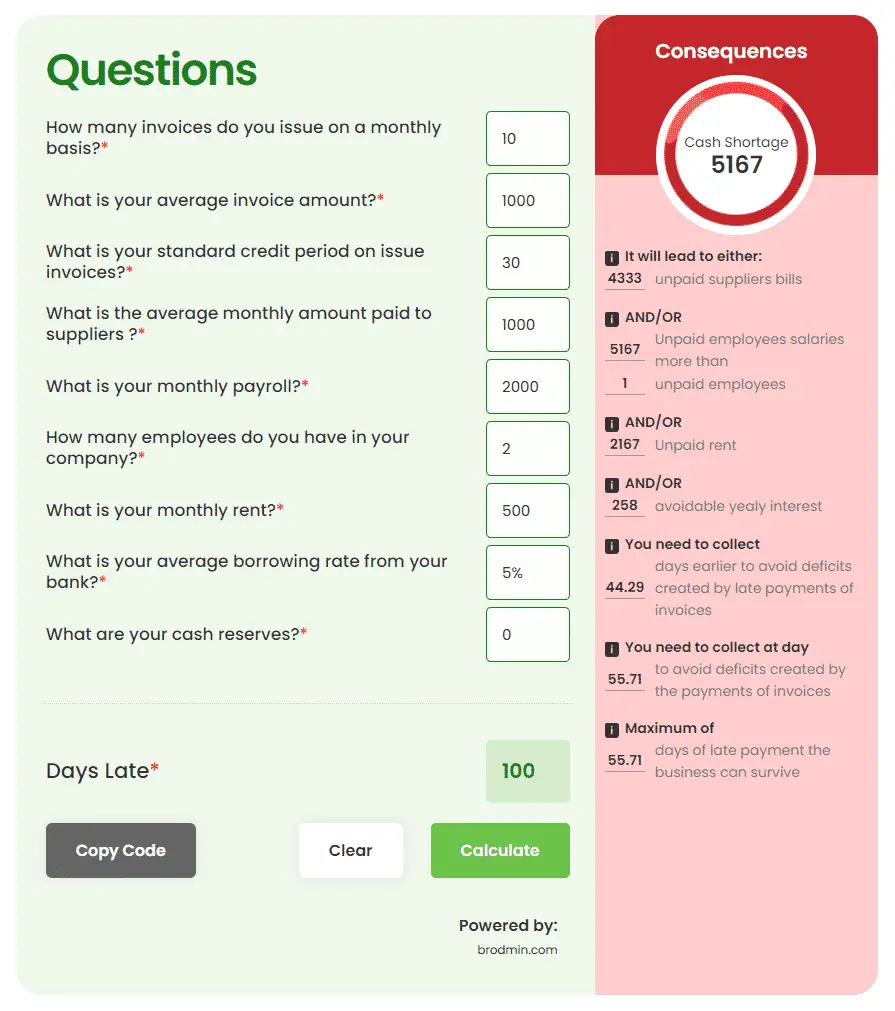

Calculate the consequences that late payments have on your business

Trying to hold your business together when you can’t work out your cash flow as your debtors will not pay, causes serious problems every day.

We have created a ‘consequences of late payments calculator‘ – a calculator that highlights the issues that you are facing, from the impact of late payments on your business and your supply chain.

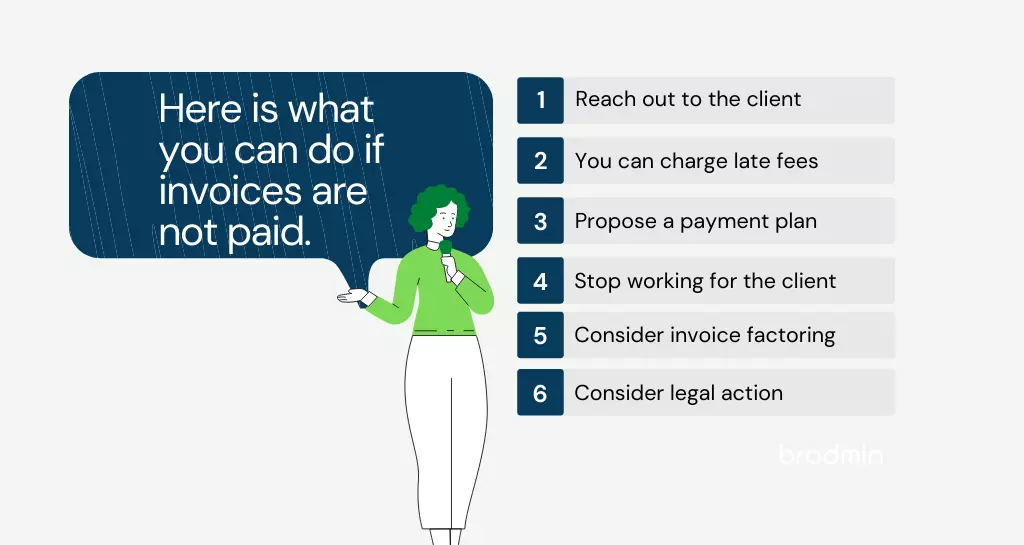

What to do when a client doesn’t pay an invoice on time?

When a customer doesn’t pay an invoice on time, your first response should be to reach out to them. Try to find out why they have delayed payment. Find out if there is anything that you can do to help to get the invoice paid.

Be persistent with the late-paying customer. You can call them, send them emails, reach out to other people in the company, or visit their offices if they are nearby. Don’t be aggressive, but don’t stop asking.

You can charge late fees. Set up a system that’s supported by terms of service or policy. For instance, you can send a warning to clients who fail to pay within five days.

If the customer doesn’t pay on time because of cash flow issues, you can propose a payment plan where they pay for the balance in installments. As part of the payment plan, you can negotiate with the client the amount they can comfortably pay within an agreed-upon period.

You can stop working for the client until they pay. Inform the client that you’ve halted work on the project until they pay. If you continue working with that client, consider asking for a down payment before you start a project or charge them upfront.

Consider factoring in the invoice. Factoring means selling the invoice to another company. You won’t get the full amount but it’s a good option if you need some cash fast.

If you realize the client doesn’t want to pay, you may consider legal action. Have a solicitor send the client a letter urging them to pay or face a court case. In some instances, the threat of legal action motivates a customer to pay.

Alternatively, you can file the matter in a small claims court.

How long does a client have to pay an invoice?

The customer must pay an invoice within 30 days unless you’ve agreed on a different payment date.

If you forget to issue an invoice, the Limitation Act of 1980 states that you can chase after the unpaid invoice up to 6 years in the past [3].

You cannot chase after an unpaid invoice if it’s over 6 years old. In that case, you’ll need legal advice on how to pursue the matter.

Invoices must include the date of issue and the due date. This gives the customer a clear deadline to follow.

If there’s no agreed-upon time limit, then the general rule is within 30 days.

Here is how to help your clients to pay invoices on time

Your right to be paid for good and services provided

The UK government states that you have a right to be paid for work provided. You can set your own payment terms or accept the standard payment terms of 30 days.

If payment is delayed, you can use a statutory demand to request payment for what you are owed. [4]

Companies delay payments for several reasons, including:

- Unsatisfaction with the goods or services delivered

- Some companies delay payment as part of their cash flow strategy [5].

- Incorrect invoice details

- Administrative issues

- Financial challenges

When a company delays payment, contact them about why they delayed payment. It could be a simple issue as incorrect details on the invoice. In that case, you can edit the invoice and resend it.

If you’ve tried to reach out to the customer but they still haven’t paid, then you can send them a formal letter demanding payment.

Download a free sample of a formal letter demanding payment, also known as Letter Before Action.

In conclusion

When clients don’t pay on time it can be stressful, and when chasing those overdue invoices is handled poorly, it can strain your relationship with the client.

Don’t rush to conclusions if an invoice is overdue. Just remind the client of the amount due, send a simple follow-up email or resend their invoice. It may seem like your invoice won’t get paid. Know when to stop worrying and move on. If necessary, your attorney may also send a letter.

![How to write past due invoice emails that work [+ tips & templates] 6 How to write past due invoice emails that work](https://brodmin.com/wp-content/uploads/2022/04/How-to-write-past-due-invoice-emails-that-work.webp)

![How to invoice international clients [+ 10-point checklist] 7 Invoicing international clients](https://brodmin.com/wp-content/uploads/2021/10/Invoicing-international-clients-0.webp)