Entering professional life can be overwhelming, and people are forced to deal with technical stuff that they had never heard of before. Invoicing doesn’t have to be one of those issues, but you need to make sure you get it right and understand the basics.

There are a lot of different types of invoices, and they are all around us. They are used in daily business life but could confuse with its variety. Be it a fresh new graduate or an aspiring entrepreneur, everyone needs to understand an invoice and its types.

Of course, a lot of businesses use invoice systems that will most likely include the most popular invoice types for your business. Even if you are using software for invoicing, you will still find the descriptions and explanations of the various invoice types helpful.

This article covers the ‘types’ of invoices, for an in-depth explanation of what an invoice is, read this article: What is an invoice?

Jump to a section:

Different types of invoices

In this article, we cover twenty-six different types of invoices used for most business transactions.

These are only some of the many invoices you might come across in the business world. Nonetheless, it is good to know what you are dealing with.

The invoice types will also vary depending on where you live on this beautiful planet. Although you could argue that an invoice is an invoice, each of the invoices listed in this article has subtle differences.

The explanations below are helpful even if you are using an invoice software or if you must create your own invoices.

Standard invoice

This is the most used form of an invoice issued by a business. It should include a description of the service, the cost, accepted payment methods and due date. A normal invoice usually includes:

- Every invoice needs an invoice number

- The customer’s name and information

- The business’s name and contact information

- The amount of money the customer must pay

Sales invoice

Sales invoices are used by sellers to inform the buyer of the sum owed for the goods purchased. Sales invoices are an important part of your business’s bookkeeping and accounting recordkeeping as they record sales transactions. At its basic, a sales invoice includes:

- Name of the business

- Name of the buyer

- Invoice number

- Date of purchase

- Items the customer bought

- Quantity

- Discounts (if there were any)

- The total amount owed.

Purchase invoice

A purchase invoice is issued at the end for an agreed deal and displays the items or services purchased.

It is different from the sales invoice, which is given in the middle of the trade to show the client for the number of items or services, the discounts, and the total amount of money they owe.

Past due invoice

The due date has passed! Pay up! A past due invoice is issued if a buyer has not paid by the due date. It serves as a reminder urging the buyer to pay by giving a new due date. Besides the original invoice details the past due invoice will also include:

- A reminder of the amount due

- The new due date

- Additional payment methods accepted

Proforma invoice

With a proforma invoice, you send the invoice before the project starts. It is a sort of contract between you the buyer and the seller.

The invoice includes the date of the issue and clarifies the list of items, services, and goods provided and the total sum of money, including the shipping and transport charges.

Pending invoice

A pending invoice is a way to show customers what their next invoice may look like. It serves as a preview. It is a rough draft that does not have an invoice number and can be changed before the final issue. The invoice remains pending until payment is completed.

Interim invoice

Interim invoice or Progress invoice. Not all customers can pay in one go, and often businesses offer payment in instalments.

When a company breaks down its prices and sends invoices in regular increments, each invoice is termed an interim invoice. They are meant to make it easier for the buyer to pay.

Final invoice

The final invoice is sent after a series of business dealings has completed. The seller issues a final invoice that includes the agreed final sum, and it includes a detailed list of the services provided, the total sum of money owed, the due date, and the payment methods offered.

Collective invoices

A collective invoice, as the name suggests, includes one or multiple invoices. These are used when the seller provides several different goods at different times. They are helpful for regular customers who buy frequently or for long term transactions between businesses and their suppliers.

Recurring invoice

For example, a monthly receipt from a rental company or a subscription-based company like Netflix or Amazon Prime is called a recurring invoice. If a recurring invoice is sent to a client at regular intervals for the same items and the same sum of money, it is defined as a recurring invoice.

Commercial invoice

A commercial invoice is a document often sent by a business for large projects to its client in an international transaction. It is used frequently by customs when dealing with foreign trade.

Although there is no standard format, the document must include specific pieces of information such as the parties involved in the shipping transaction, the goods being transported, the country of manufacture, and the Harmonized System codes for those goods.

E-invoice

The rise of e-commerce leads to the need for e-invoices. While there are still a lot of invoices that are printed on paper and sent to the buyer, e-invoices are generated and sent electronically from the seller to the buyer.

This saves time and resources and ensures that the receipt is sent to the buyer. Plus, e-invoicing reduces printing costs by up to 80%!

Digital invoice

A digital invoice is slightly different from an e-invoice. A digital invoice is not necessarily generated online. It can be a scanned copy of a standard invoice, which is then transmitted digitally. A digital invoice also saves an immense amount of time and resources and presents an alternate way of sending the invoice to the buyer.

The benefits of e-invoicing

| For Buyers | For suppliers | For managers |

|---|---|---|

| Reduced costs | Faster payments | Improved visibility |

| Increased accuracy | Reduced costs | Optimised working capital |

| Increased AP productivity | Fewer rejected invoices | Improved compliance |

| Faster processing and payment cycles | Increased productivity | Improve supplier/customer relationships |

| Focus on higher-value activities | Enhanced accounts reconciliation | Enhanced IT system optimisation |

| Enhanced accounts reconciliation | Improved customer relationships | Meeting green initiatives |

| Improved cash management | Improved cash management | |

| Reduced fraud, duplicates and late payment fees | Alternative finance options | |

| Improved dispute handling | ||

| Improved supplier relationships | ||

| Optimised community management |

Debit invoice

A debit memo or Debit invoice. Does the invoice have some information missing? Is there any change needed? A debit invoice could be issued if an undercharge occurred or when the buyer wants an additional item, the new invoice generated is known as a debit invoice.

Credit invoice

Credit memo or Credit invoice. When a client returns a product, a new invoice is generated. It may have the same amount of money listed, or it may be lower than the amount stated in the sales invoice. The goal of a credit invoice is to add the sum of money to the buyer’s account.

Mixed invoice

Mixed invoices, as the name suggests, is a mixture of credit invoices and debit invoices. The total number on this invoice can be positive or negative. If an item is and another one is eliminated, leading to the change of prices, one can generate a mixed invoice.

Self-billing invoice

It isn’t always necessary for the seller to send the invoice. Often the contract allows the client to make the invoice, which is then forwarded to the seller. They both mutually agree on the sum of money and the payment method before finishing their dealings.

Timesheet billing

These invoices are useful for small businesses that bill their customers by the hour. They can also be used by employers to keep track of their employees. Timesheets record the time and date invested in a project, a particular task, or a customer. Often used in hospitality, shift workers and the gig economy.

Time billing invoice

Time billing invoices track your time and the amount of work done by the buyer, and the amount of money the seller owes accordingly. This often involves recording the time that you have worked with the aid of a time billing software.

It is perfect for professionals like accountants and lawyers who bill according to the amount of time they dedicated.

Expense claims

Did the company forget to pay for the expenses that they once promised? Are they refusing to pay? It is time to generate an expense claim!

Expense claims are often used by staff members of a firm when they spend money on behalf of the company. These expense claim forms can be used if the company reimburses its employees for travel, food and or accommodation.

Utility invoice

Utilities are used in houses, shops, restaurants, industries, and corporations regularly. To demand payment for these utilities, gas, electricity, water, or sewerage companies issue utility invoices to their customers. The purpose is to alert them about the number of utilities used and the sum of money owed to the company.

Milestone based invoice

Value-based or Milestone based invoice. When certain milestones are achieved, businesses issue invoices, alerting their buyer about the sum of money owed for that milestone. This type of invoice does not look at the amount of time invested but instead measures the cost according to the value of the goods and services provided.

Account Statement

This type of invoice mentions all the financial transactions between the buyer and the seller with the date and time. This helps evaluate the expenses at the end of a project. It also assists in keeping track of detailed finances.

The miscellaneous invoice

Miscellaneous invoices are used when a buyer owes money for services such as shipping or setup. These services often don’t involve any items or any parts.

These invoices are used for quick financial transactions or to make small adjustments in a previously issued invoice. Often, miscellaneous invoices don’t have an invoice number to distinguish them from other invoices.

Evaluated Receipt Settlement (ERS)

These receipts are generated automatically; subsequently, the payment is also automatic. ERS is used when both the buyer and the seller have already agreed to a price in a previous contract. This system was created to save time and resources.

Tax invoice

A registered seller issues the tax invoice to its buyer, and it shows the amount of tax that is being charged for those goods or services. There are different kinds of taxes that need to be charged, this is different by country and its tax laws.

For example, in the EU states or the UK, a value-added tax is levied (VAT); in Canada, the GST or HST tax is used, and so on.

Highest Statutory Corporate Income Tax Rates in the World.

| Country | Continent | Rate |

|---|---|---|

| United Arab Emirates | Asia | 55% |

| Comoros | Africa | 50% |

| Puerto Rico | North Americ | 37.5% |

| Suriname | South America | 36% |

| Chad | Africa | 35% |

| The Democratic Republic of the Congo | Africa | 35% |

| Equatorial Guinea | Africa | 35% |

| Guinea | Africa | 35% |

| Kiribati | Oceania | 35% |

| Malta | Europe | 35% |

| Saint Martin (French Part) | North America | 35% |

| Sint Maarten (Dutch part) | North America | 35% |

| Sudan | Africa | 35% |

| Zambia | Africa | 35% |

| France | Europe | 34.43% |

| Brazil | South America | 34% |

| Venezuela (Bolivarian Republic of) | South America | 34% |

| Cameroon | Africa | 33% |

| Saint Kitts and Nevis | North America | 33% |

The tax invoice completes our list of 26 invoice types.

Remember, these are just some of the many invoices you might come across in the business world. Below we talk about what you should include with your invoices and what to do to make sure that your invoices get paid right away.

A brief history of the evolution of invoices

Financial transactions have been part of human history since civilization began. The earliest known resemblance of an invoice is the Inshango bone, from the Upper Paleolithic era.

The first-ever invoice can be traced back to 5000 BC.

It was a list of items that had been exchanged amongst two people. As the trade market flourished, the need for more sophisticated invoices increased. As resources in the world increased, the invoice’s face changed and evolved from stone to the ones we receive today.

Written in stone (competing with 5000 BC)

It’s written in stone now! Can’t change it. The lack of paper or parchment didn’t prevent people from writing invoices. Instead, they creatively sought objects on which they could write. Among the first few objects, they wrote the invoice on stone.

Papyrus, parchment, and paper

In the fourth century BC, invoices were hand-written on papyrus. Papyrus was a thick paper made from the papyrus plant, and it was used as a writing surface before parchment became common. Parchment was made from dried animal skin and was used to write invoices until the fifth century BC.

By this time, invoices had also grown sophisticated and included elements such as signatures. Paper was introduced in the 8th century, and invoices used to be hand-written on it until the introduction of the typewriter.

Typed invoices

The industrial revolution sparked off in the late 18th century, and with that came the invention of typewriters. To conduct financial transactions in a more organized manner, many businesses started using typewriters to type their invoices. These invoices are like the ones seen today.

As they had elements such as the date of issue, the details of the buyer and the seller, a detailed list of items, and the sum of money.

Today’s modern invoice

Invoices today are created digitally and are often still printed for customers in retail shops and restaurants. They are also sent by mail by banks or by utility companies. With the rise of e-commerce, e-invoices have also become quite common.

They are produced and transmitted electronically from the buyer to the seller as a confirmation of purchase. It saves time and resources as people do not have to get them printed.

Why do we use invoices?

Businesses invest time and resources in issuing invoices because each item or service they sell comes at a price and getting paid on time is essential for the survival of the business. Along with that, there are many other reasons why invoices are useful and required.

Keeping a record

It not only helps to keep track of financial transaction or dealings is also a legal requirement in most countries. It is a record of the name of the buyer and the seller and mentions the items bought. These records are needed for refunds and other customer services.

Evidence of a transaction

Since it is a legal requirement, it is, of course, legal proof that a transaction took place between two or more individuals. It shows that an item was bought and paid for.

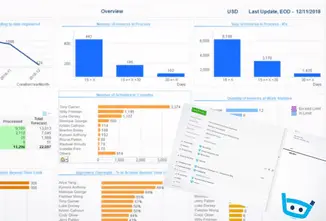

Assists in accounting

To establish a successful business, a business must track their finances and keep a firm eye on their accounts. They need to study their profits and losses, and the number of orders they get.

Record taxes

A vital element of maintaining a business is keeping track of your taxes and paying the set amount at the right time.

Legal support

Want to be protected from fraudulent cases? Invoice records help with that as well! Invoices provide legal support by acting as proof of a sale. In case of an issue, they can protect the seller.

Marketing invoices

Invoices can help the company collect vital information about sales, customers, popular products, and popular trends. Studying this information can help businesses in improving their marketing strategies.

Although we have extensively covered the invoice types, next is a quick overview of what most invoices should include. This is helpful if you are issuing your own invoices. If you are using an invoice software, all this should be covered automatically by your invoice software and much more.

What all types of invoices should include

A chocolate chip cookie is incomplete without the chocolate chips, the same way an invoice is deficient without all these essential elements. Make sure you get this right so that you can avoid reporting late invoice payments.

All types of invoices must include an invoice number

All types of invoices must have a unique invoice number to keep track of their orders and separate the charges according to the invoice number.

Company and seller’s information

You must include the buyers and sellers information. For example, in case the buyer wants to re-order, or in case of any questions, the buyer should have the companies and the seller’s information. This will not only make the process smoother but will also cover any legal requirements of record keeping.

Date of issue

All invoices must include the date of the issue, especially for the seller, as it allows them to keep records of the sale and note when payment is due.

Note that the date of issue and date of the invoice is different:

- The issued date is the date the sales order was issued

- The invoice date is the date an invoice was printed or created

Items or services provided

The number of items or services must be mentioned so that the buyer is consciously aware of their investment. It also helps you to stay on top of your accounts by ensuring the details are in order and easy to find at a moment’s notice or when needed for an invoice.

Discounts

If any discounts are available, these are also mentioned on the invoice to show the original price compared to the discounted price. An example of a prompt payment discount is a customer being offered a reduction in the amount payable if the payment is made within a certain number of days.

Tax (if applicable)

VAT (UK) TAX (US) GST (Australia, Hong Kong, Canada, New Zealand) In areas where tax is applied on goods and services, the invoice should also mention the percentage and amount of tax levied on the products.

Price, the total cost

The total cost must be written clearly so that the client is aware of the payment that needs to be made. The total cost is used to combine the variable and fixed costs of providing goods to determine a total. Total cost = (Average fixed cost x average variable cost) x Number of units produced

Payment methods

Make sure you make it crystal clear how to pay your invoice. Offer choices to your client. There are a range of invoice payment methods to help you get paid faster for your services. Make sure it is clear how your client can pay your invoice.

Due date

Every invoice should have a due date, by which the seller expects the payment. The seller can also mention any penalties the buyer will have to face if it is not on time. This is an important feature, make sure you include it on all our invoices.

Get your invoices paid fast!

Ensure that your invoices get paid right away. Don’t give your client an excuse not to pay the invoice on time. Include the basics on all of your invoices so that there are no reasons for delays in receiving payment.

Offer different payment methods on the invoice

This will make the payment process much easier for the customer.

If applicable, use recurring invoices

If a long-term project or the work is continuous, using a recurring invoice can help the seller get paid in regular increments.

Mention a due date along with a penalty

I know we mentioned this already before, but it is worth repeating. If the payment is outrageously late (like two months), the business should consider adding a penalty for the late fee. Read our late payment of commercial debts guide on how much you can charge.

Automate invoices

Investing in an invoice system or website which issues invoices automatically after a sale will make the whole process simpler and smoother.

Stop the work until you get paid

Customers who pay too late could act as a wake-up call, which reminds them to pay instantly.

Frequently Asked Questions

We hope that you enjoyed reading this article as much as we enjoyed creating it. If you now have a better understanding of what the different types of invoices are, we don’t have to fire the content writer. :)

If you have a specific question on types of invoices that we have not covered, please let us know in the comments below.

17 Comments

Comments are closed.

![How to write past due invoice emails that work [+ tips & templates] 4 How to write past due invoice emails that work](https://brodmin.com/wp-content/uploads/2022/04/How-to-write-past-due-invoice-emails-that-work.webp)

![How to invoice international clients [+ 10-point checklist] 5 Invoicing international clients](https://brodmin.com/wp-content/uploads/2021/10/Invoicing-international-clients-0.webp)

I have just recently had to send a past due invoice. I didn’t think I would have to send such an invoice (didn’t even know that this existed up until a few days ago) but here we are. Running a business is not easy, especially now with this pandemic.

@Andrew, – unfortunately, sooner or later we all have to send those reminder ‘past due invoice’s to our clients. It’s a shame that we have to in the first place, let’s hope it changes in the near future : )

Proforma invoices are my most used ones nowadays. In the beginning, it might be hard to get clients to work with you and pay you upfront but as you garner some clients and people get to know you and trust you this should be the way to go. Now I get to choose the clients I want to work with, that respect and appreciate my work. And I always make sure to give 200%.

Well done John on taking the initiative in choosing who you work with more carefully.

Too many of us are too quick to accept any client that we can get without doing any checks to see if they pay their invoices on time.

Make sure you report any repeat offending clients that you may have here :-)

I just started gravitating towards asking clients to pay at least 1/3 of the price from the start. In most cases, people who know me will pay 50% from the beginning and the rest when I am done. This motivates me to start and to finish which are both important. And I feel like people respect me and my previous work for them. It’s a great feeling!

Hi Brody,

Good call to ask for some money upfront before starting work. Can I assume that most of your clients are ok with that? Did you have issues with late payments before?

With this pandemic going on, we’ve had to go for interim invoices to survive and help others survive. In most niches, this is just the way things are right now. We have to help each other out or we’ll all go down.

Thanks for your comment @David. I agree it is hard at the moment, especially for sole traders/freelancers.

Helping each other is the only way we can do our part to make sure that we all thrive going forward.

Using digital invoices is a smart move. It reduces time and costs for everyone involved. I’m still surprised not more companies use this type of invoice. Some companies are stuck in the past and don’t “like” this type of invoice for some reason. Too bad they don’t realize they would be much better off with implementing these invoices.

Hi Gregory, you are right, it is surprising how many small businesses are still not using invoice software that automates most of the invoice follow up process for them. PayPal is a good choice for ‘free’!

Recently started using milestone based invoices and I seem to fare better doing things this way. I like to break bigger projects into several milestones and immediately get paid after accomplishing them. It provides a certain motivation feeling as I receive a reward as soon as I reach this mini-goal. I think more freelancers and companies should try this type of invoice: they may see some big boosts in productivity.

Hi William,

Glad to hear that milestone invoices work for you! I agree with you that more freelancers should bill in milestones. It could build trust (especially with new clients) and you would get paid consistently for our work.

If they are not even paying their milestones on time …. you know where to report them :)

Let’s hope I don’t have to report anyone, Kris :) But if I do I will come here first.

And yes, milestone invoices are a MUST for any freelancer. They have completely changed the game for me and I can’t do business without them anymore.

Finally a place that tries to help good businesses and weed out the bad ones. It’s good to see this. And no, I didn’t know about all of these types of invoices. I guess you learn something new every day, right?

Hi Katie,

Glad this post was helpful. Any questions about any of the invoice types, lets us know.

Hi guys! What is the name of the invoice we send when we decide not to charge our client but we want the client to know what the price should have been?

Hi Ben, not sure if that would be an ‘invoice’ that you would send if you are not charging the client? Prehab a ‘invoice quote’ would be a way of letting the client know what the cost of the project was?