Impact Calculator.

Work out the consequences that late payments have on your business.

Trying to hold your business together when you can’t work out your cash flow as your debtors will not pay, causes serious problems every day.

The calculator will highlight the issues that you are facing, the impact of late payments to your business and your supply chain.

Maybe a visual representation will drive home the seriousness of the problem to your client.

How to use this calculator.

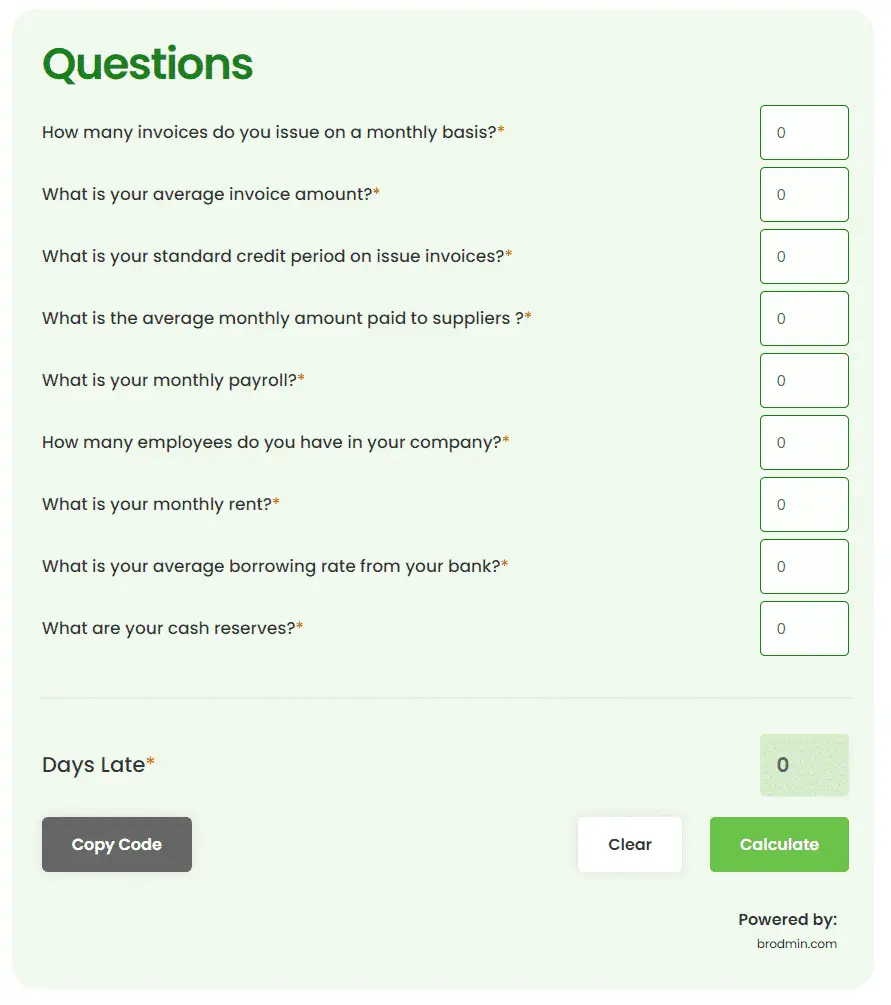

Following the instructions, you will be asked 10 simple questions about late payments and your monthly income. Although most calculators of this type are concerned with working out what you are owed, we want to work out the impact it will have on your business.

(video has no sound)

The questions explained:

- How many invoices do you issue?

Enter the number of invoices you issue each month. This does not have to be an exact number, just the best estimate for your average monthly sales.

- What is your average invoice amount?

Fill in an average payment that a client must make to your company after you have provided your service.

If you are unsure how to do this, take the last 10 to 20 invoices that you have issued, add together the amount due, and divide the total sum by the number of invoices you have referenced.

- What is your standard credit period on issue invoices?

Enter how long you allow clients to take before the sum they owe is paid. This should be clearly noted in your contracts. If it is not, this period is no less than 30 days for public clients and 60 days for private entities.

- What is the average monthly amount paid to suppliers?

Using the same formula as the average invoice amount, work out the last 10 to 20 payments to your suppliers, add together the amount that was paid, and divide the total sum by the number of payments you have made.

- What is your monthly payroll?

Take average outgoing payment for wages and enter the sum into the calculator. If you rely on contractors or freelance workers, enter the amount that you would expect to pay in the average month.

- How many employees do you have in your company?

Enter the number of permanent full time or part-time employees that you have who could be affected by a lack of funds to pay their wages.

- What is your monthly rent?

If you pay rent for the building where you base your business, enter the figure that you pay monthly. You can leave this blank if you do not pay any business rent.

- What is your average borrowing rate from your bank?

Taking loans from a bank or a private lender is a normal part of modern business, but late payments can lead to financial ruin if they cannot be paid.

Enter the interest rate for any borrowings that you have; if you are unsure how to do this, divide your interest rate by the number of payments that will be paid during the financial year.

- What are your cash reserves?

Enter the amount of money that you have available for emergency funding. If you do not have any cash reserves, you can leave it blank instead.

- How many days late?

Enter the number of days your invoices are paid late – remain unpaid. Meaning, on average, how long you have to wait to get paid after the payment due date.

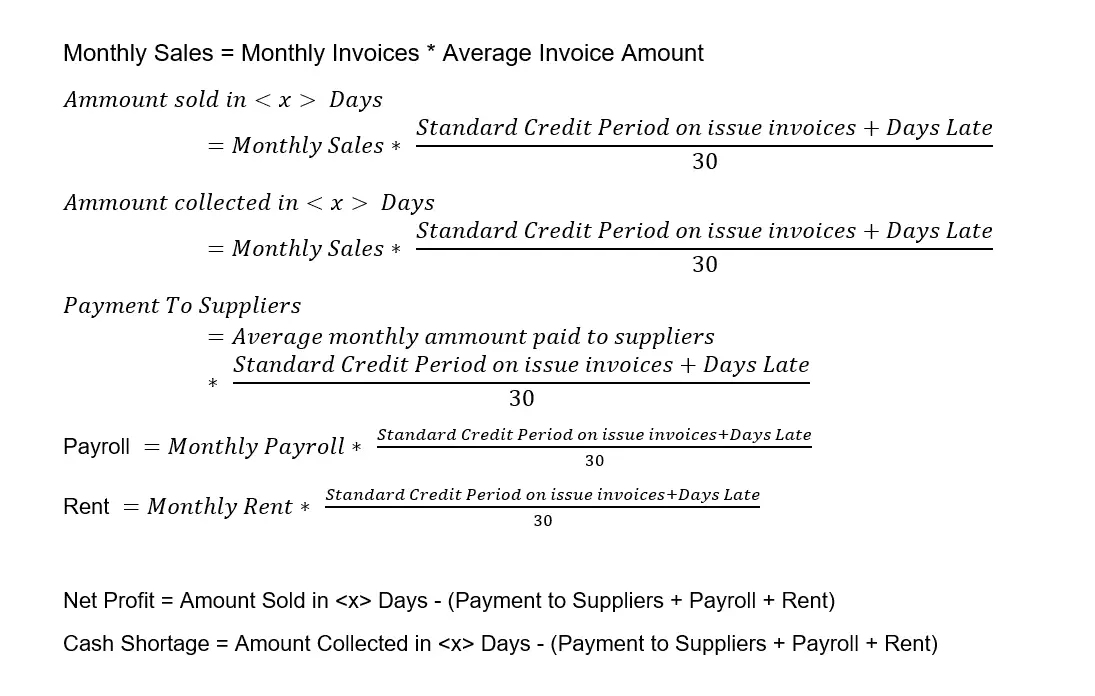

The calculations explained

What do the results mean?

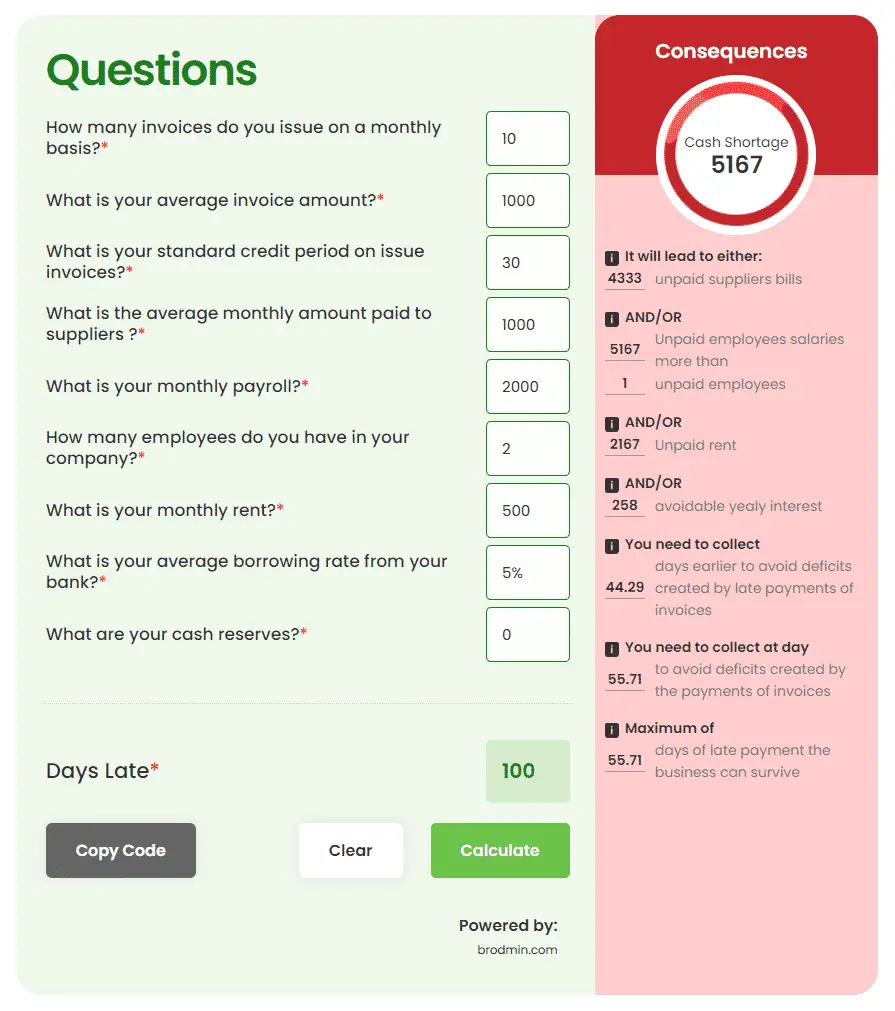

Using the figure given by the calculator, you will see how late payments can cause damage to your business, suppliers, and employees.

Pay attention to the ‘results column’ that will appear on the right when you calculate the numbers that you have entered into the calculator.

The calculator will try to tell you the number of days you need to collect your money earlier – to avoid deficits created by late payments of invoices.

It will also show you an estimate of how long your business could survive.

Clearly, every business is different, so this calculator can only be so accurate. Use your own judgement when making important business decisions.

If you only see negative results (highlighted in red) and if you are in a position to do so – try to make changes to your payment terms. Maybe consider milestone invoices (taking payments as you deliver your work) – or ask for half of the money upfront before you start work.

(move slider left/right)

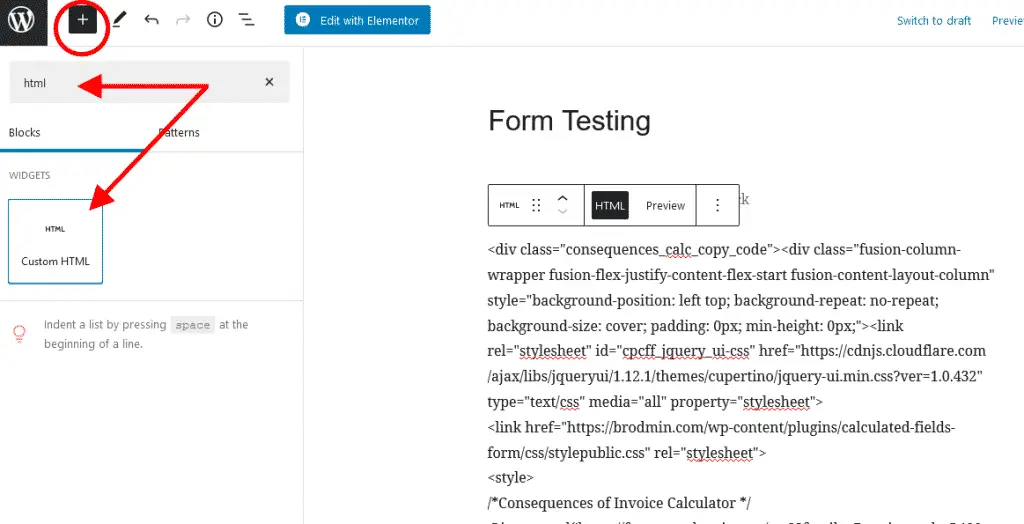

Like the calculator? Add it to your website!

If you find this calculator useful, why not put it on your own website and share it with your readers? It is easy to add the calculator to your website.

‘Copy the code below & paste’ the code to your website.

Now paste the code into your website via HTML block (A block that allows scripts tags).

This is how you would do it if you have a WordPress site.

If you have issues adding this calculator to your website – let us know, we might be able to help. Send an email to [email protected] for help.