Reporting late invoices from repeat offending businesses should be as common as leaving an online business review.

But if we are honest, we don’t report late invoices. We take other actions to chase invoices, including legal actions, but never just report them on a public platform to help others. So, to get you started, we’ve listed a few sites where you can report your late invoices.

Jump to a section:

Business today is fast-paced, often remote and requires you to build lots of new connections as you progress. One of the most challenging aspects of doing business today is dealing with unpaid invoices.

Many people find themselves in a position where they’ve upheld their end of the deal, have provided what the client asked for, and then never got paid.

Being ghosted by a client after you’ve put in the hard work is one of the worst things you can go through. Those of us who’ve been in that position have all thought to ourselves “Is there nowhere I can report this? Could I do anything to get my payment or at least make sure they don’t do this to anyone else?”

This article list where you can report your overdue invoices and answers many more questions about why, when and how to report.

What is a late invoice?

Although there are different types of invoices for every business – a late invoice is precisely what it sounds like – an invoice that has not been paid within agreed payment terms. The order or service has been delivered and the payment terms both parties agreed upon has passed, but the payment that should have been in your accounts already, is nowhere to be seen.

Going through this can be frustrating, but what kicks it up a notch is when you know the client is just stalling the payment. That is something that most freelancers and small businesses go through way too often.

Why report unpaid invoices?

Every business owner should put in place strict payment procedures for the service provided. There must be a list of terms and conditions that both parties must agree to as failure to comply with the agreement could attract repercussions.

A brand’s inability to implement these procedures could become detrimental to its continuance; for example, more than fifty thousand small businesses in the UK close their doors for good every year.

While this may seem alarming to most people, there is a thin line between failure and success when running a business. Many businesses experience casualties because of a series of unpaid invoices, which may run into millions of debts.

Overdue invoices create an imbalance in cash flow. The (lack of) money coming into the company isn’t enough to run the business nor oversee outgoing costs. The employees are often the first to feel the impact when a business is headed towards its downfall.

Workers will begin to experience multiple layoffs, salary reductions, and no more additional incentives.

When to report overdue invoices

It may be time to report overdue invoices after you have exhausted all the available measures to prevent late invoices by encouraging early payments or resolving complaints against defaulters.

Reporting a business for late payments should not be taken too lightly. You don’t want to ruin someone’s hard-earned reputation without first making sure it is warranted to submit a report.

Reporting someone if it is the first time that they have missed a payment or if the payment is only a few days late would not be OK.

You should only report repeat offenders. Those that make it a policy of not paying on time. If you are in business, you know what we mean.

Consider this before reporting a client on a public directory.

When you report a business for not paying invoices on time on a public directory like Brodmin, that report is visible to everyone. If a business has several reports for paying late, that business stands to lose its good reputation and possibly future earnings too.

So, you want to make sure that your report is warranted. That you are helping others from potential financial hardship.

When reporting a business for late payment it might make sense that you also tell the debtor that you have reported them. Give them a chance to respond.

Who can report, and who may be reported?

Anyone that issues invoices for business can report late invoices.

Although some businesses are required by law to report late invoices in the UK and EU.

A business meets the reporting requirement when it exceeds the threshold of a medium-sized organization. The Companies Act 2006 provides the threshold requirements as:

- £36 million annual turnover

- £18 million balance sheet total

- Two-hundred and fifty employees

When a business meets these requirements, they are required to publish a financial year report. This report must be issued via the web service to the government and within thirty days. It includes records of payments, policies, and performances.

Any business that fails to comply with these requests can be prosecuted.

Studies have shown that the businesses making up the highest number of late invoices are the big shots. The multi million pound companies are wrecking small businesses by refusing to pay for the services delivered on time.

The provisions of the law on this is straightforward and simple; however, this has not guaranteed full transparency by defaulting companies. There are some noteworthy mentions on how the legislation has failed citizens by accommodating prejudices and partiality in most large companies.

The Credit Protection Association UK reported in 2019 that large companies had found a way to avoid transparency and hide their debts. Large organizations often employ their subsidiaries to do their dirty works. These subsidiary companies fall below the requirement to be reported; hence the parent companies can owe millions of debts with no duty to report.

Plan B: Getting help

When you find yourself unable to get the invoice cleared between you and the client, you must take the matter public. This can either be to get a mediating third party that can negotiate on your behalf or use a platform that will help call them out and bring attention to what you’re dealing with.

Since this is something a lot of people go through, you must not let it go. Not just to protect yourself but also to make sure that no one else is scammed out of payment as well. This platform can be social media or something like a late payment directory.

With social media, you can upload proof and tag the business and try to get the word out. In some cases, this works. But the chances of them noticing are slim unless your post goes viral. This also won’t ensure that they can’t do it again.

It’s unlikely that people researching clients end up on Facebook, so this way could only work out if everything goes right. A late payment directory might be the better option if you don’t have a large following on social media online.

What is a “late invoice payment directory” and how does it work?

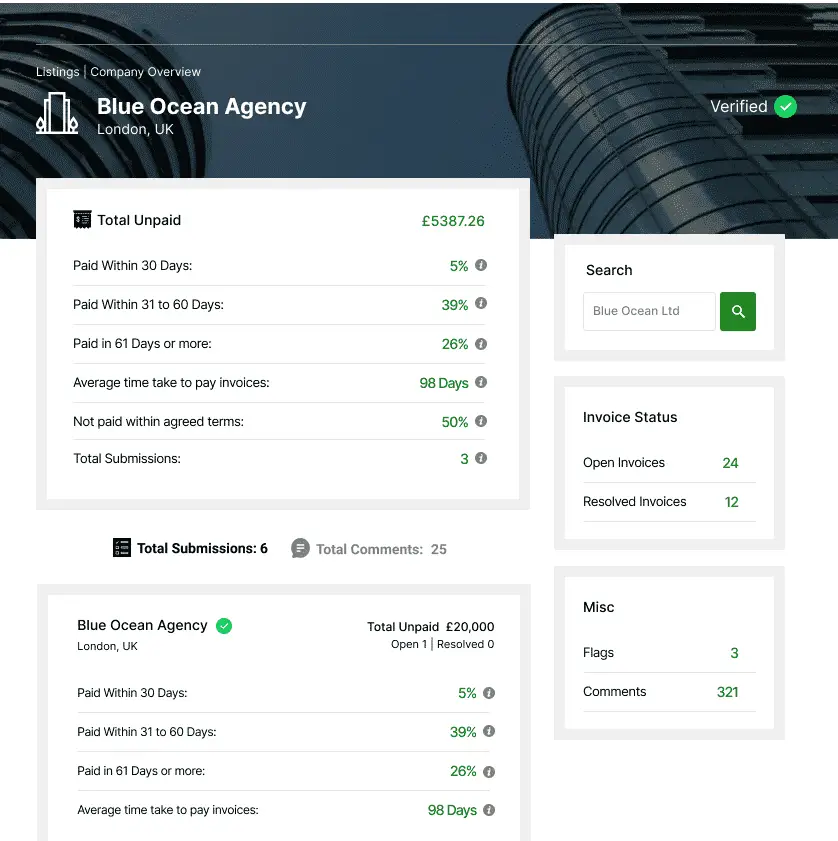

A late invoice payment directory is an online database where people can report clients that don’t clear invoices in time. It is meant to be a place where habitually late-paying clients can be called out, and their information is made public.

image is for demonstration purposes only!

Most businesses take action if they think that their reputation is at risk.

This could help you with your unpaid dues to get them cleared and slowly build a list of businesses that other people can check before starting to work with someone new.

The entire community comes together to not only protect themselves but also to protect each other by sharing information.

Businesses that tend to withhold payments (for whatever reasons) will think twice knowing that they are on a public directory and that their brand could be in jeopardy. It should strongly encourage them to ensure payments are made on time.

The aim is to change the culture of late payments. In the UK alone, 24% of businesses report that late freelance payments are a threat to their survival. It is worse for people that run a small business with employees, as they also pay salaries.

This cycle means that just one late payment can affect several homes all at once, which is what makes the culture of late payments unacceptable.

Where can I report late invoices?

Numerous sites allow SMEs to report late payments by offering workable solutions to resolve conflicts between businesses and their customers.

Reporting in the UK:

The UK government set up Small Business Commissioner to handle late invoices. It is a website that gives professional advice to SMEs to check their invoices’ status, follow-up on clients, and enforce payment of overdue invoices.

Prompt Payment Code website was created for businesses in the UK to register as code signatories, which entails undertaking to pay SMEs within the agreed time. Payment must be made following the laid down procedures in the contract. The code encourages fair business practices between Big-sized companies and SMEs.

Checklate is a site set up expressly for SMEs to look up potential clients and assess their financial history of prompt or late payments. This service helps to save small businesses from potential risks and significant losses. Checklate compiles the necessary information, like data and customer reviews from large companies, to make quality predictions of a company’s financial status and practice.

The Prompt Payment Directory website allows SMEs to report defaulting customers by rating them. Reports can be submitted anonymously, and ratings can be adjusted or removed anytime by the reporter. Any business owner can research a potential customer via the website before offering their services. It saves SMEs in the UK from doing business with companies that are habitual debtors.

The UK government created the Register of Outstanding Invoices to enforce the legislation governing commercial payments:

- The Late Payment of Commercial Debts Regulations (2013)

- The Late Payment of Commercial Debts Regulations (2002) – England, Northern Ireland & Wales

- The Late Payment of Commercial Debts Regulations (2002) – Scotland

- The Late Payment of Commercial Debts (Interest) Act (1998) – UK

Companies that fail to pay their invoices in due time can be reported and will then receive a letter of demand, and failure to adhere will lead to a publication of the entry on The Register of Outstanding Invoices (ROSI)

PayOnTime is a creation of the UK government in partnership with business organizations to offer services to SMEs to ensure early payments and prevent overdue invoices. Businesses are required to register on the site to enjoy the products and services.

The Business Disputes Register seeks to resolve commercial conflicts among businesses in the UK, including unpaid invoices. With a minimum fee, SMEs can register disputes to encourage erring customers to redeem their debts in due time. All registrations on the Business Disputes Register can be removed by SMEs after payment is made.

The most accessible website to register your unpaid invoice complaint is BRODMIN. Their online directory is simple to use and is also easy to manage. Your disputes are visible to everyone, and anyone can comment on them, including the debtor.

All comments are public too, so if there’s any communication happening in the comment section, anyone can see it and reply to it. This can help you connect with other people a client might have scammed as well; the whole community can come together and act against the client until they pay up!

Brodmin allows you to remain anonymous by keeping your personal details private and confidential. You are permitted to report multiple offenders, and the report can include the number of unpaid invoices and the total debt amount per defaulter. You are advised to update reports regularly to feature new developments like whether they have been paid or provide further information.

Brodmin is free to register and make submissions to promote and encourage better payment practices. The information is available for public viewing and does not expire.

Reporting in the USA:

In the US, you can use https://anytimecollect.com/. They don’t have a public directory, but they do have one for their members.

You’d be able to layout and see all your pending payments and track your expenses easily. They have over 3 million users already and have an automated service that’s pretty easy to use.

In America, the three main credit bureaus to report late invoices are – Experian, TransUnion, and Equifax. Most of the sites mentioned above offer credit reporting services at Bureaus to reduce the defaulting companies’ ratings and protect others from falling victim to these dubious practices.

Reporting in Canada:

For people based in Canada, you can register an unpaid invoice on https://www.dgs.ca.gov/.

If it has been over 45 days and your invoice is pending and undisputed, according to the Prompt Payment Act, the state department would step in, and you may be eligible for a payout through them.

Invoice 911 is a credit reporting and debt collection organization in Canada. Companies that fail to pay their invoices are reported to two of the country’s largest credit bureaus – Equifax and Trans Union. Invoice 911 delays publishing the report to give erring customers a chance to pay up and avoid bad reviews and low ratings.

Reporting in Australia:

For people in Australia, you can sign up on https://business.gov.au and register your unpaid invoice there. They will refer you to a debt collections agency which can help recover your payments if you’re unable to it yourself.

Reporting in New Zealand:

If you live in New Zealand and have suffered because of unpaid invoices, you can register your invoice at https://fsp-register.companiesoffice.govt.nz/ and add all the details about your invoice, including any payments you have already received. When you end up with late payments, you can use the tracked data to start a dispute with your client.

Why is it so important to report overdue invoices?

There are several benefits of reporting unpaid invoices.

You need your money – ASAP. You use the money on resources that you need daily. Cash flow is essential, so you need to make sure it is available when needed.

It establishes you as a serious professional who has a business to run. Report the unpaid invoice to uphold your reputation as a professional business.

The chances are that if that client isn’t paying you on time, they are doing the same to other contractors too.

Brodmin highlights the advantages associated with reporting late invoices:

- To motivate the defaulters to pay their debts

- To save small businesses from financial loss due to unpaid invoices.

- To change the culture of poor payment practices

- To prevent late invoices – when businesses make a habit of reporting offenders, it will encourage prompt payments to maintain regular cash flow and business development.

- To protect small and minor businesses

Benefits of using a late invoices payment directory

Since reputation is everything when it comes to the world of business, once your report is up, the longer the client takes to process your payment, the worse it is for them, and they know it.

It is in their best interest to clear your dues as quickly as possible. Even if they don’t, it will ensure that they will have a challenging time getting someone else to work for them as long as your unresolved payment is still listed.

The way a late payment invoice directory works is simple. Depending on which side of the situation you’re on, the way you use the guide will differ.

As a Creditor:

Suppose you’re a creditor with an overdue payment. In that case, you can easily register on a directory like the Brodmin late payments directory.

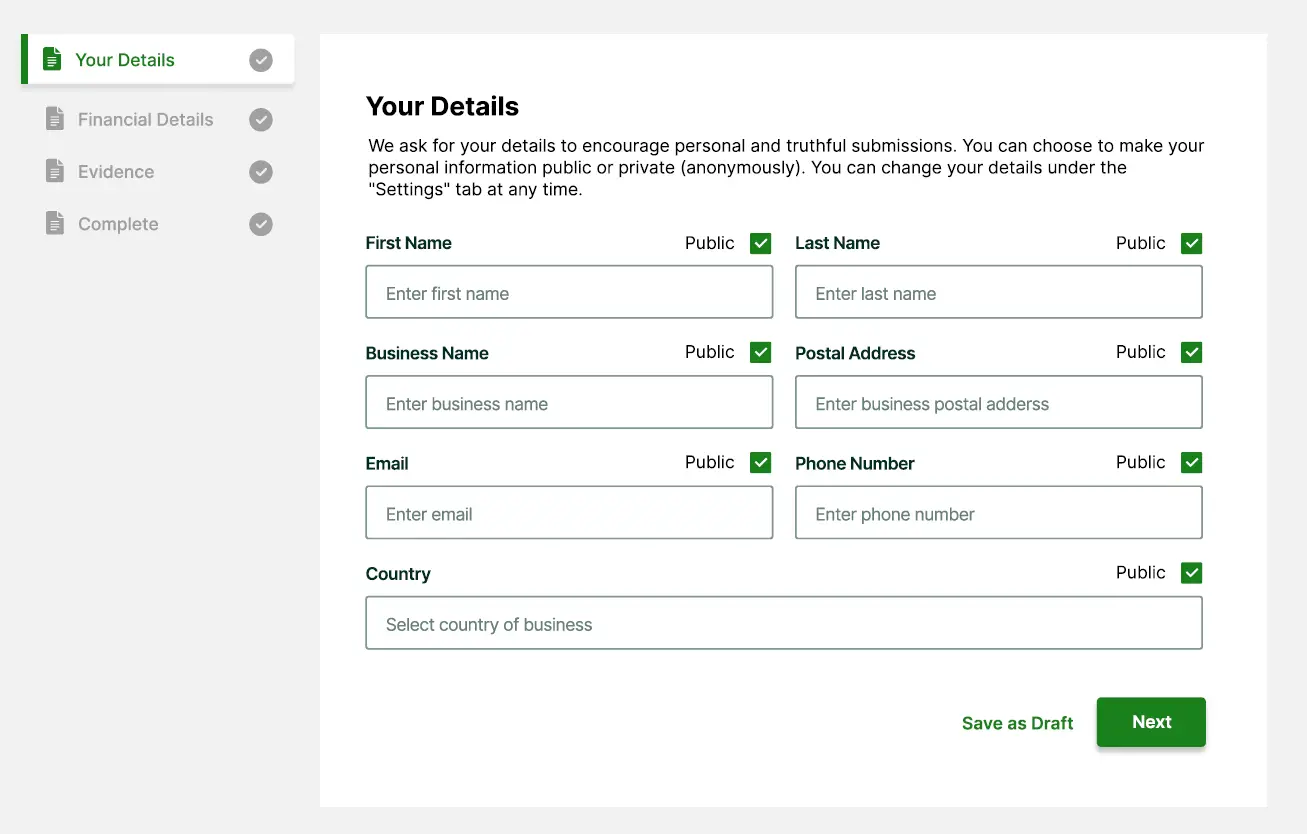

Reporting late invoices – adding your details to Brodmin

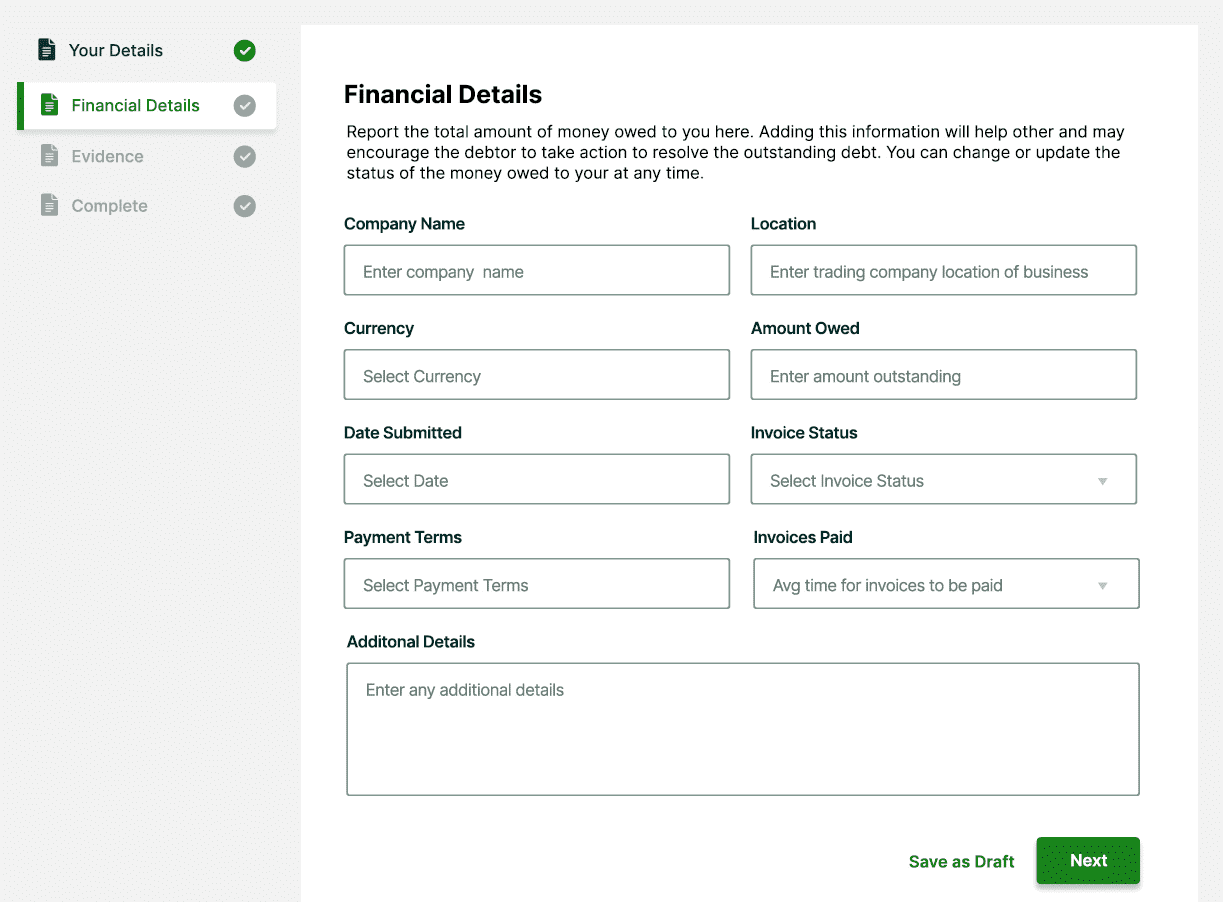

You fill out a few form fields to create your report. They include details about your outstanding invoices. It is optional to include proof of the unpaid invoice, emails and texts between you and the client where you’ve asked them to clear the dues and anything else that could help support your case.

Reporting the financials of late invoice payments

You save your report to the directory and you can also notify the business that you have reported. Notifying the debtor is optional. Then it’s up to the debtor to decide how they want to deal with the situation.

The best part about this is that you can have complete anonymity while reporting. No one will know that you have submitted a report if you don’t want to.

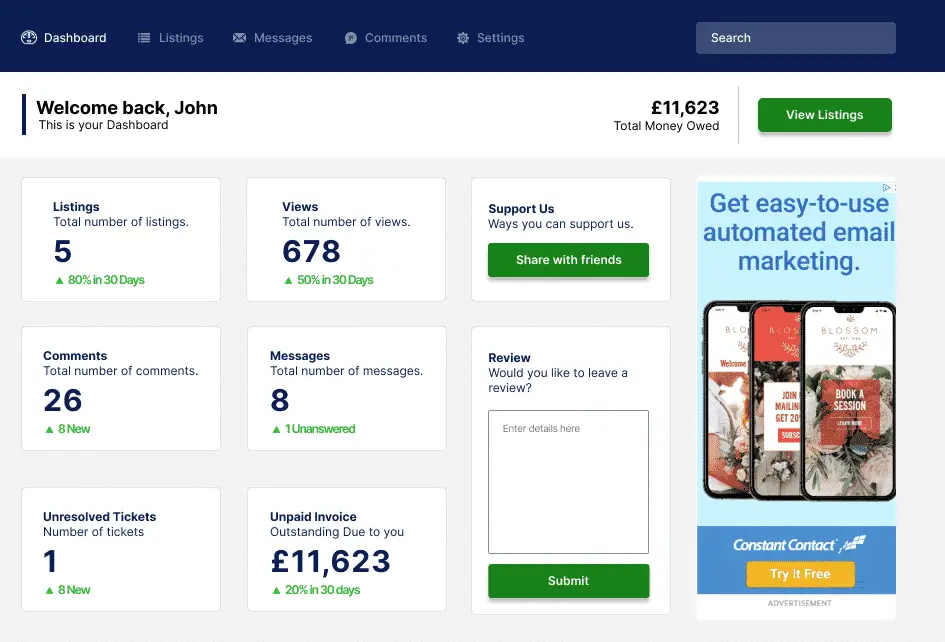

You can also search the directory as a way of researching which of your competitors are in rough waters with their clients.

Dashboard view of the Brodmin application

Is a late invoice directory only useful for creditors?

No, if you are a debtor that has been named in a report, the directory doesn’t leave you voiceless either. You can also sign up on the website and engage with your reports.

Either you have the option of directly contacting the list owner and resolving the matter privately (you can offer them a payment solution or send them their outstanding payment) or you can comment on their report. Comments are always public, and anyone can see them and reply to them.

If you have no outstanding dues and have been wrongfully named in a listing/post, you can “flag” the listing, and a moderator will be notified.

One of the most significant benefits you can have by using the directory yourself is that if you’re someone that makes payments on time, people will not find your business in the directory.

What to do if your invoice remains unpaid after reporting?

If your invoice remains unpaid after you have contacted the client, reported them on the directory, you could give then another chance and reach out to them again. See if they are willing to create a payment plan or come to an agreement.

You could also show them the statistics of your online report.

Brodmin provides a ‘view’ count – how many eyeballs your report received. So, if a debtor sees that a lot of people are seeing that they are not paying their invoices it might just be enough for them to take action to save their reputation.

If your outstanding payment is substantial, you could send them a legal notice and involve the courts. Although, you would have to do that privately with the help of a lawyer.

In any case, you have put their name out there and have made it easy for other people to find the information on them if they are about to work with them. Take the lessons you learned from this experience and protect yourself in the future.

What to do if your invoice has been processed?

The primary purpose of a late payment invoice directory is not to shame clients and leave it at that, it is to get your dues cleared and prevent it from happening again.

Even if there was a lot of back and forth and getting the payments was burdensome, you should update your post once the payment has been made and specify that you have received your payment.

You don’t have to delete the post, update it. Marking it “paid” or “resolved” – according to your particular situation and how it panned out.

You can also add information about how the process went and how easy or difficult it was to retrieve your payment.

It will help keep track of how the particular business deals with late invoices, so if someone else is dealing with them too, they would know what to expect.

How to make sure (or at least try to) that you don’t end up with late invoices again

Make sure you have researched the client you are about to work for.

Use late invoice payment directories to your advantage and make sure they haven’t been reported.

If you have looked them up and still not sure whether you can trust them or not, don’t wait until the order is complete. A common practice is to ask for 50% in advance and then the rest in smaller increments throughout the project.

You can tweak your payment plan as you see fit, increase, or decrease the advance, but take something.

This way, you know that they are a serious business, and you have covered some of the cost before you start working on the project.

Draw up a contract and have them sign it.

Even though a lot of freelancers think that asking to sign an agreement will lose them the potential client, the reality is quite the opposite.

It will protect you both and will serve as one of the main pieces of proof that you can use later to report them should you need to.

Have a list of “policies”. These should include essential things like a refund policy, in case they want one, if so, what are the terms and conditions that apply. Do you keep the advance if the client cancels the order, how many revisions do you offer etc.?

Anything that you can think of becoming an issue later, have it written down and hand a copy over before you start working together.

Send official reminder letters a week before payment is due.

Wait out the courtesy period before doing anything.

FAQs

Overdue invoices are not just an inconvenience, they kill your cash flow. It is incredibly stressful to find out that you are working for free.

Businesses taking ages to process invoices has become a common practice. And just because it happens all the time, doesn’t make it okay. The only way this practice ends is if we all step up, report them and hold them accountable.

Each report added to the directory can help bring change one step closer.

Eventually, late or missed invoice payments would become a thing of the past!

Did we overlook a place where you can report late payments?

Do you have a suggestion or recommendations?

Let us know in the comments below.

13 Comments

Comments are closed.

![How to write past due invoice emails that work [+ tips & templates] 4 How to write past due invoice emails that work](https://brodmin.com/wp-content/uploads/2022/04/How-to-write-past-due-invoice-emails-that-work.webp)

![How to invoice international clients [+ 10-point checklist] 5 Invoicing international clients](https://brodmin.com/wp-content/uploads/2021/10/Invoicing-international-clients-0.webp)

I have already been duped twice now, but not anymore. I’m asking for at least 50% upfront from now on. If the client doesn’t want to do things this way then we don’t work together at all. I only keep working with people that keep their word and respect my work.

@Steve, sorry to hear that you have been affected by unpaid/late payments.

Unfortunately, this happens far too often to far too many! Taking a 50% deposit is a great idea and smart move, but not everyone is in a position to do this.

That is one of the reasons we’ve set up our directory – to help those that want to warn others about consistent late payers!

Why do you think we shouldn’t report unpaid invoices? Isn’t it a good idea to let others know about a “bad” client even if it’s the first time they did this? I agree with repeat offenders, that’s a given I feel. But what about first timers? What if this person/business does this “one time” late payment again and again to different businesses?

Some people never learn and by not reporting them, aren’t we encouraging such behavior even in cases it happens rarely? What I’m trying to say is client A is late in paying me, business B. He pays me eventually but then goes to business C and is late again. Then he goes to business D and is late again and so on. Shouldn’t such a practice be stopped?

Hi Alexander, thank you so much for your comment.

The behaviour of some clients is truly shocking. As you’ve mentioned some businesses simply switch suppliers to avoid paying on time (or worse all together). What makes it worse, that this is often a ‘policy’ and not due to circumstances, let’s say the cashflow issue at their end.

I have personally experienced this, what made it worse is that those where overseas clients, so it made it harder to pursue the outstanding payments. Any legal action that you want to take is also made more complicated and expensive.

I believe that those companies do this as they count on sole traders not being able to afford legal help and thus seems to get away with late or non payment frequently (as a policy?)

This is where we believe brodmin.com can make a difference. If enough of us make it a habit of reporting those offenders – any proud business owner would care about their business reputation and make sure that they pay their suppliers on time.

I also believe that a platform where businesses can report offenders (late ones or ones that don’t pay at all) is very, very useful. Growing such a platform will take time because more businesses need to hear about it and use it, but I feel it’s well worth it. We need to weed out the bad apples and encourage good and fair trade, no?

And yes, the behaviour of some clients is shocking to say the least. Some people just don’t seem to understand how trade works and what responsibility is. We should aim to educate people to pay on time and for those that don’t we should have measures in place to nudge them to do the right thing.

I hate it when a client just stalls on a payment. If I am honest and do the work I promised I will do then the client should also honor his/her word and pay me on time, no?

We 100% agree, @Michael!

You delivered your work so you should expect to be paid on time.

Sometimes a client can’t pay you in the agreed timeframe – you’ll find that those clients that truly struggle to pay your invoice will communicate with you and they will usually keep you up-to-date too.

It’s no wonder so many businesses (50000 just in the UK!) yearly when there are so many people that like to scam others and not pay! And like you mentioned, what they do is have other companies do their dirty work so even if you do report those companies, the actual culprit rarely gets in trouble :(.

Hi Sandra : )

The government is aware of this but don’t seem to be in a position to do anything about it. More reasons to use our platform to name and shame those that consistently pay late.

I didn’t even know that you could report your late invoices! If I had known I could have saved the money that I spent on getting the money I was owed collected? Glad I came across this article and site. Just wish someone told me about this earlier.

Hi Amelia,

Glad that you found us. Going forward, let’s hope that you don’t need to report too many of your clients for late payments – but if you need to – now you know where to report them!

While I don’t like people paying late, I understand it can happen. Fortunately, I haven’t met many like that so I haven’t had to report them.

Excellent blog about reporting late invoices!