When clients are late paying invoices, your finances and business relationships can take a huge hit. When late payments happen, you have to figure out how to solve the problem without damaging your relationship with these clients.

In this article, you’ll learn how to maintain a good relationship with clients and handle unpaid invoices in the future.

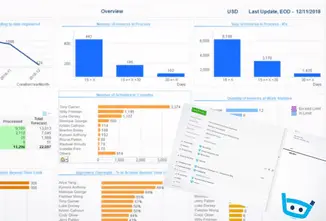

Calculate the impact of unpaid invoices on your business

Although late payments are not uncommon, it can be difficult to act without endangering the relationship with your client.

But you need to consider the implications of unpaid invoices on your business. It is difficult to keep your business together if you cannot manage your cash flow because your debtors won’t pay.

Calculate the impact of unpaid invoices with this calculator, it will show you the problems that you face, as well as the effects of late payments on your business and supply chain.

What reasons cause companies to pay late?

It is common for clients to put off payments when they are short on funds. Clients also forget about pending bills, which results in unpaid invoices. As a business owner, it is important that you understand why your clients are unable to pay on time, and what you can do about it.

Unless you know the reason why companies pay invoices late, you may not be able to convince your customers to pay their invoices before their due date.

Here are some of the other reasons, why clients pay late:

What behaviour can exacerbate matters with clients?

When you’re dealing with an unpaid invoice, it can be easy to get frustrated and react in unprofessional ways.

The worst-case scenario is a lack of professionalism in communication. Many businesses lose loyal clients to rude, impolite communication. Avoid over-pressuring and remember angry outbursts are never helpful.

It’s also worth remembering that sometimes a client might be in a difficult financial situation, and not being considerate can make things worse.

Your clients may misinterpret our intentions if you go and claim your unpaid invoices without proper homework. Always provide the evidence of service with terms of the agreement in detail when you are communicating.

Don’t surprise your clients with a court summons.

Reminders and notices before opting for legal action are what good customer service looks like.

How to collect late payments and maintain good client relationships?

When you are faced with late payments, the best course of action is to reach out to the client promptly. Approach them with clear terms and stay communicative throughout the process. You can also hire third-party mediators for negotiations and work out a mutually beneficial plan.

These are few steps you can take to recover late payments and maintain positive long-term relations as well.

Bottom Line:

A lot of companies have difficulty handling unpaid invoices and, in the process, they end up destroying the years of work that went into building that connection. But it is also important to maintain a balance between your business’ interest and your client’s interest. It’s a difficult balance but it’s worth it.

![How to write past due invoice emails that work [+ tips & templates] 4 How to write past due invoice emails that work](https://brodmin.com/wp-content/uploads/2022/04/How-to-write-past-due-invoice-emails-that-work.webp)

![How to invoice international clients [+ 10-point checklist] 5 Invoicing international clients](https://brodmin.com/wp-content/uploads/2021/10/Invoicing-international-clients-0.webp)